We have experienced good performance in the last three months in both Avenue’s Equity Portfolio and Bond Portfolio. The key reason is an extraordinary reversal in interest rates.

Our repositioning of the Equity Portfolio over the fall and winter have us well positioned for what we believe will be a continued slow growth economy with interest rates remaining in this band certainly for the next year.

There was a great deal of nervousness into December that interest rates would continue to rise given the strength of the US economy. In last quarter’s letter we forecasted that interest rates were unlikely to go any higher, simply because any further increase was likely to trigger a consumer-led recession. Even though sentiment was positive on the economy, we saw there were signs of a slowdown.

This is the odd and often perverse logic of the stock market. Interest rates moved up to the point that the economy looked like it was going to stall. Wouldn’t that be bad for stocks? Actually, a stall in the economy generally results in a dramatic drop in interest rates, and lower interest rates propel stock valuations higher. I can pay more for a stock because the cost of borrowing money is lower. It is the same idea as when housing prices go up when the cost of a mortgage goes down. We have benefited from our recent re-positioning of the equity portfolio where we sold expensive US holdings and reinvested back into Canadian companies with lower valuations and higher yields.

Table: Government 10-Year Bond Yields

| Canada | USA | Germany | |

| Nov 6th, 2018 | 2.55% | 3.45% | 0.54% |

| Mar 31st, 2019 | 1.60% | 2.85% | -0.05% |

The table on the previous page shows how much interest rates have fallen over the first three months of 2019. The chart at the top of the page shows the Canadian 10-year Government bond yield over the last two years. We then compare this to the stock price chart of Enbridge, and we can see that as interest rates come off, the share price of Enbridge goes up.

The yield curve and what is called ‘the shape’ of the yield curve is also at an important juncture. After 10 years of aggressively lowering interest rates to stem the 2008 financial collapse, short term interest rates have risen and long-term interest rates haven’t, so the shape of the yield curve is what is called flat.

This is not great if you run a bank; you borrow money from depositors and lend it longer term. Therefore, we are now out of our US banks and we are just holding our core positions in TD Bank and Royal Bank. Both our Canadian bank stocks yield 4% and we think much of the negative sentiment is in the stock price.

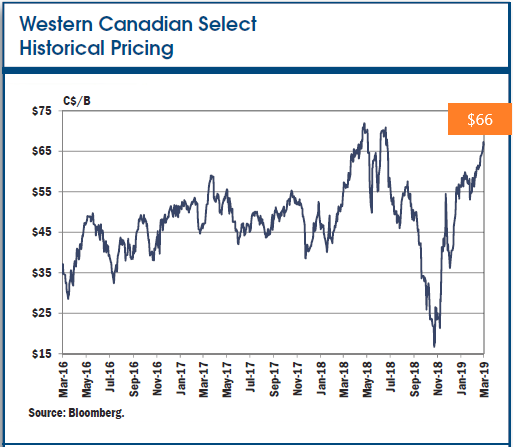

The other extraordinary anomaly is that the price the Canadian energy companies get paid for selling their oil has recovered but the stocks have not. We believe the stocks will eventually go up but because we can only guess the timing, our investments in Canadian Natural Resources, Vermilion and Prairie Sky all pay us a nice dividend while we wait. Also, there is finally an argument for the Canadian dollar to strengthen given the doubling of the demand for Canadian dollars just from Americans buying our Canadian energy exports.