“plus ça change, plus c’est la même chose.”

– Jean-Baptiste Alphonse Karr, 1808 – 1890, French Critic

Translation: “The more things change, the more things stay the same”

We would like to start this quarterly letter by acknowledging that we are in an extraordinary period of financial change and extremes. What has not changed is Avenue’s strategy which we call quality investing, and we believe it is more relevant than ever. Our strategy is designed to be a universal approach to get us through both good and bad stock markets. The first principle is to identify what are the best stand-alone compounding businesses throughout the stock market. Second, we do our best to be patient and invest when these businesses are trading at a fair price.

Avenue’s quality investing strategy sounds simple but pursuing the strategy in the real world as stock prices change can still be challenging. Our belief is that stock prices fluctuate far more than underlying business values. A core principle is that given time, quality businesses will compound earnings, and ultimately share prices, with better long-term predictability than a strategy which is based on playing trends. We know we are giving up the ability to ‘hit it out of the park’ on an individual stock in the short run, but we also shouldn’t have any major losses. When we look at what we own in the portfolio, it should always reflect our criteria with nuance for the type of specific business.

We are emphasizing our strategy this quarter because we are again at what we feel is an extreme point in the stock market. The handful of large tech companies that dominate the US stock market index are once again expensive and, given our approach, currently un-investable. At the same time, many of the traditional Canadian dividend stocks have had their business models seriously impaired by the sudden rise in interest rates and cost inflation. Given these changes in both stock market valuations and business fundamentals, we have had a higher turnover of our portfolio names than we would have had in a less volatile market, but we expect our turnover to now decrease markedly. We believe most of the necessary changes are behind us and our portfolio is in good shape for the financial environment ahead.

Theme #1: Big tech is too expensive.

The big tech names have become such a dominant theme, we feel it is important to give our assessment. These are all good businesses, but they are very expensive. The problem with the stock market is that if you pay too much, in this case for a technology stock and the technology changes, then you are exposed to a major loss. All the top businesses are now priced as if their hold on technology will never end.

Apple for example, which we owned until a few years ago, now trades at 40 times earnings. This would imply that the company, even with a $3 trillion market capitalization, is growing earnings per share rapidly. However, revenue and earnings are both down over the last 12 months. As well, Apple now manufactures most of their products in China, as the US and China trade tensions continues to escalate. It is not that Apple’s success cannot continue; it is just an assessment that there is now a significant amount of risk to the stock price.

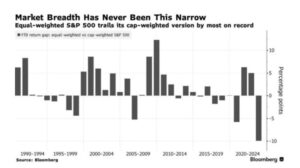

To point out another way of looking at the extreme impact Big Tech has on the US index, stock market breadth has rarely been this narrow. Narrow market breadth is where a small number of stocks are more dominant than the rest of the stock market. Generally this tends to happen at the end of an economic cycle as it did in 1999/2000 , 2007/2008, and more recently in January/February 2020 (all highlighted below).

As more money comes into the index, it continues to disproportionately push up the price for the biggest companies which is becoming known as the ‘index effect’. Like any stock market trend, it will continue until it doesn’t. Our goal is to find stocks that will do well but don’t have this embedded risk. Tech stocks have done well for the first half of 2023 but last year the tech heavy US NASDAQ index was down 30 percent.

Avenue has 12 investments in the US where the businesses are consistently profitable and have strong positions in their respective industries. We believe all our businesses have a market niche, where they have potential to grow for many years to come. And for the purposes of our strategy, their valuations are reasonable.

Avenue’s US stocks Top 10 stocks in the S&P500

15x earnings 40 x earnings

The stocks we own must be high-quality growing businesses but investing in these stocks with lower valuations gives the portfolio a better margin of safety. Very few companies have been successful at both compounding high margins and maintaining high valuations for long periods of time. It simply does not happen.

Theme #2: Traditional dividend payers face challenges.

Traditional dividend paying stocks in real estate, energy infrastructure and utilities are facing major earnings head winds from higher interest rates and inflationary cost pressures. A major part of Avenue’s strategy has been to invest a substantial part of the portfolio in what are traditionally consistently profitable and often regulated businesses. Recently, our view has changed because these stocks are too expensive given our outlook for their earnings and the expectation of higher interest rates. We have reduced our exposure for now to companies like Emera and Brookfield Infrastructure, but we believe in the future these companies may offer attractive investments again at a later date when the price levels are more rational.

Most of these hard asset businesses in real estate and infrastructure have debt and while the debt is not due right away, these companies are facing a much higher cost of capital. Meanwhile valuations are still too high given the now much higher interest rates. As well, these types of businesses build ‘things’, and reliable cost estimates are very hard to pin down in an inflationary cycle.

Enbridge is an example of a multi-decade successful Canadian dividend paying stock that we owned until 2021 which now has major challenges. The core pipeline business remains profitable but the return on new projects is suspect given the potential for cost overruns. They have a lot of debt, and their debt continues to increase even as profitability is stalled. They have also had to issue new amounts of equity over the past few years which is dilutive for investors and adds a further strain on the dividend. Additionally, traditional oil and natural gas pipeline infrastructure faces ever-increasing regulatory and social license headwinds.

We can build a solid portfolio in this stock market.

We are quite positive about our investments in the portfolio even though we describe the two major themes of tech and hard assets as being too expensive. As we have written in the last few quarterly letters, we are able to find quality essential businesses that can maintain their profit margins, do not have to rely on financial markets for financing, and their stock trades at a fair price given the outlook for the business.

We are holding more cash than usual, currently invested in 5% yielding T-Bills, as we wait and look for more attractive levels to add to a few existing positions. An important part of Avenue’s strategy is to recycle our investment dollars to areas of the market where we find value. When sectors of the stock market are at a low valuation, it is a good time for us to build positions for future returns.

Higher interest rates are better for Avenue’s bond portfolio.

Higher interest rates are better for Avenue’s bond portfolio returns, and it is almost that simple. However, we are continuing to be conservatively positioned given the potential for a corporate credit default cycle and higher interest rates for longer maturity bonds. We want to make sure we are positioned so we can take advantage of either a credit event or higher longer-term interest rates.

Interest rates have gone up quickly, but companies reissue bonds as their existing debt matures, which takes time, so the credit cycle seems to play out in slow motion. We believe there will be some stress in the credit market at some point in the next year. We already know that bank failures like Silicon Valley Bank, will have the effect of reduced lending in many areas of the economy.

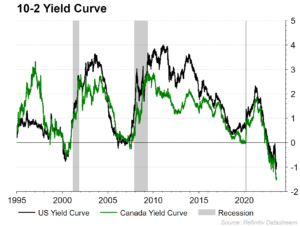

The chart above is a way of depicting the relationship between the short-term 2yr interest rate and the medium-term 10yr interest rate. We are currently at one of the most negative points for this relationship in history. It is important to acknowledge that this is an anomaly. Our whole credit and banking system is based on getting a higher rate of return for taking on the risk of lending longer term.

This relationship cannot last like this for long but how it resolves is important. We believe that by this time next year, short-term interest rates will be able to be at least slightly lower. What is now clearer is that medium term bonds may go higher in yield. Our view is based on the amount of bonds that need to be issued over the next six months to fund fiscal deficits. Inflation is coming down but regardless, the level of 10yr interest rates may be set by the fundamentals of too many bonds needing to be issued into a market where there is limited demand.