Q2 2021 Letter

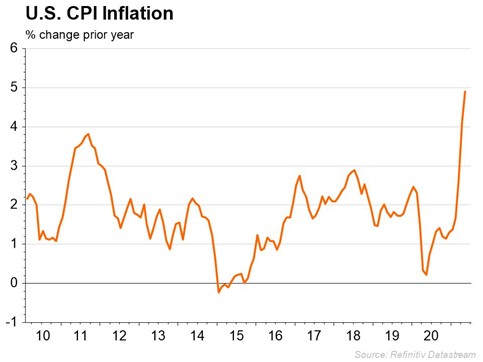

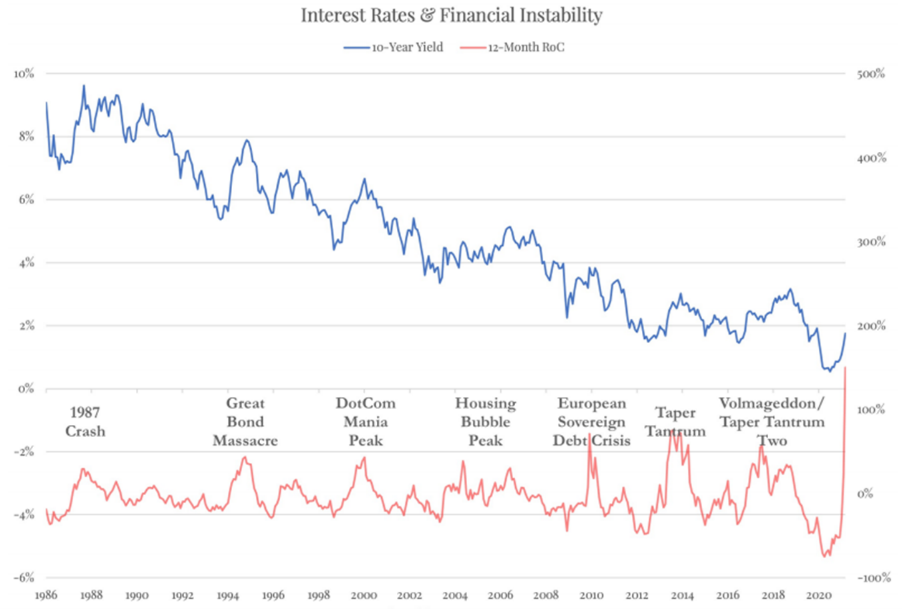

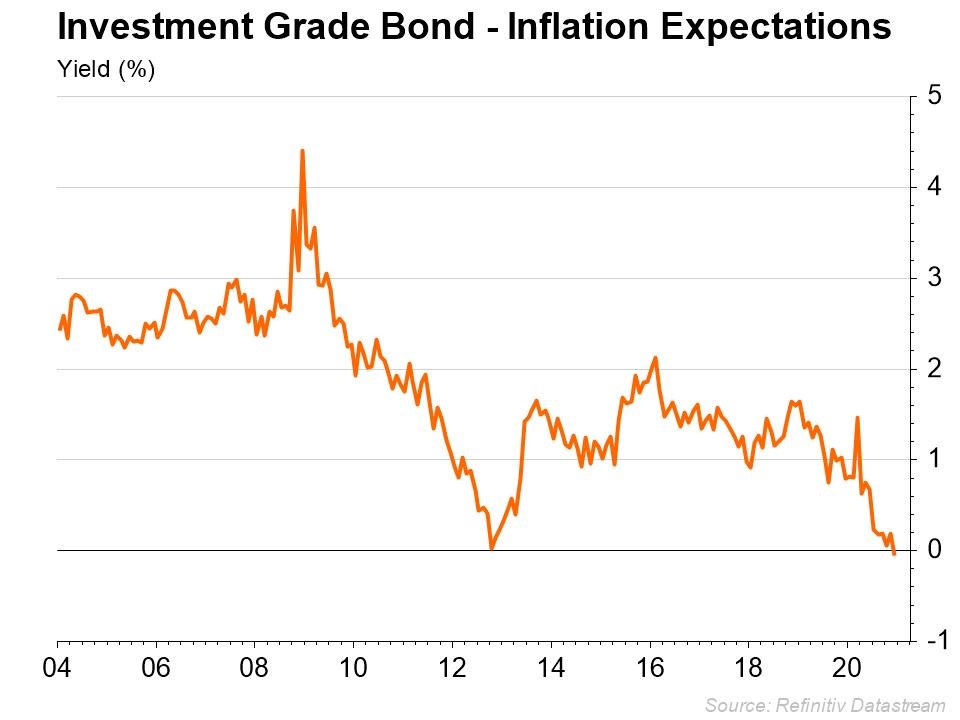

In this quarterly letter we would first like to discuss Avenue’s view of inflation, which has quickly become the main topic for investors. Leading from our view on inflation is our broader thinking about how nothing is normal in our current financial world. But we believe we need to get used to it; we are living in a new normal. Our conclusion continues to be that we have to stay invested, but more than ever it matters what we own and it certainly will always matter how much we pay for our investments. Lastly, we would like to give an update on the Avenue Tail Hedge portfolio now that we have been incorporating this strategy for a full year.

read more