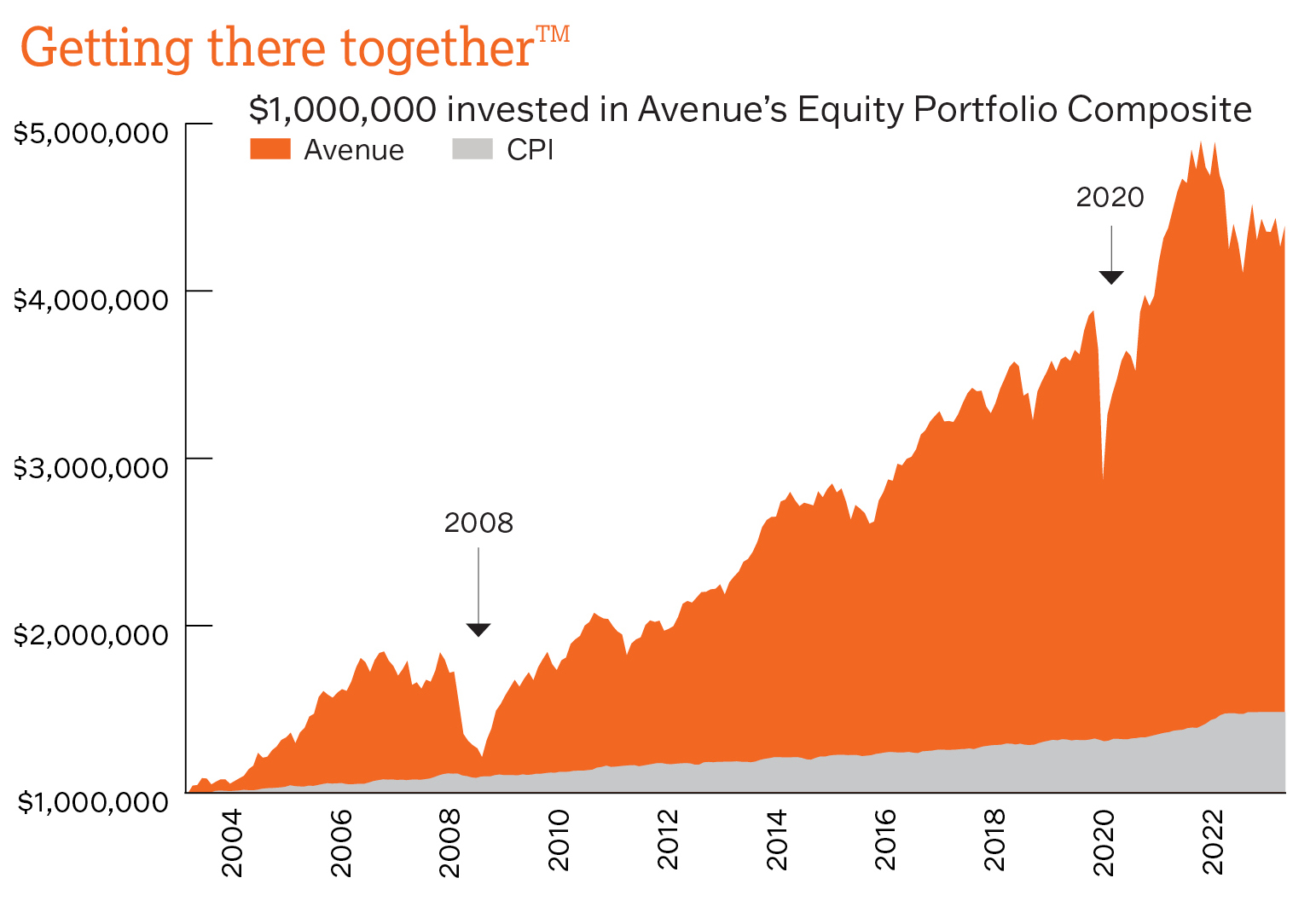

Source: Avenue Investment Management Inc. Data as of June 30, 2023.

Not every investor has the same goal.

At Avenue, we have one philosophy and strategy for managing clients portfolios that can be customized to accomplish different objectives for the investor. Customization occurs based upon clients individual tax, income and personal values, allowing for flexibility in the portfolio construction process.

Tailored Asset Allocation

Every client has their own unique asset allocation and risk parameters that may include investing in bonds when appropriate. The portfolio management team will assess the client’s needs and make suitable recommendations for certain allocations within the portfolio.

Bonds

Avenue manages an active bond portfolio primarily comprised of Canadian corporate bonds. Corporate credit has been a core competency of the firm since inception in 2003.