“Face reality as it is, not as it was or as you wish it to be.”

Jack Welch, Former CEO of General Electric

In this quarter’s letter we would like to give our assessment of the many contradictions of financial orthodoxy in which we now find ourselves. The economy is in terrible shape and yet the stock market has had a strong rebound from the March 23rd low. Central bank intervention in the bond market means businesses can still borrow easily but this intervention by central banks is sacrificing the usefulness of investing in bonds because of how low interest rates are. There is a rush to ‘global’ investing which isn’t really global, but more like a second technology bubble. And cash is not a safe place to ride out stock market turmoil now that central banks are under pressure to devalue their currencies. Our conclusion at Avenue remains, to protect and grow our financial wealth we must be invested in a mix of hard asset and high-income producing businesses.

Avenue’s Bond Portfolio

The stock market remains the focus of most investors’ attention. It seems like a contradiction that the stock market is rebounding in the face of the worst economic crisis since WWII. But to get the progression in order of importance, let us discuss the current state of the bond market. To stave off financial panic in March, the US and Canada’s central banks aggressively purchased bonds in the open market. Our central banks started by buying government bonds, and now buying has extended to purchases of corporate bonds as well. This process of buying bonds keeps interest rates suppressed and frees up cash to be invested in other things, like stocks. This manufactured liquidity is easily the most important factor in turning around financial markets.

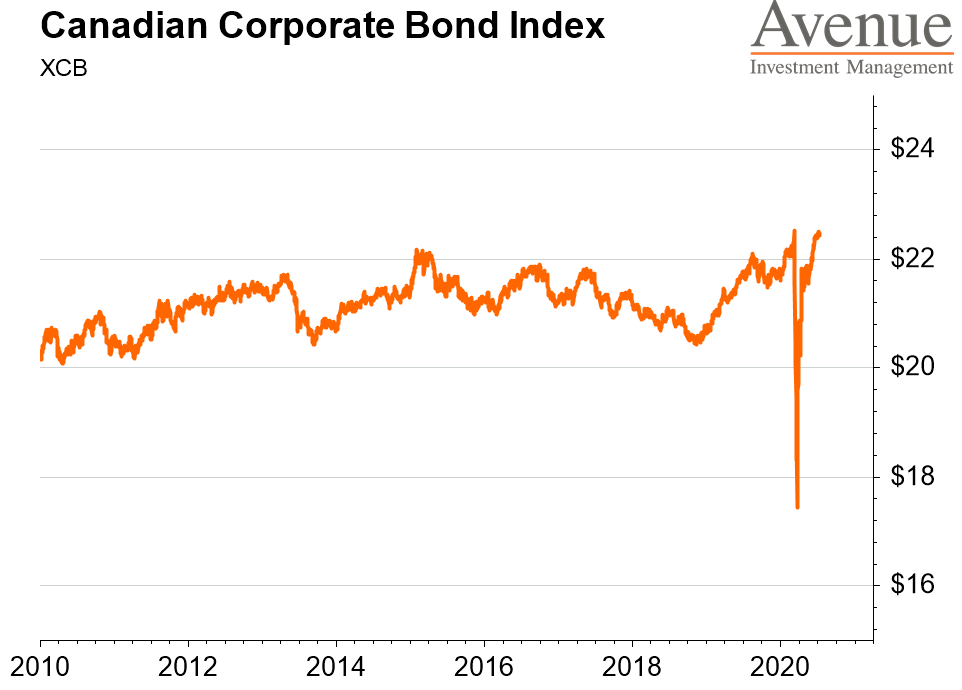

We were able to take advantage of the initial sell off and make several timely purchases in Avenue’s bond portfolio. However, where we were hoping for more higher yielding purchases, any further opportunity was taken away by the swift and overwhelmingly large central bank intervention. Despite the bond selloff in March, to look at the price level of corporate bonds today, you might well conclude that the bond market is not reflecting any stress in the real economy.

A major part of Avenue’s bond portfolio strategy is to invest in Canadian corporate bonds and we believe the portfolio is in much better shape because of the crisis. We were conservatively positioned going into March which gave us the ability to buy as the price of corporate bonds sold off. We expect the bond portfolio to return between 3 – 4%, at a time when the government of Canada 10-year bond currently yields 0.5%.

There are far reaching implications for this scale of central bank bond purchases. So far, our central banks have not printed money, they have borrowed it. Which implies that they have an obligation to pay it back. For this reason, the current actions are technically not yet inflationary, but that might change in the next few years. More on this later in the section: Cash isn’t Safe.

