“The power of the population is indefinitely greater than the power in the earth to produce subsistence for man.” – Thomas Malthus, 1798

At Avenue we believe we have entered into a period of scarcity like we have not experienced for some time. We face scarcity of capital, energy, food and labour. While this will be a challenge for all investors, we believe there is an opportunity to invest in what we think of as resilient quality businesses that can take advantage of scarce resources while also avoiding businesses where profits may decline.

It was over two centuries ago that Thomas Malthus predicted that the human population would always increase beyond its ability to feed itself. He was famously wrong as he did not account for human ingenuity and the subsequent global population boom from 1 billion to 8 billion souls today. It was only a few years ago, pre-covid, that food and metals were abundant, there was global excess manufacturing capacity in almost every industry, cheap labour, interest rates had never been lower and there was capital available for everyone. That world is behind us, and we now face shortages but not ones constrained by nature the way Malthus predicted, but shortages from self-imposed human choices.

Man-made Scarcity

The war in Ukraine is almost a year in and the Western response has been to arm Ukraine and isolate Russia. However, Russia and Ukraine are major suppliers of grain, and Russia is a major supplier of metals, oil and natural gas. The Western world is also a major supplier of oil and natural gas but to address climate change, governments are committed to limiting the supply. In this quarter’s Case Study, we have put together some charts that help demonstrate the scale of the challenge we face with the energy transition.

China has become the world’s manufacturing hub but the Chinese government has become increasingly authoritarian and hard to deal with. We believe the trend to get manufacturing out of China will continue even after Covid supply chain bottlenecks are resolved. Many finished goods that China produces will be harder to get and will cost more. This trend called reshoring and friend-shoring are happening at the same time as Western economies experience a mass retirement resulting in labour scarcity and higher wages.

Finally, interest rates are now higher, and capital is scarce. Again, this is not a bad thing as much of the excess speculation is being taken out of the market and stock market valuations are coming down to more reasonable levels. We can now evaluate our investments using a more rational cost of capital. However, this process is taking its time and there is a lot of excess to unwind.

The Hangover

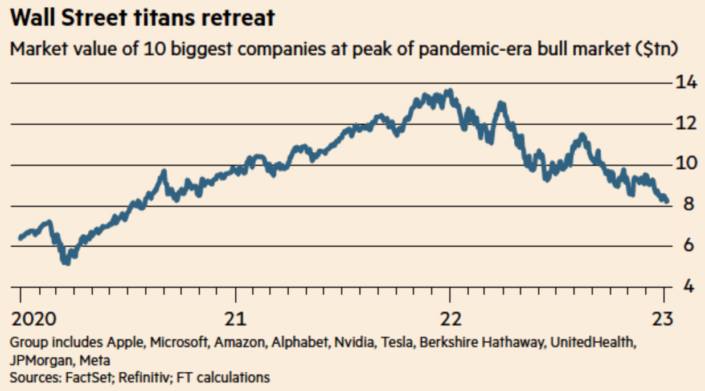

It is truly impressive how some of the highflying stocks have declined. The posterchild in Canada is Shopify which is now down 80% from its highs. In the US, arguably the most controversial highflyer is Tesla, which is down 75% from its high. And amazingly both these companies are still expensive using traditional sales and earnings ratios. With the return to higher interest rates, we expect excessive speculation will continue to unwind.

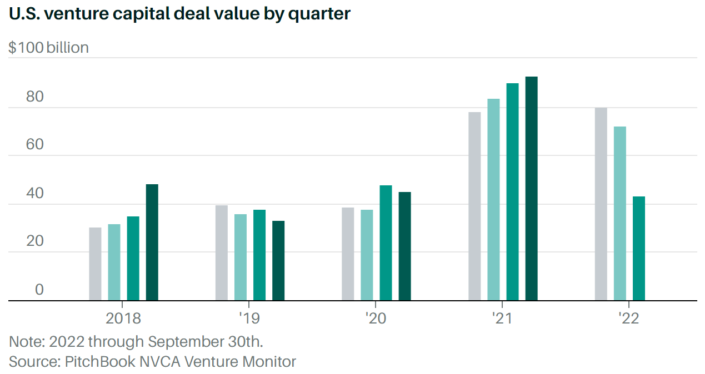

The following chart of venture capital actively shows that it has fallen to a pre-pandemic level. However, we anticipate that given the scarcity of capital in the financial system, the number and size of venture deals will decline further and offset the excesses of 2021.

Investing 101 – Lower asset prices are better for long-term compounding

We usually discuss investment concepts in the quarterly Case Study and the Letter is used as a discussion of how we are adjusting our investments given the economic environment. However, reiterating the power of compounding is essential to how we see the next few years unfolding.

Buying low and selling high is ubiquitous to all investing but it can also lead to over trading and outright speculation. The overused phrase ‘buy and hold’ has come to mean buy the index of the overall stock market and overtime the overall stock market will go up. However, we believe this is a unique point in time where excess valuation must come out of many individual stocks and out of the broad stock market indices, like the S&P 500. So yes, buy and hold but it depends on what we buy.

