In this quarter’s case study, we will discuss the return of investor interest to Canada. As well, we need to understand what is continuing to propel many US stocks to some of the highest valuations in history. Neither of these two issues are changing our investment strategy of owning a balance of high-quality businesses. But we know it is always important to understand how what we are doing at Avenue fits in with current stock market trends.

Investors come back to Canada

The Canadian One Dollar Bill first issued in 1935.

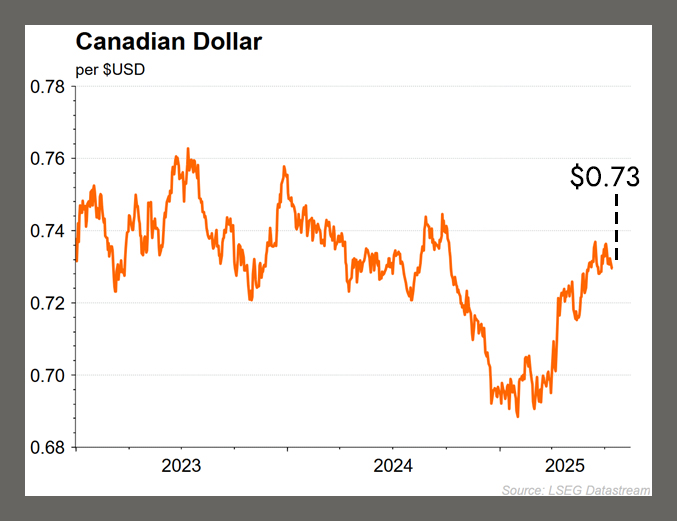

In our Avenue case study written in December we gave what we felt was a compelling argument to not give up on investing in Canada. At the time, sentiment for Canadian stocks could be described in medical terms as anaemic and the Canadian dollar headed to a low of $0.68 cents in January. The core of our argument in the Q4 letter was that political change was in the air and investor friendly policies were likely to return to Canada.

At the time, the Canadian conservative party was ahead in the poles where they were promising lower taxes and simpler regulation for business. What actually happened was a galvanizing of Canadians against US tariff policy resulting in a strong mandate for the newly ushered in Liberal leader Mark Carney. Ironically, while Mark Carney heads the same Liberal government, he has dramatically changed policy to pursue many of the items on the Conservative agenda. This new Liberal Government has started with attacking interprovincial trade barriers and fast tracking permitting of infrastructure ‘deemed’ to be in the national interest.

While these changes are not dramatically transformative, the result is that Canada is being viewed in a better light by investors. The Canadian dollar has rallied to $0.73 and the Canadian stock market index has made all-time highs.

Avenue’s Equity Portfolios prove defensive in April

April feels like a lifetime ago, but we believe it is important to analyze how our investments faired during the Trump Tariff Tantrum earlier this quarter. The newly elected President campaigned on tariffs so Avenue did our best to make sure we didn’t have anything that would take a direct hit. We were surprised, given all the news was transparent, that many of the prominent large-capitalization stocks in the US fell 20-30% when tariffs were announced in April.

We received a number of calls and emails asking how our Avenue investments were doing. We were pleased to report that during April, given our defensiveness and diversification, our portfolio returns can be described as mostly flat. This reinforces the benefit of avoiding overvaluation and herd mentality so characteristic of this current stock market.

However, we acknowledge that many of our high-quality investments are consumer and industrial businesses. The overall slowdown in the North American economy is incrementally depressing near-term earnings and investor sentiment. We hope to use this weakness to add new investments in quality businesses that we have identified.

The US is on Fiscal Steroids

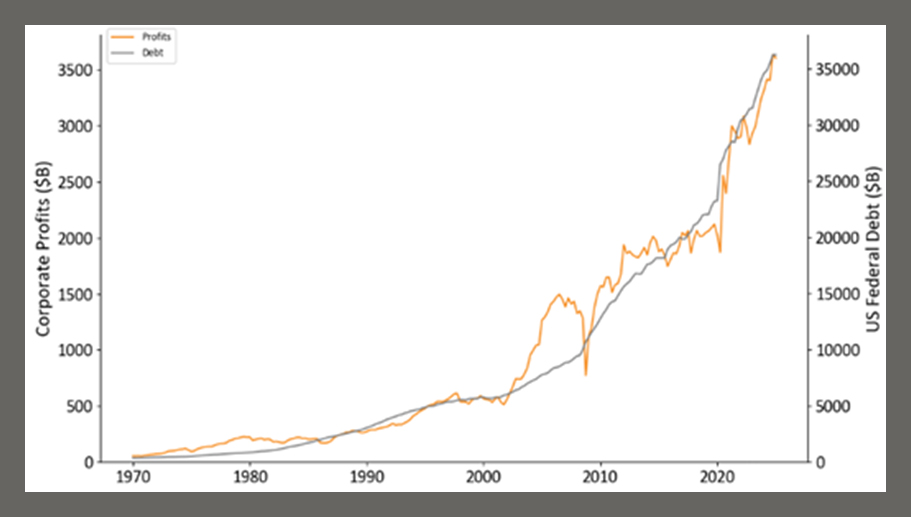

As I am writing this note, the US stock market made another all-time high. While this can feel good, we must acknowledge why this is happening and what could change. Let’s think about this in as simple terms as possible. The US federal government is running a $2 trillion deficit in a time of low unemployment. There is a massive amount of excess money in the financial system with a lot of it ending up in stocks.

Investors are nervous anticipating how the US government is going to issue this much debt without long-term interest rates going up. The answer is a technical term now coined Activist Treasury Issuance (ATI). All the debt gets issued with less than a one-year maturity which subsequently adds money to the banking sector. The more Federal Government debt results in more money in the financial system.

We are in the camp where we believe this much debt will not end well but we don’t know when the day of reckoning will come. It could be tomorrow or years from now. Regardless of the inevitable market disruption, we know owning businesses that are flexible and can navigate economic adversity is the best way to retain wealth.

New era of AI

AI represents a seismic shift in technology. Historically and proven again today, this kind of change comes with rampant speculation by investors. While we believe our portfolio investments are taking advantage of AI in their respective businesses, Avenue directly investing in AI is a challenge for our strategy where we focus on consistency of the underlying business. It is just as easy for an AI business to lose as it is to win at this stage of disruptive adoption.

We do our best to be experts in our Avenue strategy of quality investing, but emerging technology is its own field of endeavour. We would like to share a recent article from the Financial Times of London which did what we felt was a good job of summarizing exactly where AI lives today. The interview features Mary Meeker, who is one of Silicon Valley’s prominent venture technology investors.

Training the most advanced models remains a prohibitively expensive task. Estimated costs to develop cutting-edge models have increased by 2,400-times in eight years, pricing out all but a handful of competitors which lack a clear path to profitability.

OpenAI, Anthropic and xAI have raced to a collective annualized revenue of around $12bn. But they raised a combined $95bn to do so. OpenAI’s valuation-to-revenue multiple “looks expensive”, according to Meeker.

Price wars and a proliferation of cheaper models are good news for consumers, but mean start-ups aiming to take full commercial advantage of their technology will need deep pockets and patient financiers.

Meeker compared their challenge to Uber, Amazon and Tesla, each of which burnt through cash in order to establish a large business they could ultimately monetize. “The rules that hold well in these times of euphoria are only invest what you’re willing to lose, and take a portfolio approach,” said Meeker. “Putting all your eggs in one basket is a risk here, because everything is up and to the right — until it isn’t.”

Financial Times, 30 May 2025, Open AI risks being undercut

Bill Harris

July 2025