“The number one rule of compounding is to never interrupt it unnecessarily.”

-Charlie Munger, Vice Chair Berkshire Hathaway

In honour of the late Charlie Munger, Vice Chairman of Berkshire Hathaway, we thought it would be fitting to use his elegant quote regarding the importance of not interrupting the long-term compounding of our investments. Implicit in this quote is the importance of time when it comes to achieving satisfactory investment results.

In this year-end letter, we wish to extend a particular thank you to all our clients. The close of calendar year 2023 marks the 20th anniversary of the founding of Avenue Investment Management. Twenty years is a long time in the investment industry, and much has changed in the world since 2003. Avenue continues to occupy a unique place in the Canadian investment management landscape as an independent investment firm with a long track record of managing the investments of private clients. Avenue’s success has been made possible because of the longstanding trust and support of our clients, and for this we thank you.

Avenue was founded in 2003 on the unique guiding principle that clients should always be put first, a principle that sits at the core of Avenue to this day.

Our investment philosophy has always focused on investing to achieve reliable returns for our clients over the long term. This is achieved best from owning companies that have the common traits of being consistently profitable and high quality. We will explore this topic further throughout the letter.

Before getting into our thoughts and updates on how we are investing in the current economic environment, let us first ask an important question:

“Why do we need to invest in the first place?”

The Goal for all Investors

It is our view at Avenue that all investing should begin with the above question.

As consumers we are all faced with a simple conundrum: How much goods and services do we wish to consume today? And how much do we wish to consume in the future?

If we wish to consume all our savings today on our current spending then we have no need to be thinking about investing at all. This is because all our savings will be spent and consumed in the current period. Although this may feel like the most exciting and enjoyable option in the short run, it is a choice that also creates long-term consequences.

If on the other hand we decide to be prudent and accumulate our savings with the goal of spending it in the future, then our investment strategy becomes critically important to achieve our long-term goals. Ultimately the goal of investing our savings is to protect and grow our purchasing power over time so that we can consume more in the future. To answer our initial question: “Why do we need to invest in the first place?”

Answer: We invest our savings today so that we can consume more in the future.

If we are planning to consume our savings in the future, then it is natural to conclude that the biggest threat to our future consumption is that prices for the goods and services we consume will be higher in the future. This leads us to a critical investing implication:

The biggest threat to our future consumption is inflation.

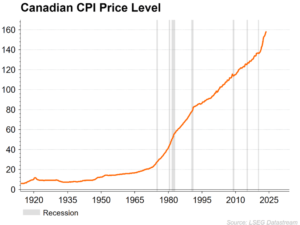

Inflation has become a point of focus over the past few years given its precipitous rise after the 2020 pandemic. However, inflation has always been part of the picture for investors and is something that can not be avoided in a world of fiat currencies. The monetary system we live in is one of fiat currencies which are backed by the faith and credit of the issuing government and are not backed by gold or silver.

In a fiat currency system, a rise in general prices is an inevitable side effect. Governments can borrow money and then spend those dollars into an economy much more easily in a fiat currency system.

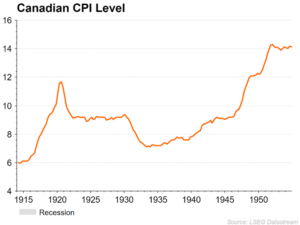

The history of the consumer price level in Canada over the last 100 years can be divided into two distinct time periods. Between 1915 and 1950 consumer prices rose at a 2.1% annual rate.

As the chart highlights most of this initial inflation occurred during and after World War I. From 1920 to 1950 the rise in consumer prices was close to 0%, with a period of severe deflation in the late 1920s and 1930s.

This deflation was possible while Canada was still on the gold standard until about 1934, at which point it was abandoned.

The next period of inflation that is noteworthy is from the beginning of 1970 until today.

This 53-year period saw prices rise at close to 4% annually, with the inflection point over the past three years being particularly noticeable. The major change that occurred during this period was in 1971 when the United States officially left the gold standard. This change in 1971 pushed the western world fully into a fiat currency system as the U.S. dollar was no longer backed by gold.

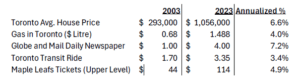

Inflation is more than just something that gets quoted in government statistics, it is something that we all experience in our daily lives. Although year-to-year changes are not always noticeable, over longer periods of time changes in prices become more obvious. As an exercise let’s look at some prices from back in 2003 when Avenue was founded and compare them to 2023.

This is not meant to be an exhaustive list and we know we could find many other examples to show the same effect over this period. Suffice to say that if we hope to maintain our current purchasing power 10 or 20 years in the future, we can expect that prices will be higher than they are today.

As investors we know that we want to consume goods and services in the future, and we know that the prices of those goods and services are going to be higher in the future than they are today. Given these two facts, how should we be investing today?

Quality Investments are the Answer

At Avenue our belief is that the best way to invest to protect and grow our purchasing power over time is to own high-quality investments. Our portfolio of investments is centred around the principle of owning high-quality companies who are consistently profitable, earn good returns on capital, and can reinvest in their businesses at good rates of return. It sounds very simple, but there are few companies that meet this criterion.

