“Be like a Duck. Remain Calm on the Surface and Paddle Like Hell Underneath.”

– Michael Caine

This quote from Michael Caine, while a little extreme, does translate well to investing in an uncertain market. The asset value of Avenue’s portfolios moved up a bit in the first quarter of 2023, and our investments were relatively stable, given the swings in interest rates, currency and many sectors of the stock market. At Avenue, we are staying calm and analytical and working hard to make sure we can stay invested while avoiding areas where profit margins might be under pressure. As the economic landscape shifts, there are many new opportunities as other investors pull back.

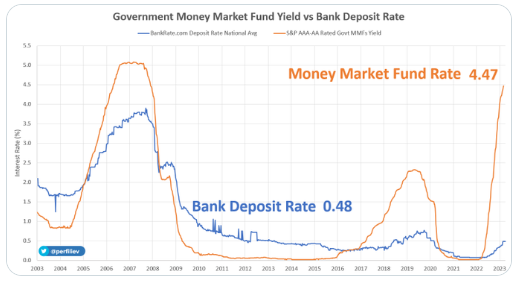

The economy is finally feeling the effects of short-term interest rates rising to levels not seen since 2007. Short-term interest rates are significantly higher than long-term interest rates, a situation known as an inverted yield curve. This situation occurs near the end of an economic cycle when a central bank raises interest rates to slow the economy down. Because interest rates are higher many individuals are making the simple decision to move their savings from bank deposits to short term treasury bills. Also, some investors are making the same decision to reduce risk in their investment portfolios. We would argue that much of this money always should have been invested in safe short-term securities, but because of zero interest-rate policies of the last decade, investors were encouraged to seek out more risk.

While stating the obvious, that many investors are seeking safety and lowering risks in their portfolios, the net effect on the financial system has been dramatic. In just the last month we have seen bank runs in the US leading to bank failures and rapid central bank intervention. (See Case Study: Is the Market Broken?). In times of turmoil, investors need to continue to be focused because while there are many businesses that should be avoided, there will be many that are unnecessarily discarded. As events unfold, we make sure we are actively getting our positioning right in a fast-changing market. Many of Avenue’s stock market investments made new highs this quarter and the businesses are doing very well.

Many of our investments also continue to grow their dividends and repurchase their shares. One such business is Andlauer Healthcare, which we were happy to see implement a share buyback program this past quarter. The Avenue team had previously advocated for this during our meetings with management.

Where we are seeing opportunity

We believe real estate, infrastructure and financial services are fundamental building blocks of a long-term compounding investment strategy, except for in this higher interest rate environment. Therefore, we have reduced our exposure in these three areas of the portfolio. The valuation of hard asset businesses should decline, and the cost of new construction is uncertain. We have moved our real estate and infrastructure investments to businesses where the current valuation is reasonable and where we do not have construction and financing risk. As well, we halved our exposure to Canadian banks over a year ago. Our latest effort to reduce risk and improve profitability was to sell TD Bank outright and replace it with National Bank because of its more isolated and quasi-monopolistic position in Quebec.

The intention of our investment strategy is to protect our current investments from potential losses and make new investments where we find the most opportunity. As money is coming out of parts of the stock market and the market breadth is contracting, we are finding high-quality businesses at fair valuations in the industrial and consumer areas, both in Canada and the US. This might seem like a contradiction given that the words ‘impending recession’ are everywhere. Once again, because there is a fear of recession, potential investments are trading at more reasonable valuations.

Slow motion contraction in money

We have been writing that we have been defensive for over a year. We have actively moved the portfolio to what we have characterized as essential businesses where profit margins can be maintained and where there is not a reliance on a need for raising money in financial markets. We are also maintaining a cash position and for many clients we have the Avenue Tail Hedging strategy.

