In the spring of 1970 a 40-year-old Warren Buffett presided over the first annual shareholder meeting of Berkshire Hathaway in the lunchroom of National Indemnity Company in downtown Omaha, Nebraska. The initial annual meeting was said to total less than two dozen people, made up mostly of family and friends of Buffett, along with a few early investors. For the first decade of Buffett’s tenure as CEO of Berkshire the small lunchroom in downtown Nebraska had enough capacity to host the handful of regular attendees to the annual meeting. As Buffett’s notoriety grew over the years, the annual meeting needed a larger venue. In the 1980s the venue migrated from the Hilton Hotel to the Witherspoon Concert Hall, and then to the 2,000-seat Orpheum Theater in Omaha.

In the following decade the meeting was forced to move to the 10,000 seat Omaha Civic Auditorium, but by the early 2000s even that was not enough room to accommodate all the attendees. In 2004 the annual meeting moved to its current location, a 20,000-seat venue in downtown Omaha now called the CHI Health Centre. The event by then had become known as the “Woodstock for Capitalists”, with the weekend now including a tradeshow promoting all the different Berkshire Hathaway business units, along with social activities throughout Omaha plus the shareholder meeting as the main event on the Saturday.

Attendees will travel from all around the world to sit in the arena and listen to Buffett speak and answer questions from the audience, with Buffett playing a role reminiscent of a modern-day Oracle of Delphi.

Some Avenue teammates have been fortunate to attend a few of the annual meetings in Omaha over the years, with each one serving as a great educational experience.

In May 2025 Warren Buffett once again hosted investors for his annual meeting. At age 94 he took questions from investors for over four and a half hours on a range of topics covering tariffs, the economy, and individual investments that Berkshire owns. Each response had Buffett’s characteristic combination of candidness, clarity, and humour. With just five minutes remaining in the meeting, Buffett made the surprising announcement that he would be stepping down as CEO at the end of 2025 but would remain as Chairman of the Board of Directors. It had previously been believed that he would remain in the role of CEO for the duration of his life. It was his “Exit Stage Right” moment.

For the past 60 years Warren Buffett has authored a prolific catalogue of investment, economic, and financial commentary and analysis as chronicled in his annual letters to Berkshire Hathaway shareholders. In addition to his annual letter, there are a few other noteworthy essays and articles he has written in this time including: “The Irreversible Nature of Pension Promises” in 1975 to Kay Graham when she was CEO of the Washington Post, “How Inflation Swindles the Equity Investor” in 1977 as highlighted above and published in Fortune Magazine, and “Buy American. I Am.” written as an Op-Ed in the New York Times in October 2008 during the financial crisis.

In this quarter’s letter we will focus on one of his less well-known pieces, an Appendix to his 1983 Annual Letter titled “Goodwill and its Amortization: The Rules and The Realties”. The title gives the reader the impression that there is an accounting lecture forthcoming, which there is to some degree, but more important is the example and profound analysis he uses as it relates to how different businesses are disproportionately impacted by the heavy cost of ongoing inflation. After we explore these concepts, we are then going to apply them to two examples from the Avenue portfolio, one current investment, and one former investment.

The 1983 Appendix essay focused on comparing the economics of See’s Candies, a California based candy business that Berkshire had purchased in 1972, to a hypothetical ‘Mundane’ Business with lower quality economics.

See’s Candies possessed qualities that allowed it to have very strong economics and profitability: loyal customers, strong brand value, excellent quality product, leading to sustained pricing power, while the hypothetical ‘Mundane’ Business suffered under the burden of inflation.

The critical difference between a business like See’s Candies and the ‘Mundane’ Business is that See’s required minimal ongoing investments in tangible assets, while the ‘Mundane’ Business was tangible asset heavy and required large ongoing investments in tangible assets throughout the inflationary 1970s.

As a quick definition, tangible assets include items like physical buildings, plants and machinery, equipment or vehicles; essentially if you can touch it, it is a tangible asset. Meanwhile intangible assets would include things like copyrights, trademarks, software, brand value, or propriety data; if you can’t touch it, but it is an asset that helps your business produce profits, then it is an intangible asset.

After going through some minor accounting definitions, Buffett presents a simplified highlight of the key account values in Time Period 1 for each business:

As shown above both businesses produced profits of $2 million. See’s Candies required net tangible assets of $8 million to produce these profits while the ‘Mundane’ Business required tangible assets of $18 million to produce these profits. The difference in these economics is highlighted in the calculation for return on tangible assets, which is calculated as net profits divided by net tangible assets.