“The best protection against inflation is a great business.”

–Warren Buffett, A Few Lessons for Investors & Managers

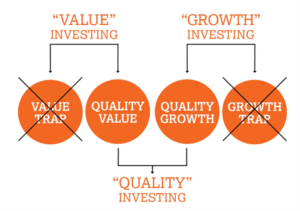

Our quality businesses are better able to successfully operate through periods of inflation because of these characteristics. The traditional investment industry attempts to label strategies as either “growth” or “value” as this is what the marketing departments at the mutual fund companies decided in the 1990s was the best way for them to explain investing styles. Previously this kind of labeling did not exist.

At Avenue, we reject this kind of simple box-checking exercise. We want all our companies to be growing so that they can either be reinvesting in their businesses and repurchasing their shares or distributing the growing profits to us in the form of higher dividends. We also want to make sure we are paying a fair price for these investments.

We have observed in 20 years that both “bottom-feeding” on cheap valuation stocks and “growth-chasing” on high flying stocks offer far less attractive outcomes over the long term. We stick to investing in businesses we know and understand, and we believe this more than gives us the ability to achieve our desired investment outcomes.

Buying quality companies at fair prices has always been the best way to explain how we invest. Thankfully our independence gives us the ability to define our investment philosophy more clearly in a way that makes sense to both Avenue and our clients.

The Outlook for 2024

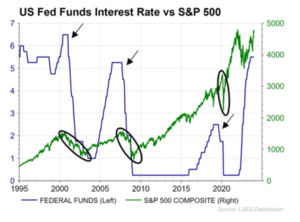

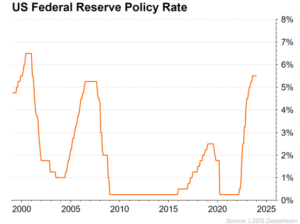

As we look out on the horizon for next year, we again see a stock market that is showing signs of exuberance. The biggest story over the past two years, aside from inflation, has been the sharp rise in interest rates after the central banks in the United States and Canada quickly moved short term interest rates higher to combat rising inflation. In July 2023 we saw what we believe was the final hike of this particular interest rate hiking cycle, and since then the stock market has reacted positively to this change in policy stance, given we are not yet in a recession.

In our experience watching these cycles play out over the years there is generally a period after the central bank stops their interest rate hikes when the stock market gets a sugar high from the possibility of no more interest rate hikes.

Now that the interest rate hiking cycle is over, the market is beginning to price in the expectation of interest rate cuts in 2024. Using the past three interest rate cycles as a guide, we can see that the first interest rate cut has happened between 6 – 13 months after the final hike. Based on comments from the Federal Reserve at their meeting in December 2023, we think it is reasonable to expect the first rate cut to be somewhere between 6-8 months after the final hike in July. For now, there is a reasonably high probability of a Federal Reserve interest rate cut on the table somewhere between February and May 2024. The same goes for the Bank of Canada’s interest rates.

There is still a possibility that both the Federal Reserve and the Bank of Canada will remain stubborn in their desire to keep short term interest rates higher for longer. However, at the moment the stock market is not pricing in this scenario. The stock market can at times take on the persona of a petulant young child when it does not get what it wants. If rate cuts are not coming in 2024 then it presents a material risk to the stock market at current prices.

The current story in the financial press is that stocks are rising because the Federal Reserve is going to start cutting rates in 2024, and this is a reason to be positive on stocks at the present time. The lessons of history and our own experience through the cycles tells us a different story.

In both the 2000-2003 and 2007-2009 cycles the beginning of the rate cutting cycles marked the top for the equity market. Meanwhile in the 2019 cutting cycle the market continued to accelerate into the final peak in February 2020, 6 months after the first cut.

Our investment strategy does not require us to try to predict how the market is going to react this time, and frankly we have no discernible edge in trying to do so. But we know that either scenario is possible.

However, this time around when we see the consensus is so one-sided that Federal Reserve interest rate cuts are going to be positive for stocks, it reminds us of the wisdom of Mark Twain:

“It isn’t what you don’t know that gets you into trouble. It’s what you know for sure that just isn’t so.”

– Mark Twain

Regardless of what 2024 brings, we believe our strategy of investing our savings in high-quality businesses is well suited to protect and grow our purchasing power over the next many years and decades.

Some Lessons Learned over 20 Years

Avenue began 20 years ago as a small partnership with a few initial supporters along with friends and family of the founding partners. Fast forward to today, we now look after close to 400 family relationships across North America. The success of Avenue has been because of the trust and support of our clients and because we have remained focused on doing what we said we were going to do.

We decided years ago that Avenue would never be all things to all people. Our uniqueness in the investment landscape is our strength, and it is something that we pride ourselves on. We believe this gives us a solid ground to stand on.

Our commitment in the years ahead is to continue to look after our clients’ savings as thoughtfully as we look after the savings of our families. Our personal wealth continues to be fully invested alongside our clients’ wealth.

At Avenue we have a quiet confidence about our straightforward and thoughtful approach to investing and we are excited about what the future holds for Avenue and our clients.

All of us at Avenue Investment Management send you warm wishes for a happy and healthy 2024.

Bryden Teich

January 12th, 2024