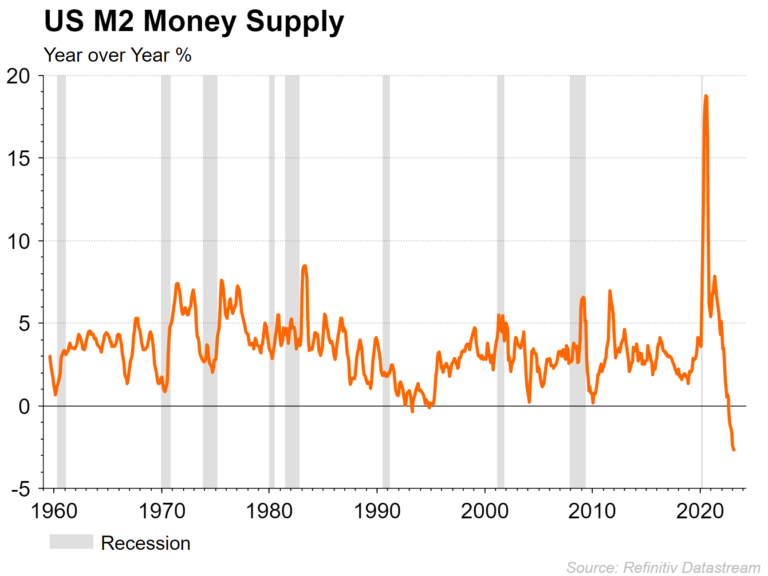

When we look at the M2 Money Supply, we see it has now contracted for the first time since the 1930s.

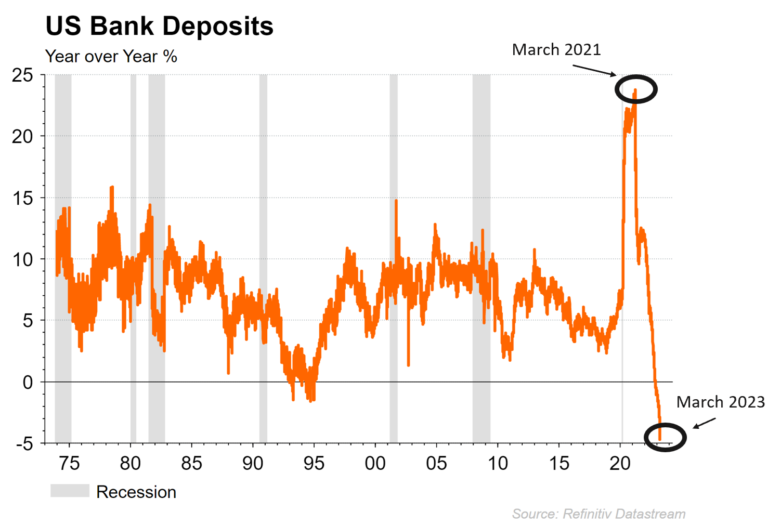

The banking events of the past few months have further accelerated the decline in bank deposits, which are now contracting 5% year-over-year. From our historical research we have determined that the only other time this happened was 1930-32 and in 1921. Both were times that experienced major deflationary recessions.

We are observing a slow-motion correction of asset prices. The reason it is taking so long and why we have not had a major stock market drop is because we still have major competing economic forces. Short-term interest rates are being increased by central banks with the goal to slow the economy. However, the central bank balance sheet is no longer being reduced and the continuing deficit spending by government is providing plenty of liquidity to the economy and financial system. As a result, some of our industrial companies are experiencing record backlogs as a by-product of the fiscal policy spending on infrastructure in the US.

We would like to share with you some charts to illustrate the scale of the competing monetary forces at work in the last quarter. We live with the contradiction that what should be an end-of-cycle credit crunch, where business loans become harder to refinance, is set against the central bank raising interest rates while government deficit spending resulting in excess liquidity.

To illustrate the tension, we will start with the negative economic scenario caused by higher interest rates, then follow with the contrasting positive financial market scenario caused by central bank balance sheets expanding again. We will use the US figures as opposed to Canada’s as they are the main drivers of overall bond and stock market prices.

Interest rate hikes mostly over

Probably the most important data point is that central bank interest rate tightening is mostly over. The following chart shows expectations for the US short term interest rate decreasing from its highpoint in February of this year. When we assess our investments, we have to make sure they remain healthy when paying this level of interest on the money they have borrowed.

