We are an independent private wealth manager, trusted fiduciary, partner-owned firm and CIPF member based in Toronto.

Welcome to Avenue Investment

We help clients achieve long-term financial stability.

At Avenue, we’re all about getting there together when it comes to our finances. Our mission is to help you compound your wealth by owning quality investments that generate returns over long periods of time. We buy high-quality investments at a reasonable price with a disciplined risk management process, complemented by a specialized tail hedging strategy. Above everything, we always put our clients first and hold ourselves to the highest level of accountability in the industry.

We are an independent firm led by true independent thought and research, which has allowed us to successfully navigate various market cycles for the past 20 years. We are not limited by a corporate agenda or incentivized to gather assets and sell products. Instead, the Avenue team is fully invested alongside our clients and treats every investor as an equal partner in our shared success.

Two core principles drive our decision-making process.

First, how do we achieve desirable long-term investment results with as little risk as possible? Second, what is best for our clients? In doing so, we have been able to provide superior value to our clients and build relationships based on trust, accountability, fairness and transparency.

We are a legal fiduciary.

We are held to a higher legal standard than the majority of the industry. This is not just through credentials but how the firm is registered. We are advising representatives, not dealing representatives or “sales people” disguised as money managers. We have a 20-year audited track record that is GIPS-verified and meets the highest standard of performance verification.

We are independent and aligned.

Avenue does not rely on third-party research, and all our investments must meet our rigorous criteria. We are not beheld to a corporate agenda or have internal conflicts of interest. We are also fully invested in the same portfolios as our clients.

We are quality investors.

Our investment approach is a blend of quality value and quality growth investing. We believe quality investing is the sweet spot that blends the best of the two, leaving the worst behind. That’s why we are focused on buying high-quality businesses at a fair price.

Investment Management & Financial Planning

At Avenue, our core investment strategy is an all-weather strategy that is designed to compound our client’s wealth over the long term. We believe that owning high-quality businesses are the best investments to own. Our investment approach also includes a tail hedging strategy that offers enhanced downside protection. This allows clients to remain invested comfortably throughout an entire market cycle.

Avenue In The News

Bill Harris on BNN Market Call – July 27, 2016

Click here if the player is not working

Bill Harris on BNN Market Call – May 10, 2016

Click here if the player is not working

Paul Gardner on BNN Market Call – Feb 17, 2016

Click here if the player is not working

Latest Case Studies

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Latest Podcasts

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

All Insights

Bill Harris on Market Call – February 10, 2022

Things to consider while choosing portfolio management services

Our financial savings are one of our most prized possessions. It represents all of the years of hard work we put in and our commitment to a secure financial future. It’s how we maintain our desired lifestyle and the means to which we can take care of ourselves and our families.

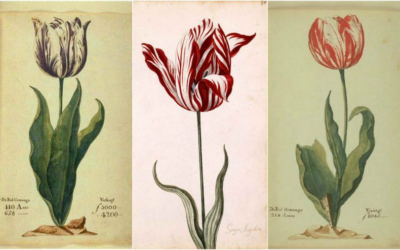

Extraordinary Popular Delusions and the Madness of Crowds

The historical example of a mania that is often sited is the Dutch tulip bulb frenzy of the 1630s. The tulip craze became popularized as a cautionary tale for investors in the 1841 book by Charles Mackay called Extraordinary Popular Delusions and the Madness of Crowds. Excessively easy monetary policy accompanied by a strong economy led to one of the oddest, speculative, price increases ever.