Buffett then proposes a thought experiment.

He suggests that investors imagine a scenario where the Consumer Price Level doubles – what would be the effect and burden placed on each business which these different economic characteristics? (A doubling of the Consumer Price Level would be consistent with a level of around 7% inflation per year over a 10-year period.)

To maintain the purchasing power over this time he highlights that both companies would need to grow profits from $2 million to $4 million (to match the doubling of inflation).

The critical distinction then rests on the question of how much additional tangible assets each business would require in its operations to produce this higher level of profits.

Buffett assumes that a doubling of profits from $2 million to $4 million would also require each business to double its investment in tangible assets.

Holding the Return on Tangible Assets and market valuation constant, this analysis is presented below:

The change in values between Time Period 1 and Period 2 is summarized below:

Where did the increase in tangible assets come from? It can come from one of two sources: annual profits that each business earned and then reinvested on its own, or, raised from outside investors either through borrowing money (debt) or issuing new shares of the company (equity) to new investors.

Buffett’s important conclusion from this analysis is that although both businesses earned the same profits of $2 million, See’s Candies did so with substantially fewer tangible assets. Businesses who require less investment in tangible assets are in a better position to navigate inflation, because less capital needs to be reinvested in the business. Businesses who require significant ongoing and growing investments in tangible assets can be much more negatively affected by the burden of inflation because inflation is effectively a hidden tax on this reinvestment.

As a side note, this argument should receive fair push-back from the natural resources community who would argue that natural resources can provide good inflation protection as commodities tend to rise during periods of inflation. This is true in many cases. Even though resource businesses require significant amounts of tangible assets and capital spending, if the underlying commodity price is rising faster than the need for capital or new tangible assets, then these businesses can do well during periods of inflation. So, to be clear, our analysis with this exercise is focused on examining non-resource businesses, which comprise the majority of the Avenue equity portfolio.

As equity investors we have been navigating the biggest inflation surge since the 1960s and 1970s. From the end of 2020 to today, the cumulative rise in prices in Canada and the United States is between 20% and 22%. Although the year-over-year increases in inflation are now lower, the cumulative rise in prices is here to stay.

One can find a varying degree of analysis on explaining why the rise in inflation has occurred: the impact of the pandemic, ongoing supply chain issues, tariffs, expansionary fiscal policy, or low interest rates. For the sake of our analysis, we are less interested in explaining why it has occurred, rather, we are focused on observing how it has impacted different businesses including our investments.

This past quarter marks the 5-year anniversary of the pandemic related market decline in March 2020. That was a highly uncertain time both for the world and financial markets. With the benefit of perfect hindsight, it was also an excellent time to be making new investments. We would make the case that the economic policy response in the spring and summer of 2020 was the starting point for this inflation cycle.

This marks a good starting date as a relevant timeline for the forthcoming analysis of two businesses we purchased in March and April 2020, and their subsequent business performance. Both are Canadian businesses in the technology sector.

One of these businesses continues to be our largest technology investment today, meanwhile the second investment was sold in 2023 because of deteriorating business performance. What makes this comparison relevant is that it provides an example highlighting the same principles that were discussed in Warren Buffett’s 1983 Shareholder Letter Appendix, as shown above. It is particularly insightful to examine how certain businesses are better suited to handle periods of inflation, while other business models are more likely to be damaged by inflation.

The two investments we are going to examine are Constellation Software and BCE.

Constellation Software, founded by Canadian entrepreneur Mark Leonard in 1995, is a leading provider of mission-critical software solutions and services to a select group of public and private sector markets. They acquire, manage, and build industry specific software businesses which provide specialized solutions to their over 125,000 customers. Essentially, they own and operate business software that allows their customers to function. Some examples would be the software to schedule a doctor’s appointments, the software to run a local library, or software used by a local gym to book fitness classes. Wherever a business interacts with software, Constellation is there.

Constellation has generated a remarkable track record of success for long term investors and Mark Leonard has built an enduring business model and culture to support it. We made our initial investment in April 2020 at a share price of $1,280 which at the time felt like an expensive price. Five years later the shares are trading on the TSX at a price of close to $5,000. Rather than focus on the share price it is the business economics and performance that is worth highlighting over this past 5 years.