Source: John Aitkens, TD Securities Research

Yet another banking crisis

The banking crisis we have recently experienced was brought on by two factors and we would argue that while the crisis is fixed at the individual banks, the original problems remain. The first problem was the flight of deposits to short-term treasury bills that we highlighted earlier. The second problem is shown in the slide below whereas interest rates have gone up, the value of bond type investment held by banks has a negative value.

Source: FDIC

While the largest banks in the US are covered by legislation that protects them as ‘too big to fail,’ the policy for protecting smaller banks is ambiguous and arbitrary.

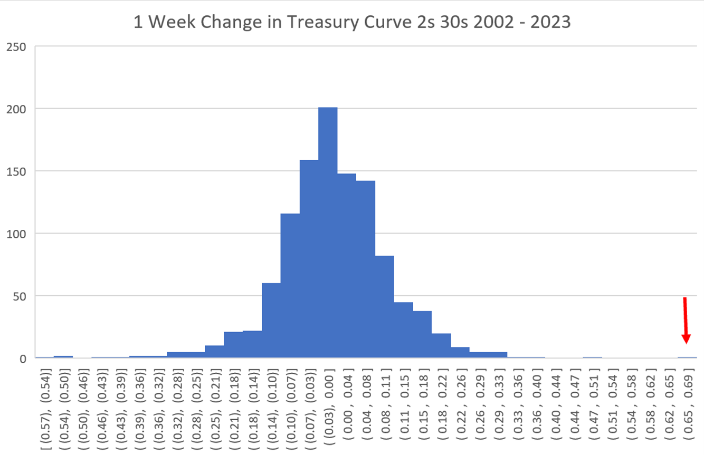

This next chart is more esoteric but worth showing because it best depicts the epicenter of the storm US banks just experienced. Banks make money by taking in deposits and paying what is usually a small interest rate and lending the money for longer terms and charging a higher interest rate. Most of the time this relationship remains stable. The following chart shows a histogram of weekly changes in the relationship between 2-year interest rates and 30-year interest rates in the US, otherwise known as the 2s 30s spread. After the effective bailout of depositors at Silicon Valley Bank (SVB) in California on March 10th, there was a 6 standard deviation weekly move in this relationship. It illustrates that financial institutions are navigating extreme interest rate volatility.

The economy is gradually slowing

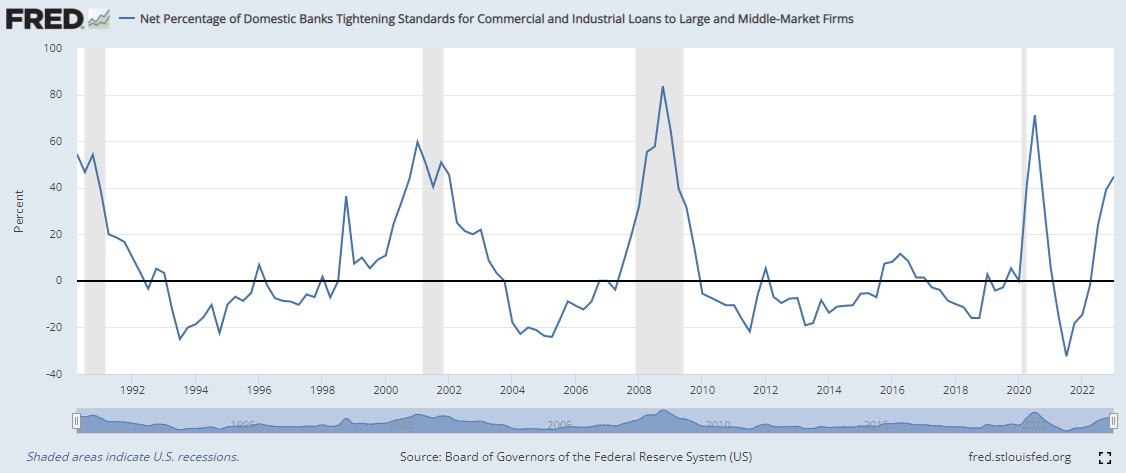

Our conclusion is bank lending will become restrictive as deposits leave the banking system. Many bank loans which were made at low interest rates will take time to mature and interest rate volatility will discourage banks from taking risks. This is a classic set-up for a credit contraction which is already reflected in banks tightening their lending standards. We are worried about the ability of businesses to refinance existing debt. It is probable that regional or small businesses will be the most affected, but this tightening will incrementally slow the overall economy.

