In last quarter’s letter we wrote that as interest rates rise, they will likely cause a stall in the economy given the level of consumer and corporate debt. It is always hard to predict the timing of when the market will react to a slowdown, but that reality finally happened in December. What is unusual is that this was a global phenomenon where almost all asset classes were down worldwide in 2018.

Now we are faced with a paradox: interest rates are likely to stay at this low level which implies stock market valuations should remain high, but the stock market keeps falling. Our conclusion is that parts of the stock market are now oversold so we will focus our investments on high cash-generating stocks. As dividends are constantly building up in the portfolio we can keep adding to our investments, even if we are faced with a prolonged period of stock market weakness.

After eight years of low interest rates, where borrowing money was basically free, financial assets have shot up in value almost everywhere. However, throughout 2018 we observed that most global markets were weakening. The US was the lone holdout with a strong economy; earnings had benefited from a onetime corporate tax cut and there was a continuing bull market in tech stocks. All that changed in December with the resetting of asset prices and the assumption that money will have a cost going forward, combined with a global economic slowdown and unresolved trade disputes.

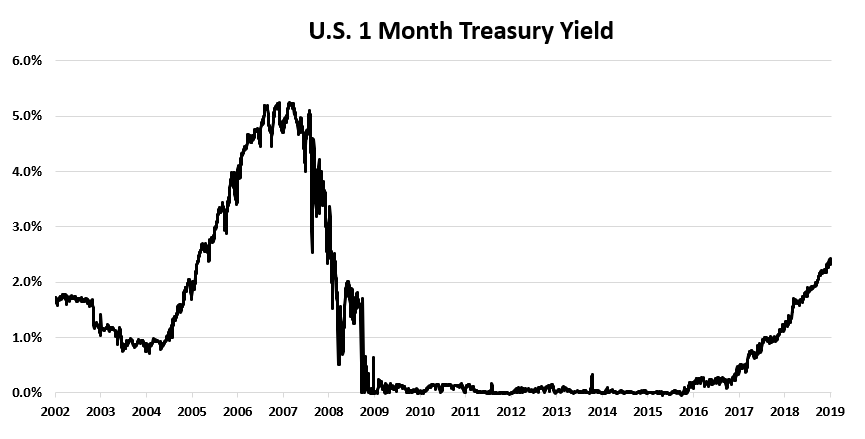

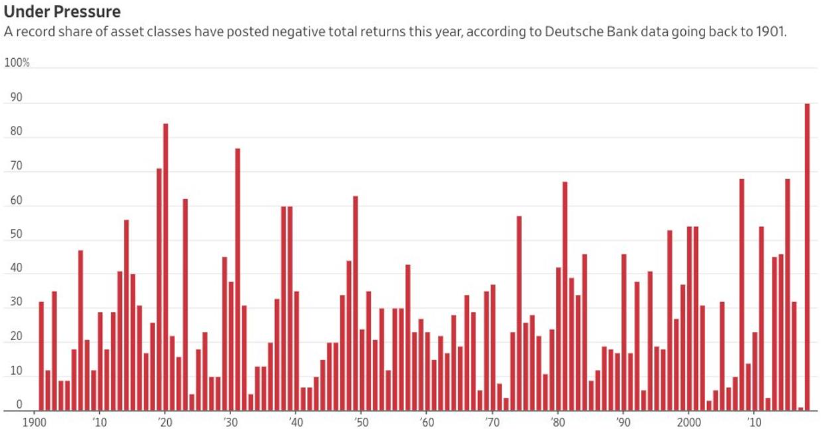

The following two charts are a good way to visualize the magnitude of the interest rate change (1) and the resetting of global asset prices (2). The first chart is the yield on 1-month US treasury bills which currently sits at 2.4%. You can think of it as the cost of money for the world’s reserve currency. The second chart shows that over 90% of all asset prices, measuring 200 categories, were down in 2018 for the first time in almost a hundred years. 2018 was truly an unusual year.

