The energy transition from fossil fuels to green alternatives like wind, solar and nuclear was a hot topic over the holidays. We have put together a few charts that help to demonstrate the scale of the global challenge. From an investment perspective it is important to be realistic about what is possible and not to be confused by aspirational rhetoric.

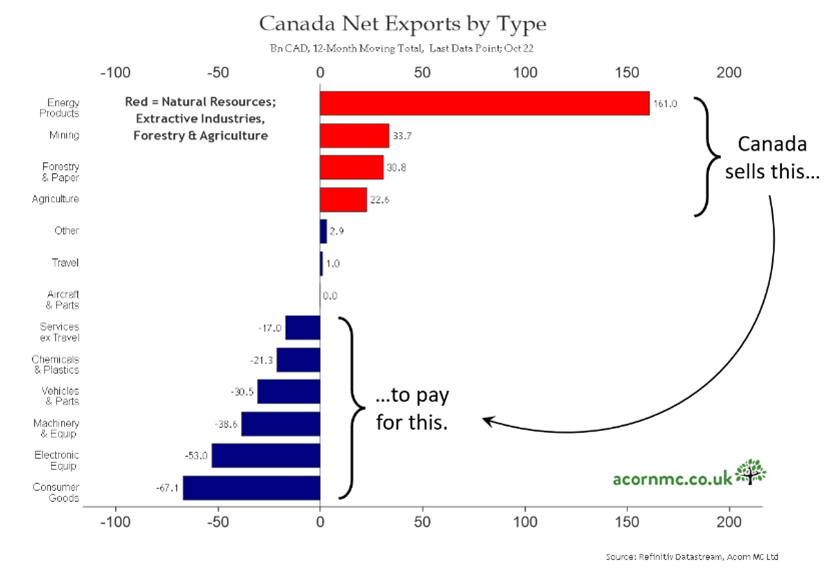

If you think of Canada as a business, fossil fuel energy is what Canada does. While Canada has a goal to reduce greenhouse gas emissions over the next 25 years, it is unclear what will replace Canada’s net exports of fossil fuels and the equipment that uses fossil fuels. As a country, we are a net seller of oil and natural gas, but it is not expected that we will be a net exporter of high value green energy or equipment that produces green energy.

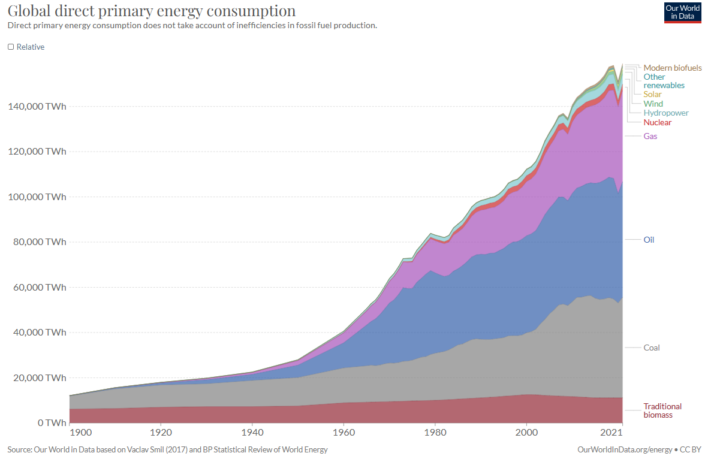

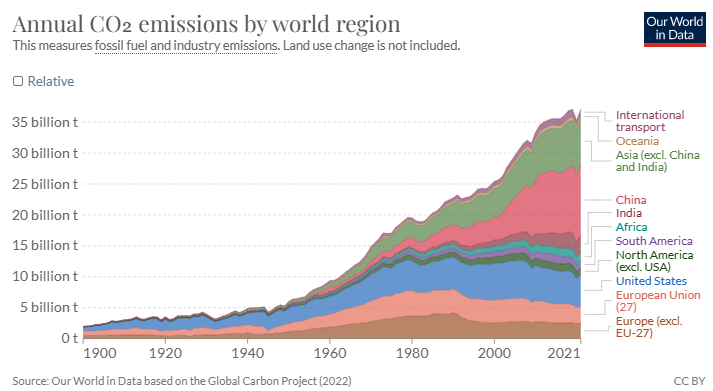

These next graphs show where the world gets its energy and how much greenhouse gas each region produces. For example, it is important to note that while coal consumption isn’t growing, it isn’t declining either.

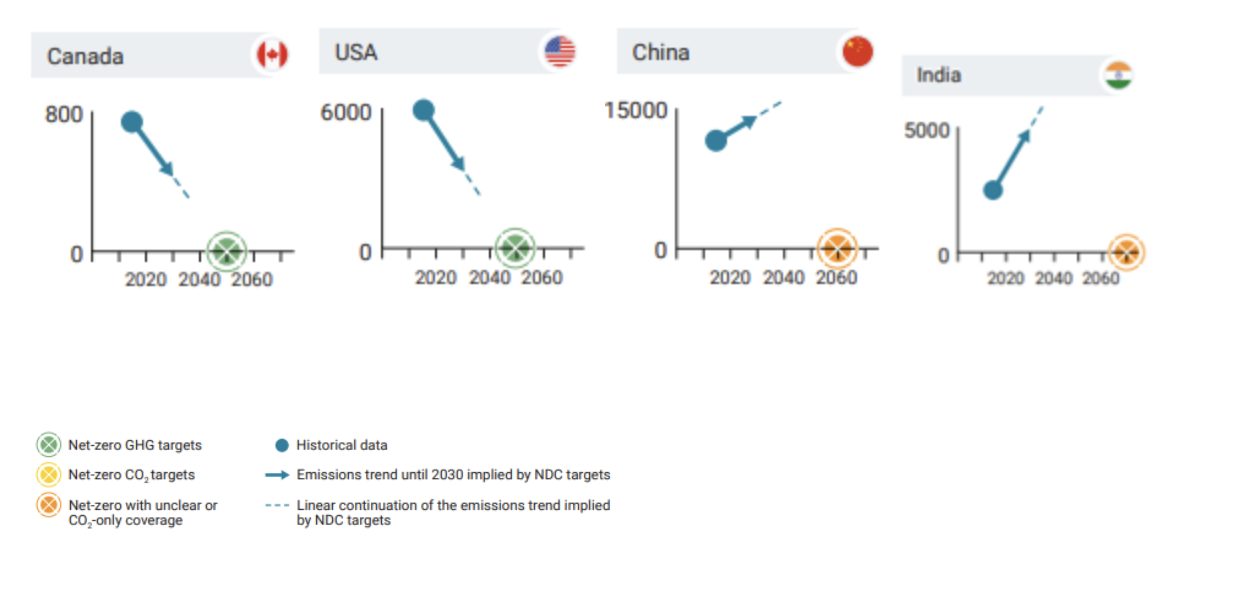

Canada in 1.3% of global greenhouse gas (GHG) emissions. China, India and the other Asian countries now produce over half of world GHG emissions and growing. We selected a representative few countries’ greenhouse gas charts from the 2022 United Nations climate report which show directional trends.

We don’t really have a conclusion other than the energy transition challenge is mind bending in scale and that we are just getting started. Also, given that there will be big winners and big losers, the geopolitical debate is going to get much louder. Avenue will continue to search for energy investments where we feel we can get our target rate of return. We will also look to avoid what may become stranded infrastructure or what assets might become political targets.