Central bank and government deficits provide liquidity

The US federal government deficit spending continues to supply financial markets and the economy with liquidity, despite the restrictive effect from higher interest rates and tightening credit. Because there is still lots of money in the financial system, we have not experienced a major decline in the US stock market index.

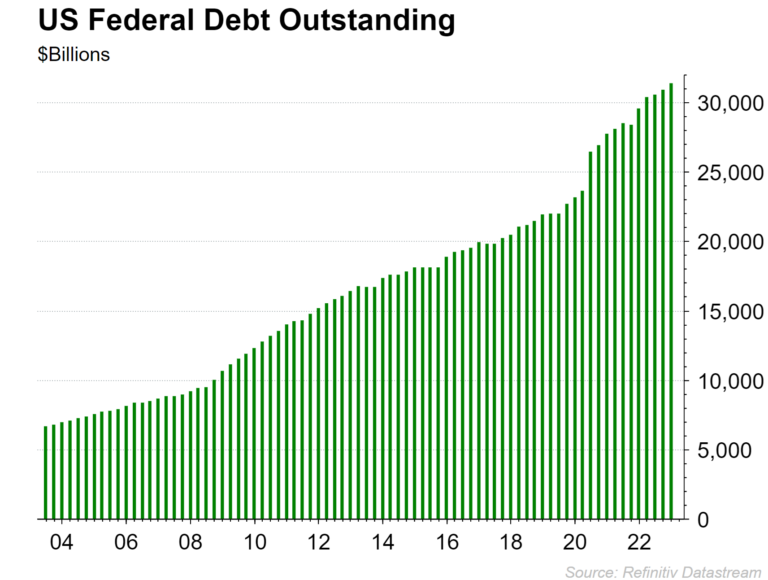

Of all the economic factors affecting the level of money in the financial system, it is the US Federal Government’s borrowing that eclipses any other influence. To truly fight inflation and inflation expectations, yes, interest rates had to go up. But taxes should have gone up too and government spending should have gone down. But nobody will vote for austerity, either in the US or Canada.

Even as we are writing this, we are aware that given the scale of federal pensions, medicare and defence spending in the US, this is not likely to happen. The US is now a $23.6 trillion economy where the federal government has borrowed almost $32 trillion. Having $22 trillion of debt just prior to the onset of COVID, the US has added over $10 trillion of debt in 3 years. This is new money that has been borrowed and spent into the economy. This is the main reason why we have seen higher inflation.

The US Federal Government’s borrowing supplies money to the economy and financial system, and for the time being there is lots of it. Structural deficit spending is likely to remain systemic no matter which political party is in power. With a sustained $1.5 trillion + annual deficit, $10 trillion more debt will be added in the next 6 years.