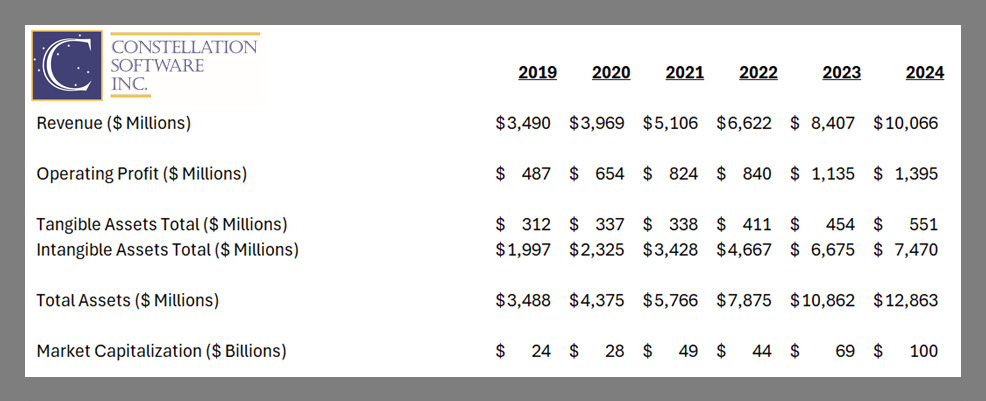

A business like Constellation has been in a strong position to weather this period of inflation because it requires minimal tangible assets to operate. Over the past 5 years Constellation has more than doubled its revenue and operating profit while only requiring a minor increase of $239 million in new tangible assets.

This is calculated below by taking the $551 million in tangible assets at the end of 2024 and subtracting $312 million at the end of 2019. Over the same period the company has grown Operating Profit by $908 million to a total of $1.395 billion by the end of 2024. For every $1 increase in tangible assets the company has generated $3.80 in additional Operating Profit.

Source: Constellation Software Financial Statements

Constellation has also demonstrated a strong ability to generate consistent and growing cash flows as shown in the below financial summary. Another critical aspect of Constellation’s economics is the requirement of minimal annual capital expenditures. Such minor requirements for capital spending mean that the company has additional cash flow that can be reinvested back into the business, principally to acquire additional software businesses.

This is what superior economics looks like. A highly profitable company, with growing profits and cash flows, with only minor needs for additional new tangible assets, in addition to having ample opportunities to reinvest its profits back into the business.

The challenge with a business like Constellation is that many investors understand and recognize these high quality characteristics and are hence willing to pay a higher valuation for the business. In this sense, the stock market can function as a pari-mutuel system (betting pool) where investors place excessive bets on Constellation’s ability to generate strong returns long into the future which drives up the valuation.

To draw an analogy to horse racing, famously in 1973 the horse Secretariat went off at the Belmont Stakes with odds of 1-10, meaning that if Secretariat was to be successful in winning the Triple Crown, the return on that wager was only going to be 10%.

You could have invested in the best racehorse in the world, and even after winning the race by a record 31 lengths, you only would have earned a 10% rate of return.

Future returns for Constellation Software are likely in the same category. At today’s share price we believe that the business can still generate modest returns for long term investors. Owning a business like Constellation is sticking with our theme of investing in high quality companies with superior long-term economics.

For the final section of our analysis, we are going to examine BCE, an investment we owned between 2020 and 2023, which for our purposes plays the role of the ‘Mundane’ Business. We sold our investment in BCE in 2023 because of deteriorating business performance.

A business like BCE has a long history in Canada as part of the backbone of our telecommunications network. A strong telecommunications network is a critical part of having a thriving and vibrant 21st century economy. From this perspective, BCE and its competitors, Rogers and Telus, play an essential role in the economy. They are essential to the Government of Canada, their business customers, and the millions of households who rely on their services.

Ironically enough – Constellation Software would not be able to exist if it were not for BCE’s (and their competitors) telecommunications network.

But are these characteristics sufficient to mean that BCE is a business that also has good economics for shareholders? This is an important distinction to make. It is possible to both: be an essential business while also offering poor economics for shareholders.

