“Inflation is taxation without legislation” – Milton Friedman

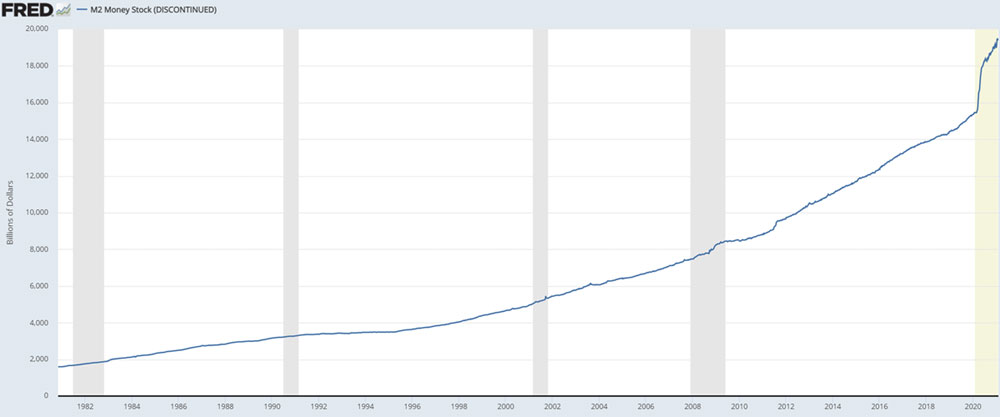

It may or may not surprise you to know that 20% of all US dollars in existence, all time, were printed last year. Amidst a global pandemic, monetary and fiscal policymakers worldwide were hitting the gas pedal. With that, one worry has crept back into our vocabulary lately after years of being a tailwind – inflation.

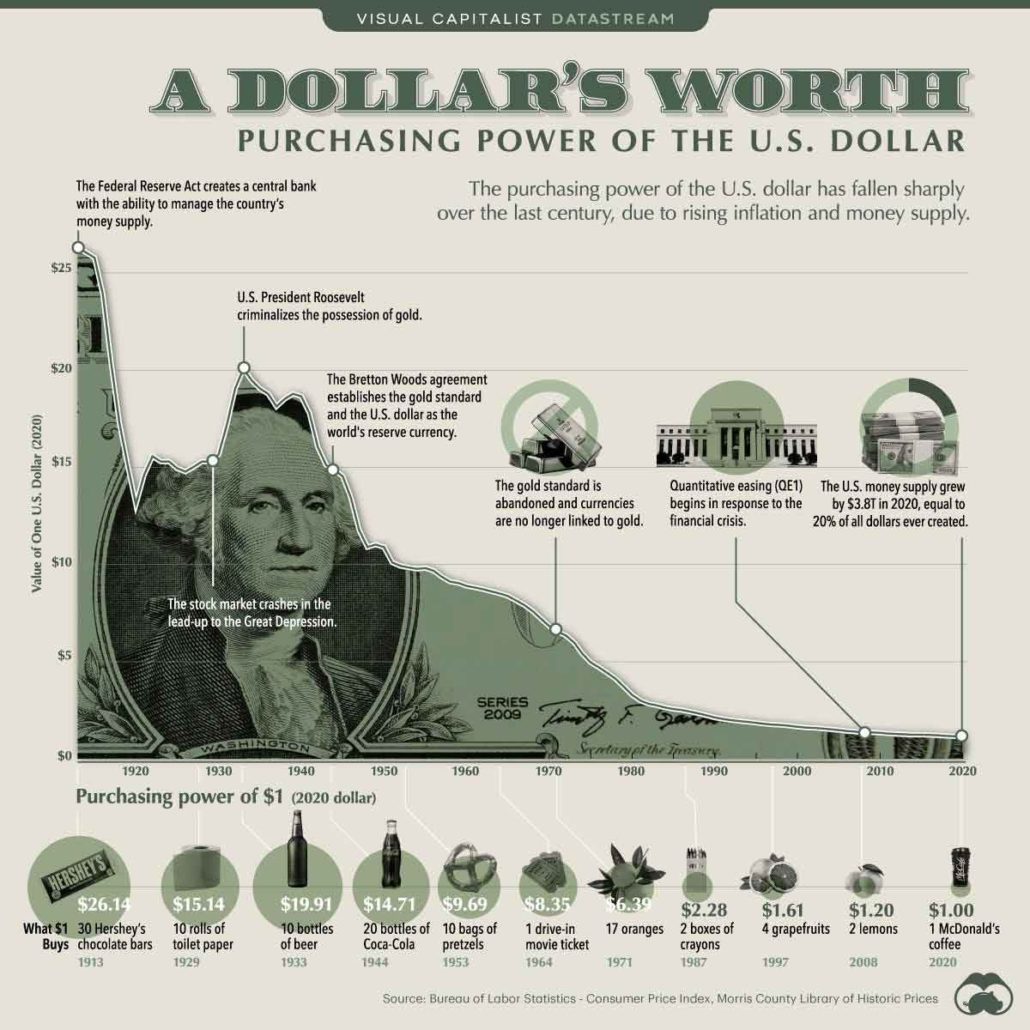

Inflation is simple to understand. It’s the decline of your purchasing power of a given currency over time, and you have probably heard of it for decades. Your parents or grandparents might have mentioned how much they paid for a candy bar back in the day or even how they bought their first home for $10,000. Today? You’re lucky to get a piece of gum for the same price, and the average home price in Canada is over $716,000. And the amount of money in the economic system, more or less, affects inflation directly. For us here at Avenue Investment Management, we want you to understand why it affects you as an investor, the difference between goods inflation and asset inflation, and how our process has changed to reflect the new reality.

