Investing in the broad stock market index has been a simple and successful solution since its conception in the early 1970s. However, we believe that the negatives now outweigh the positives. Avenue’s portfolio of high-quality businesses should continue to perform well in the coming years even as the large stocks that make up the US S&P 500 Index face headwinds.

Let us first qualify that when we are talking about ‘the index’ we are referring to the US S&P500 Index. Even for Canadian investors, where we might have included the TSX Composite Index in the conversation a decade ago, investor psychology has evolved to where the only index game in town is the US S&P500 Index. This is primarily due to the S&P 500 Index’s singular success because it is where we find the big technology companies like Microsoft and Apple.

For most of the last 20 years, Avenue has argued that we are indifferent to how the index might perform. It might go up or it might not. At Avenue, we felt we could build a better portfolio that would go up no matter what the economic and financial environment. We would like to point out that for the first nine years of Avenue’s history, the S&P 500 return was flat whereas the Avenue portfolio almost doubled in value.

We owned Apple and Microsoft for many years when these stocks were both growing and inexpensive. These investments were only sold when we believed future returns would be a challenge and we could find investments with a better risk reward. It doesn’t mean these stocks can’t keep going up in price. We simply believe we can accomplish the same return with stocks with lower valuations which should have the effect of making the portfolio safer. But only in the last few years have the dynamics of index investing revealed a major internal and external headwind for returns for the coming decade.

Internal Index Concentration Risk

The success of just a few large technology companies dominates the S&P 500 index like never before. The ten largest stocks make up 1/3rd of the index. A full 60% of individual retirement investments are now mostly weighted to owning the index, which implies that most people are counting on retiring on the same handful of stocks. We find ourselves in 2024 with an almost universal investor belief that these same technology companies will dominate our lives for years to come.

The first problem is that technology changes rapidly and high profit margins will be challenged by new competitors at some point. It is almost impossible to predict if these same companies will continue to dominate a decade from now. The second problem is that these large technology companies are now expensive when measured against their respective underlying businesses. Currently the average price earning multiple for the large technology companies is 40 times earnings. So, if the fundamentals of the businesses change and growth does not continue as expected, the stocks have a long way to fall. It really isn’t more complicated than that.

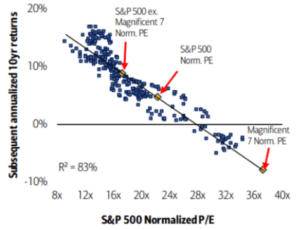

This regression chart shows that there has been a strong correlation between what you pay for a stock, measured by its price earning multiple, and what the ‘next’ decade of return will be. We are not saying that if you pay 40 times earnings, then these stocks will not compound at 8-10% for the next 10yrs. The chart simply demonstrates that it has never happened before and that it would be a real statistical outlier. If you were in a casino, you would have to acknowledge that you were making a bet on a low probability event.

External Risk that Money Flows will Reverse

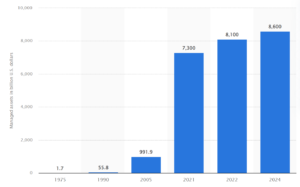

As the baby boom generation has worked and saved, the stock market has been a big part of where those saving go. However, that strong tail wind for the stock market looks to become a headwind and baby boomers reduce the risk in their portfolios by moving stocks to bonds and spend their savings through retirement. It looks like that pivot from putting money into the stock market to taking money out is starting to happen now.

Exacerbating the mechanical nature of this trend is that the majority of stock ownership is done through index funds and not portfolios of individual stocks. Historically, an investor might sell their losers and keep their winners as cash was needed. But now that most people just own the index this means the index as a whole must get sold. And you guessed it, all this selling will impact the biggest stocks because that’s where the bulk of the money is invested.

Vanguard Assets Under Management Decelerating

Avenue’s solution to this net selling structural problem is simply to avoid the large cap mega stocks, at least while they are expensive. Avenue’s investment strategy is to find growing businesses with economically resilient profit margins, that trade at a reasonable valuation. At this time, Avenue’s 15 investments in the US trade at a price earnings ratio of 16 times earnings compared to the big technology stocks which trade at 40 times earnings. To find these companies, it takes hard work and discipline but we believe opportunities are always out there. It is worth the effort to have a portfolio that will give us returns that meet our expectations and be safer than investing in the S&P 500 stock market index.

Avenue’s solution to this net selling structural problem is simply to avoid the large cap mega stocks, at least while they are expensive. Avenue’s investment strategy is to find growing businesses with economically resilient profit margins, that trade at a reasonable valuation. At this time, Avenue’s 15 investments in the US trade at a price earnings ratio of 16 times earnings compared to the big technology stocks which trade at 40 times earnings. To find these companies, it takes hard work and discipline but we believe opportunities are always out there. It is worth the effort to have a portfolio that will give us returns that meet our expectations and be safer than investing in the S&P 500 stock market index.

Bill Harris

April, 2024