Central banks have the singular power to un-glue financial markets so that good businesses that borrow money have access to financial markets. But it also sustains the life of many marginal businesses that have too much debt and, perhaps, should have failed or been restructured. The creative destruction that occurs in a capitalist system can at times feel harsh, but it allows for capital and investment to be directed to (hopefully) productive uses. At least that is how the economic system is supposed to work. This past decade of artificially low interest rate has filled the economy with ‘zombie’ companies which has reduced the economy’s ability to rejuvenate itself. When the hurdle rates for investment decisions are today’s government bond rates, then it is easy for capital to be misdirected and misallocated to unproductive uses and financial speculation.

Central banks have created an environment where most businesses can borrow money and are solvent for the time being. But the core idea of capitalism, where financial markets find the right price where a lender is willing to lend and a borrower is willing to borrow, has been taken away. Rightly or wrongly, bond investing for the moment is an act of anticipating central bank policy. This is reality as it is, not as it should be.

The main implication for long term investors is that interest rates continue to be suppressed which leads to effects on investors’ behavior.

Historically most pension funds, insurance companies, and retirees had invested the majority of their money in the bond market and some smaller allocation was invested in the riskier stock market. For most of our lifetime if an individual investor was nervous, they had a choice of limiting their stock exposure and have say 70-80% in bonds for safety. Even in the crisis of 2008 you would have been able to get out of the stock market and buy a 10-year government of Canada bond with a 3.5% yield.

Using the government bond market for safety no longer gives the same return. Or it has been said that long term bonds now provide “return-free risk”. It is difficult to comprehend the scale of this shift where a vast sum of institutional investors’ former bond money is now forced to seek a new home in cash or the stock market.

Avenue’s Equity Portfolio

Living through the panic in March we were still confident in the long-term value of our investments. We just thought the stock market would take longer to recover. We now have a clearer picture of why the stock market has rebounded with such speed in the last quarter. The phrase being used is that the US central bank has the ability to save Wall Street but not Main Street. Low interest rates make bond investing unattractive and pushes money toward a potential higher return in the stock market.

We also have the additional liquidity, generated by central bank purchases of bonds, which also finds its way into the stock market. We are currently using a rough number of about $5-trillion dollars of newly created funds in the US, which is about 25% of the entire economy. This includes both central bank asset purchases and the fiscal deficit. A further anomaly of this crisis is that many people are saving money at the highest rates in generations with a savings rate of 30%, and so there is even more money available for investing.

In our last letter we explained how the stock market has a way of looking through to the other side of the pandemic. We focused our investments on businesses that have stayed open through the crisis and can be termed as essential to the economy. This pandemic will pass. At the moment the consensus priced into the market is that there will likely be a vaccine available sometime in 2021. We have built the portfolio to survive this crisis, but these businesses are also ones that we want to own in the years ahead.

Global Isn’t Global

A post-panic trend is to encourage investors to get their money out of Canada and own a broader global portfolio. This idea was fashionable before the crisis but now the noise has become even louder. Avenue’s strategy is always to go find consistently profitable businesses, regardless of where they are, and be careful not to pay too much for them. So, we ask the question, are we missing something? On closer inspection what is making up these global portfolios is just the same handful of big US technology stocks.

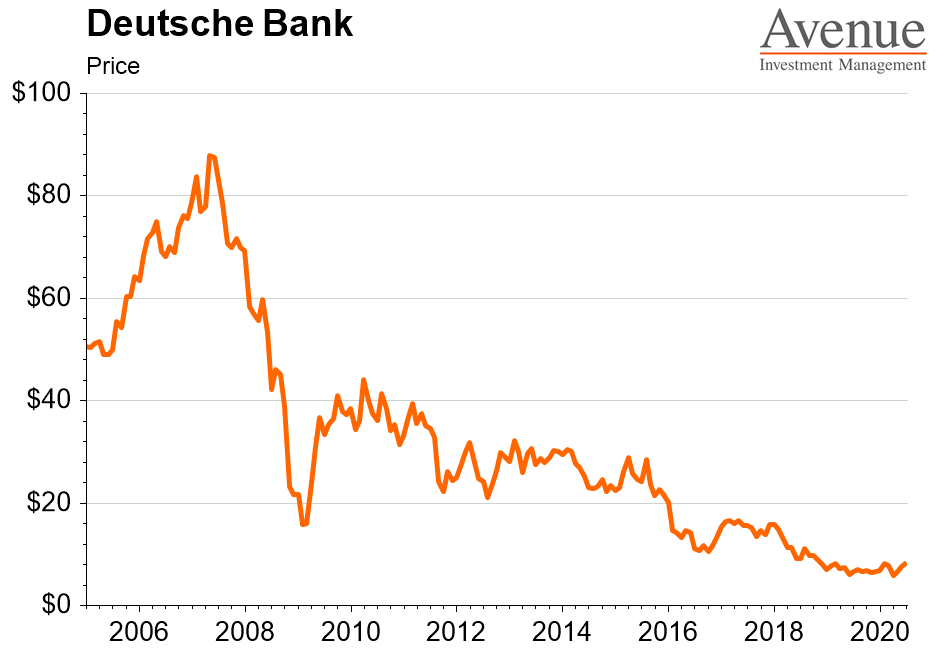

When the term “global investing” is thrown around you do not hear many investors talking about wanting to own German banks or Japanese bonds. Deutsche Bank for example has a stock price still sitting at close to a 15 year low.