Why is Inflation Important to Understand for the Investor?

The bottom line here is that companies can take advantage of higher input prices by pricing their goods higher with good, steady inflation. However, when inflation spikes to the upside, costs often start to spiral out of control, and the steady increase in output pricing becomes more difficult. Thinking logically, you might not think twice if your phone upgrade cost went from $800 to $850, but you may delay an upgrade if that new phone jumps to $1000.

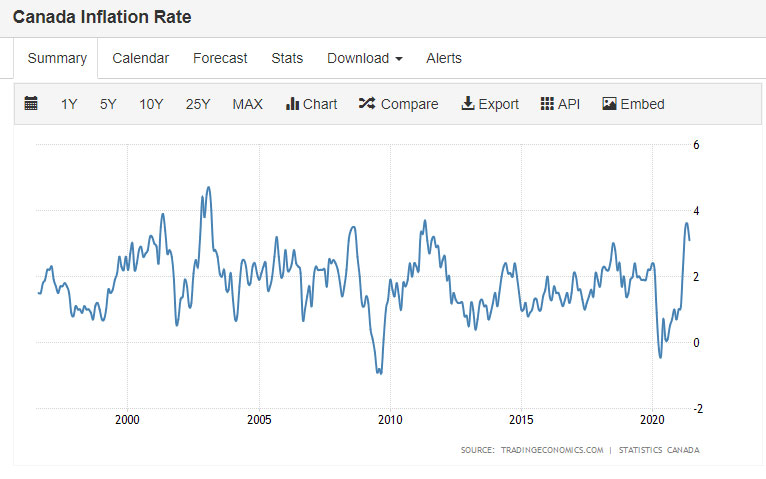

While Canada’s inflation rate has been range-bound for some time, we have seen spikes recently, which concerns investors. Halfway through the year, Canada’s headline consumer price index (CPI) is sitting at 3.6%, and in the United States, it is at 5%. That’s much higher than the goal of about 2% that central bankers want to see. Now, central bankers have maintained that this inflation is going to be temporary. And while we agree on the goods inflation front, asset inflation may be a different story.

Goods Inflation Vs. Asset Inflation

Goods inflation – i.e., the “stuff you buy” inflation – is here. And while there is plenty of debate whether it will be transitory or permanent, it is expected to continue above trend for the short-term. Much of the pressure we see lately is from the disruption in the global supply chain due to the pandemic and demand/supply mismatches or the shortage of labour pushing up wages. This paradigm is not likely to change soon with the dynamics we see today, amid fresh lockdowns globally, a new delta variant surge, and global production issues, alongside the elevated demand from fiscal support. Higher consumption alongside lower goods supply is driving inflation higher.

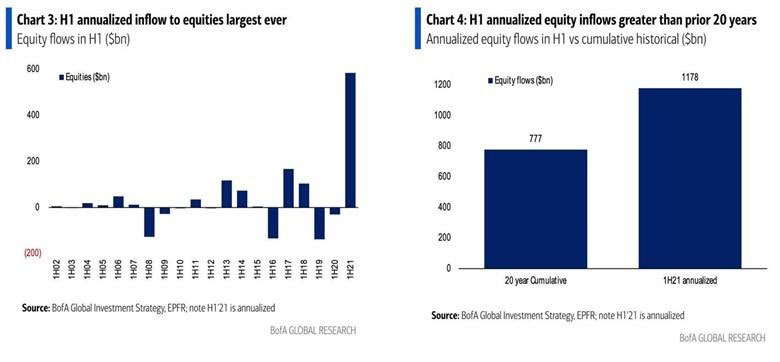

Asset inflation, however, is different. With fiscal support alongside lower barriers to trading, like free trading for discount brokerages, an unprecedented amount of money flows into assets like equities. Global equities have had more inflows year-to-date than the last 20 years – combined.

This phenomenon has driven up valuations in our stock markets, and why we are at a dangerous time allocating savings and investments. Many investors will chase returns and create a cycle of higher highs, which may continue for some time. However, failing to understand the cyclical risk at this point is a dangerous game to play. Asset inflation is here to stay, and designing an equity portfolio that finds opportunities in non-indexed investments will give the best probability of a positive outcome. Being out of the index does not mean being out of equities, and finding opportunities where asset inflation is not as extreme is what we, at Avenue, strive to accomplish.

Learn More – The Avenue Investment Management Process

Source: Visual Capitalist

Inflation is an increasingly important topic in our new normal world. But it is important to remember that since the Federal Reserve was founded in 1913, the US dollar has lost over 90% of its buying power. In that same time, the stock market has returned over 3,000,000%. Being in the right assets, investing in companies with compelling valuations, and sticking to the long-term strategy is paramount during inflationary times. However, protection is critical at this stage in the investment cycle, which is why we introduced our Avenue Tail Hedge Strategy. Sign up for more information here, or watch the full video from our podcast to learn more about our process and how we plan to tackle the inflation debate while investing.