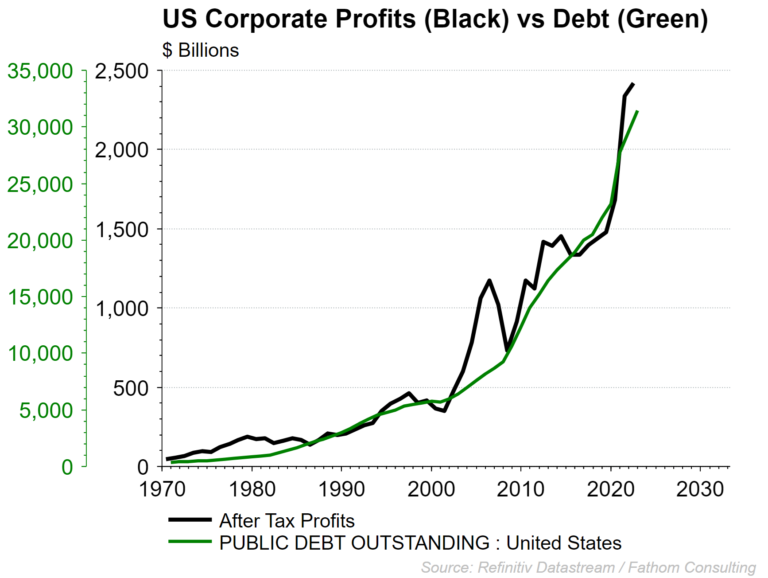

If you compare corporate profits to total debt you can see a similar pattern in the below chart. As more money gets borrowed and spent into the economy, it has the knock-on effect of making the economy and business profits look better in the short run. How should investors think about this relationship?

While this ever-increasing debt might seem alarming, it is better to be clear eyed about how it will impact asset prices. Bond and stock market prices are just as much influenced by the amount of money in the financial system as they reflect underlying earnings of a particular business.

To conclude, we remain cautiously positioned due to the slow-motion tightening of the credit cycle but hard at work knowing the only way to compound our money is to be invested in dynamic businesses over the long run.

A Case Study on Is the Market Broken?

In the last month we met with a client who spent their career in financial markets and before we even said a polite hello, they asked flat out, ‘is the market broken?’ After taking a moment to put together what was hopefully a thoughtful response, we answered, yes. However, we still need to be invested in high quality businesses to compound long-term to protect ourselves from inflation and currency devaluation.

The most obvious example directly impacting our Avenue portfolio strategy was the Bank of Canada supporting corporate bond prices in March of 2020. Buying high quality corporate bonds in a market liquidity vacuum was key to Avenue’s successful investment navigation of the 2008 financial crisis. However, in 2020 this opportunity was taken away from us as the financial risk was effectively nationalized. We are forever moving to a banking system where profits are privatized, and losses are socialized. More than ever it really matters what we own, and we must acknowledge that the rules are constantly shifting. The motivation to construct Avenue’s Tail Hedging strategy came out of this experience.

Since this conversation with our client, we have had yet another week where major financial institutions collapsed. Both are new examples of how established financial system regulations are fluid in the time of a crisis. In the case of Silicon Valley Bank (SVB) in California, there was no resolution process for winding up an insolvent bank. There was deposit insurance of up to $250,000 per depositor but this policy was ignored, and all depositors got their money back. This is an example of socializing losses.

In the case of Credit Suisse bank of Switzerland, which was founded in 1856, there was an insolvency resolution but then the Swiss regulators ignored it. About $3 billion of equity value was salvaged while $17 billion of ‘special insolvency contingent’ bonds had their value wiped out. The core belief of our financial system is that the equity holder gets to profit when the market is positive and is the first to take the loss when the business fails. Bond holders are limited to their interest payments, but they get to be converted to equity holders in the case of insolvency. If these fundamental rules of capitalism are not followed, then we start to question the system itself.

The following is now a notable March 16th exchange between James Lankford, the Senator for Oklahoma, and Janet Yellen, the Treasury Secretary, about the recent bank bailouts.

James Lankford:

“Will the deposits in every community bank in Oklahoma, regardless of their size, be fully insured now? Will they get the same treatment that SVB just got or Signature Bank just got?”

And Janet Yellen’s answer last week was “not necessarily.” That kind of extraordinary help would only be extended, she said, if it looked as if there were a danger of a more widespread bank run. Now, that worried a lot of community bankers because it might encourage their biggest customers to pull money out of small banks and move to a bigger bank where they might be more likely to get government help.

In summary, in normal times we are told everything should function just fine. The problem is that it is the ‘not normal’ times that we are worried about. What has made Western financial markets so successful is their predictability of the rule of law and fair regulation. The events of the last few weeks will definitely have an ongoing effect on who gets to borrow and who doesn’t. For Avenue it is yet another reason to focus on the quality of the underlying business and avoid unnecessary and arbitrary risks.