It is the success of the big tech stocks like Microsoft, Amazon, Apple and Google which is completely overwhelming the investment industry’s ability to make clear decisions on diversification. They are all good businesses, but for the most part they trade at high valuations and there is increasing risk over coming years that they will face anti-trust issues. There is real concentration risk because everyone, globally, owns the same few stocks. In Avenue’s equity portfolio we have 10% exposure to technology, and we have an investment in Apple where we think the valuation is reasonable. But to make sure we do not get side swiped by another tech wreck like we had in 2000, we have diversification with similar weightings in healthcare, consumer service companies, real-estate and utilities.

While many investors are still concerned about a second stock market crash, what we are actually seeing is a bit of a mania unfold in story stocks like Tesla and Shopify. Both these companies have revolutionary business models and could very well change the world, but they don’t currently make money. Excess liquidity from central banks is creating a bubble even while the economy is in recession. So, we must position ourselves to cautiously steer around this new obstacle as well.

Cash Isn’t Safe

Many investors have gone to cash to wait out the current economic crisis. We argue that the perceived safety of cash is no longer as useful as it was. We spoke earlier in this letter about the central bank borrowing money to create liquidity. This has had the effect of stabilizing the bond market, but it has also sown the seeds of the next financial crisis. There is now simply too much debt in the world which cannot be paid back through economic growth or taxation. The only practical way out is to gradually devalue the purchasing power of fiat currencies.

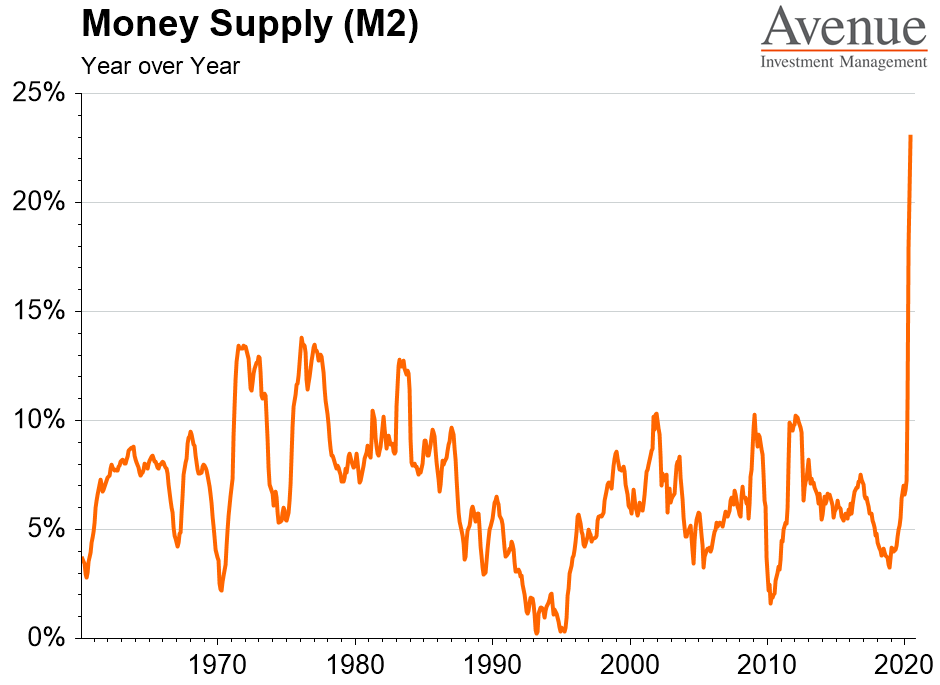

There is a staggering amount of money that has been created in the United States, with M2 money supply growing at over 20% during the last year. As you can see on the chart, this number well exceeds the growth in money supply that occurred during the inflationary period of the 1970’s.

The tricky part is that most governments are in the same situation. The relationship between the Canadian and US dollar might appear to be stable but they are both declining in value at the same rate relative to the price of a hard asset like gold.

In this month’s case study, we give a description of what an extreme devaluation looks like. While our current situation is less severe, it highlights the fact that maintaining investments in real cash generating businesses and hard assets is essential to retaining financial wealth. An important observation from past episodes of devaluation is that the path can be bumpy and test the resolve of investors.

Avenue’s investment strategy is designed to get us through these big challenges and protect our wealth. We diversify to shield ourselves from individual sector shocks. And our focus continues to be on businesses with income streams we can reinvest, hard assets and yes, gold. We believe this approach is more important now than even.