Compounding investment savings using bonds requires a grasp of a few simple concepts. However, it is amazing how complicated the financial industry makes it sound. What tends to get lost in the noise of interest rates going up and bond prices going down is the far more important result that bond interest and maturities can be reinvested at a higher rate.

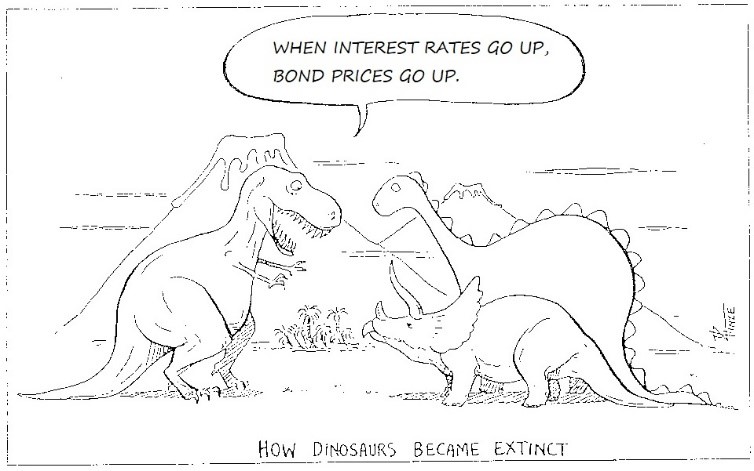

Working at TD Asset Management in the 1990s, our head of fixed income investing taped a cartoon on the trading room door. It showed dinosaurs listening to a misinformed T. Rex above the caption: How Dinosaurs Became Extinct. It was a fun little prompt of how simple our investment task was, as well as a clear reminder of what our fate would be if we messed up.

In the short term, as interest rates move up and down, there is always an opportunity of capital gains but also the risk of capital loss. When interest rates fall there is the immediate financial reward of capital gains as bonds prices move higher. More money sooner is always a good thing when investing.

However, there is one major drawback: after interest payments are made and when the principal is repaid upon maturity, this money has to be re-invested at a lower interest rate. Getting the short benefit of lower interest rates feels good today and at TD we got to keep our trading jobs. However, at Avenue we use the bond market to compound our investments over 20 to 30 or 40 years. Higher interest rates, for reinvestment purposes, are always more important than short term capital appreciation.

Using this year’s Canadian interest rate rise as an example, interest payments have been roughly offset by capital losses as bond prices fell and returns are slightly positive. So, the inevitable question comes up, “Why am I invested in the bond market when I’m not making any money? I could have got a better return from a bank account.” While true, this implies a trading strategy with perfect insight for when to be out of the market whenever interest rates rise. We might be right sometimes but we also can get the timing wrong.

Avenue’s strategy is to capture the benefits of long term compounding in the bond market and not trade interest rate moves. We currently own a portfolio with a majority of shorter term bonds so we have bonds constantly maturing and needing to be reinvested. Investment returns will occasionally take a short-term pause, but it is far more important to have our money available for higher interest rates so we can benefit from higher compounding over the decades to come.