For example, if we have invested $100,000 dollars in an essential type of business that has an 8% profit margin that it can maintain in a challenging economy, then there is $8,000 annual profit that can be reinvested. The business we own then has three choices. They can reinvest in their own business to grow future earnings. It can pay a dividend and we as shareholders reinvest that money. Or it can buy back its own stock, which is effectively like a dividend but in many cases more tax efficient. No matter how you look at it, the investor has $8,000 more at the end of the year.

We all like it when prices go up but if we are in the business of constantly reinvesting then by definition it is always better when we are accumulating more assets when prices are lower. Our $8,000 dividend buys us new investments at a lower price. Corporate share buybacks are able to buy more stock at a lower price. Reinvesting in your businesses is more profitable if these acquisitions are cheaper.

Wanting lower asset prices seems counter intuitive, but not when you think of the business of investing as being the business of accumulating assets. In this case, 8% is not a random number as it is the actual profitability target Avenue uses for our investments across the sectors of the economy. So, if this market weakness continues for a few more years, we will be accumulating more investments at a better price. In this example, over a three-year period, we will have 24% more in our investments or $24,000 ($8,000 x 3) more given our original investment of $100,000.

This outcome is all predicated on owning businesses that consistently make money even with all the challenges we are facing. This is why we have spent so much time talking about investing in businesses that provide an essential service or product in the economy, and that also do not rely on constantly issuing shares or bonds to grow.

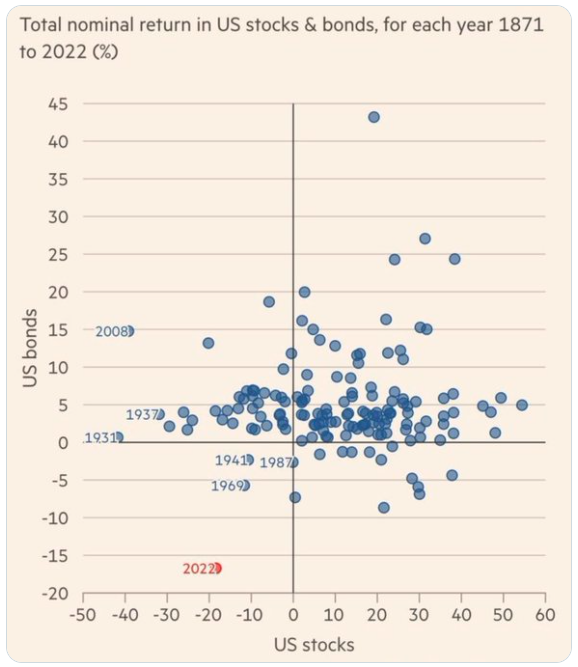

Bonds and Stocks correlation unlikely to repeat

Investing is often counterintuitive. We would like to highlight again how unusual 2022 was when we look at the combined bond and stock market decline. However, once we experience a statistical outlier year like 2022, it is unlikely to repeat itself for some time.

Inflation should decline for the time being

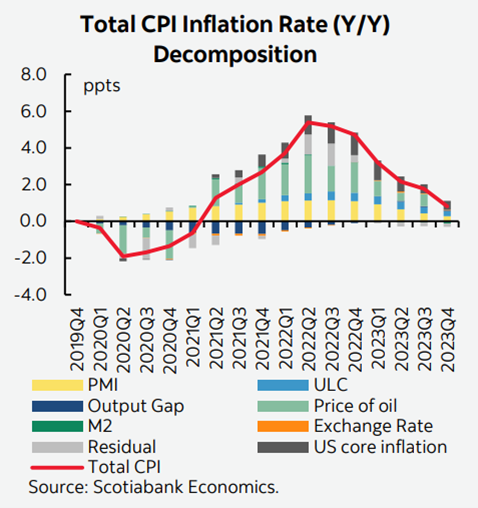

There are several definitions of inflation, and investors often have a hard time getting their heads around them. We have on occasion used an example of the oil price to illustrate in a simple way how inflation is about percentage moves in price. If oil goes from $60 to $80 then the oil price component of the consumer price index (CPI) goes up by 33%. If the following year oil stays at $80 then the contribution to CPI is 0% or no inflation. But oil is still at $80 and expensive.

We believe most of the price increases in goods and services of the last year will stay, but they will not continue to increase at the same rate. Therefore, over the course of 2023, CPI as a measure of inflation will come down purely by the mechanics of how it is calculated. The accompanying chart gives an example of how this may play out.