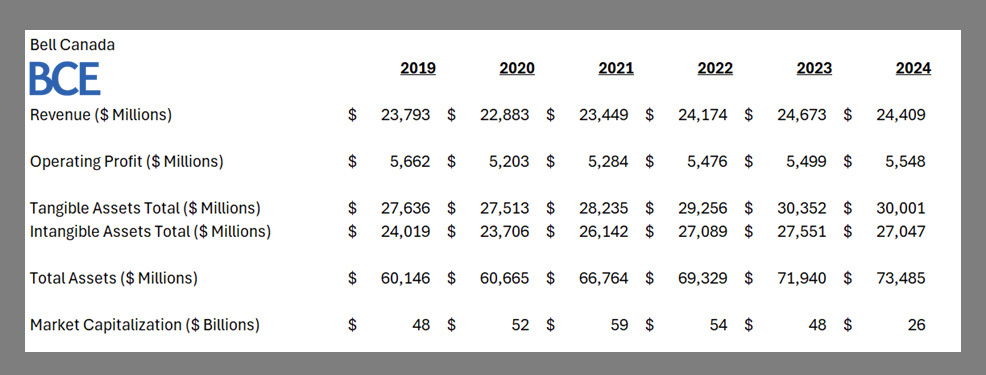

BCE is a tangible asset heavy business, meaning they have substantial investments in tangible assets and physical infrastructure like network equipment, digital transformers, and 5G infrastructure. Asset heavy businesses like BCE are hurt by inflation because of the substantial increase in cost to both make new investments and maintain existing tangible assets.

Additionally, because BCE is highly regulated, it means that it has a challenging time raising prices for customers without drawing the ire of the Government of Canada. Who wants to pay more for their cable or cell phone bill, anyway? This is a cocktail that the stock market does not like, however, sometimes it takes a long period of time for these lower quality economics to become fully evident.

Despite substantial investments in their 5G network over the past several years, BCE’s revenue has been essentially flat at $24 billion since the end of 2019, with operating profit being down slightly at $5.5 billion. This has occurred despite substantial investments in new tangible assets.

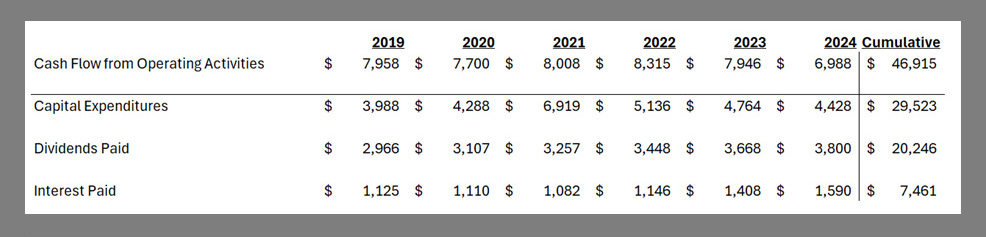

Looking at BCE’s Cash Flow Statement also provides further insight into how the business has fared over the past 5 years. The business has generated cumulative cash flows of $46.9 billion, meanwhile capital expenditures, dividends, and interest paid have totaled a cumulative $57.2 billion.

This means that the business paid out $57.2 billion in cash flows yet only received $46.9 billion in cash flows into the business. How did this $10.3 billion deficit get funded?

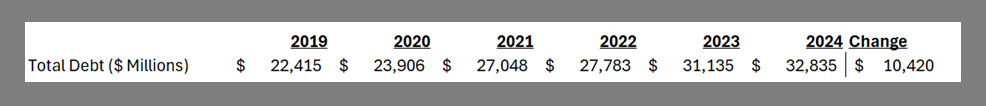

Below highlights the level of debt on BCE’s Balance Sheet, which corresponds to the cash flow shortfall.

In effect – once the profitability of the business deteriorated, they were paying the high dividend by borrowing money from new investors – an unsustainable situation. In May 2025 BCE cut its dividend by 50%.

One argument some investors have made in favour of BCE is that they own valuable media assets, including their investment in Maple Leaf Sports & Entertainment (MLSE). But as is often the case, when a business enters financial distress, it sells what it can, not what it wants to. Along with the dividend cut in May 2025 BCE announced that it is selling its minority stake in MLSE to fund its expansion into the U.S. 5G network. Essentially, they have decided to double down on their existing business. Whether this works out for shareholders in the long run – only time will tell.

A fair argument that some investors could make is that at today’s price BCE now offers better “value” relative to Constellation Software, because expectations are lower for BCE and the valuation is significantly lower.

If investors were looking to make a short-term trade over the next 12-24 months it is quite reasonable to argue that BCE’s share price might well outperform Constellation over the short term, as excessive pessimism about BCE and excessive optimism about Constellation work to balance itself out.

However, we believe this argument ignores the relative economics and profitability of the businesses, which have not changed at all. As long-term investors we want to own investments that can grow and compound over the long term. To do so requires a portfolio of investments that possess superior long-term economics, which drives consistent growth in long-term profits.

While always remaining focused on valuation, we believe it is the underlying qualities of each of our investments that will drive long-term returns for our investments.

We continue to be on the lookout for new opportunities that meet our Quality investment criteria.

Bryden Teich

July 2025