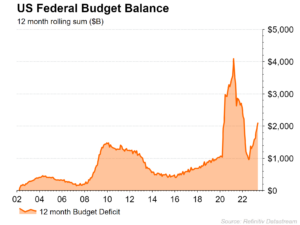

Most of the headline news has focused on central banks raising short term interest rates to combat inflation. Higher interest rates will restrict businesses and consumers alike and we will experience a recession. However, we are not in recession, because this line of thinking is missing a key component when we measure economic activity and that is government deficit spending. It is the size of the deficit spending that helps explain the buoyancy of the economy and financial markets.

In the last two quarterly letters we have discussed the contradiction of raising interest rates at the same time as running large Federal Government fiscal deficits. In this case study we will use the US as our example, but Canada is doing the same deficit spending as well. Raising interest rates has the effect of decreasing the supply of money in the economy and fiscal deficits increase money in the economy. While the central bank tries to fight inflation by raising interest rates, the US federal government is stimulating the economy at what looks to be $2 trillion for this calendar year alone.

Raising interest rates alongside large deficit spending is akin to doing donuts with a front wheel drive car.

Doing Donuts with a Front-Wheel-Drive Car

“To keep the car spinning and gliding on the rear wheels, you will have to continuously press on the accelerator and lift the hand brake at the same time.”

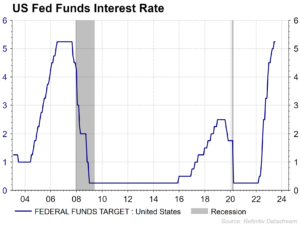

The hand break is firmly engaged as short-term interest rates have risen to over 5%. Borrowing money is the most expensive it has been in 12 years. Banks have failed in the US and Europe. Bankruptcy and consumer loan defaults are starting to accelerate.

The economy powers on at historically low unemployment levels with the federal government pushing the gas pedal to the floor. Federal emergency Covid spending never ended. The deficit is being sold partially as industrial policy to deal with climate change but really it is the baby boom generation’s social security pension, medical entitlements kicking in, new defense spending, and taxes remaining low. Americans have always been described as wanting a social welfare state, but they don’t want to pay for it.

The donut analogy fits perfectly to our current financial predicament where it feels like we are in a perpetual financial whirlwind, but we keep coming back to the same place. Unfortunately, many of the real issues that would put the economy and financial markets on a stable footing are not being addressed.