Here is the paradox. Interest rates are hitting a point where they have caused the consumer to slow down. We now have higher confidence that interest rates will stay at the current low levels for some time. If interest rates remain at this low level, then the valuation on stocks should remain higher. But as the stock market continues to fall, stocks are getting cheap by historical measures.

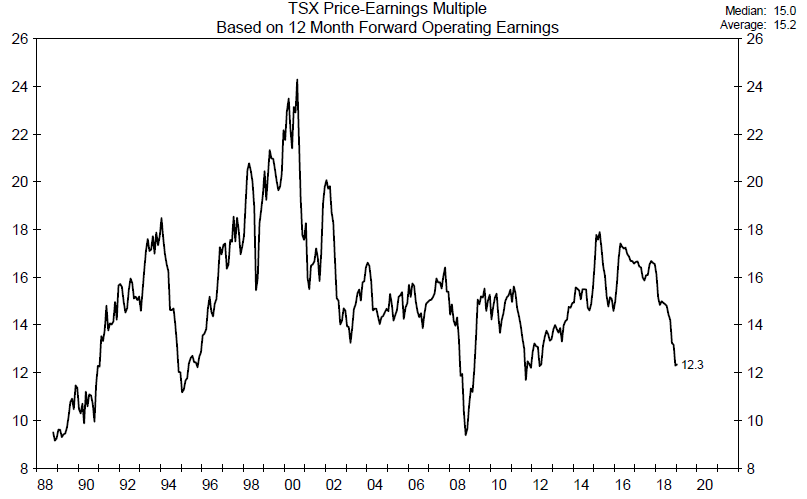

So, either stocks are great value, which is what we have been waiting for, or maybe something else is wrong and we are entering an earnings recession and we don’t know it yet. The following chart shows that the Price to Earnings relationship for the TSX index is now close to the lows of the past 30 years. To phrase this another way, Canadian stocks have only offered this much value three other times in the last 30 years.

An important part of Avenue’s strategy is to minimize losses and more importantly to get through and take advantage of periods of weak markets. We try to avoid areas of overvaluation. Also, if there really is something wrong with the greater economy, which we can’t see yet, we try to avoid economically sensitive and cyclical businesses. We keep our core portfolio investments, which generate lots of cash, and it is the income from these businesses that we use to keep adding new investments to the portfolio to take advantage of a weak stock market.

A volatile market gives us an opportunity to shift the portfolio around more than usual. Starting in September we lightened our exposure to parts of the portfolio that we felt had become overvalued and added to investments where the underlying businesses were more stable, the valuations were lower, and we could get a better income stream. And again, it is the income stream that gives us the ability to keep adding investments to the portfolio in a weak stock market.

For example, we have now lightened or sold outright Amgen, Apple, Blackstone, CN Rail, Johnson and Johnson, and Microsoft. We have added to our existing investments in Baytex bonds and BCE, bought Slate Real Estate and reinvested in Blackstone at a lower price. As of the time of writing this letter, our cash position in the equity portfolio, which includes the Canadian government bond, is 12% and the yield on the investments within the portfolio is the highest it has ever been at 4.7%. This gives us cash to spend when we find good companies trading at attractive levels.

Given the particular weakness of our energy investments, we would like to make a more detailed comment about this part of the portfolio. A global slowdown has dropped the global price of oil from $80 US dollars in October to under $60 US dollars today. However, our investments are influenced by the Canadian sector where we believe market sentiment has given up on Canadian oil stocks after a decade long slump. We now have three investments in what we believe are the highest quality companies which are trading at compelling valuations. With patience, pipelines will be added, and we will have an opportunity to sell these investments a few years from now when we believe the Canadian energy market will recover.

We have also added to gold with our investment in Barrick. With almost all asset classes weak, gold is again a useful hedge and we feel most investors have little or no exposure. Also, cryptocurrencies don’t look like they are replacing gold any time soon. Barrick is Canada’s largest gold company and it has spent the last five years restructuring financially. It has now merged with Randgold and has acquired the best operating team in the industry. The Randgold people are now in charge of getting the most out of Barrick’s operations. We are positive on gold and positive on Barrick but we will use careful risk management for this holding where valuation is more important than the income stream. It will not likely be a long-term investment.