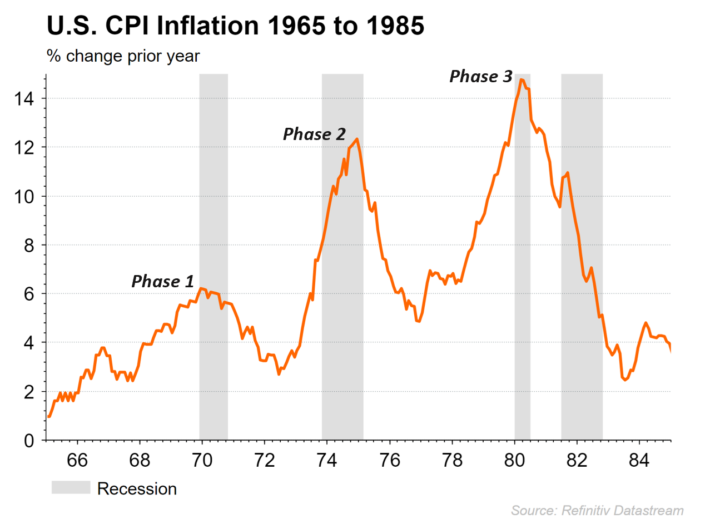

If we look out beyond 2023, the main question we are thinking about is if the inflation rate will eventually return to higher levels than we experienced last year. If we enter a mild recession in 2023 which gets met by lower interest rates from Central Banks along with more expansionary fiscal policy into our current world of scarcity, one could reasonably argue that inflation will return to the upside. This is a scenario that few investors are expecting but we at Avenue will be on the lookout for. It is important to remember that inflation cycles generally occur in multiple waves. The 1970s highlight this well with the three phases of inflation shown below.

Avenue’s Bond portfolio remains defensive

Over the past three quarters, interest rates have risen dramatically from the lows of the past decade. As bond investors, now we can finally get a reasonable rate from higher interest rates. And for the time being inflation expectation should be coming down over the course of 2023.

However, Avenue’s bond portfolio remains defensive for two reasons. We feel there might be an oversupply of longer-term bonds and few people will be buying them. This is simply a technical supply and demand issue that we need to have more clarity on before we extend the maturity of the portfolio.

As well we are coming out of a period of very low corporate bankruptcies and the additional return we get for investing in corporate bonds has generally been low. We believe there is the potential for higher yields from corporate bonds at some point this year and we would like to maintain our ability to invest in these opportunities if presented.

Avenue’s equity portfolio remains defensive

We have worked hard at Avenue to build an investment portfolio of high quality and resilient businesses that we believe will survive and hopefully even thrive in this challenging environment. That said, we still continue with our defensive strategy with the types of businesses we own and the amount of cash we keep on hand.

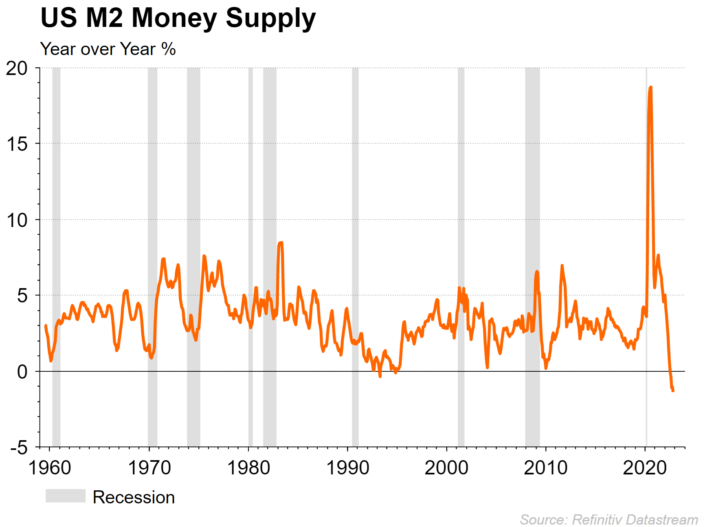

We are expecting that financial liquidity will continue to contract, at least for the first half of the year. We will be better able to determine investment opportunities for our cash when we see how valuations are affected in each sector. An example of the contraction in liquidity would be looking at M2 Money Supply in the United States, which has contracted to the lowest year over year change ever recorded.

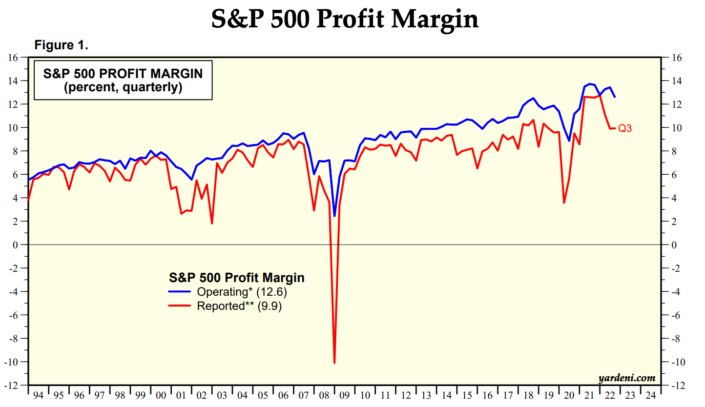

We believe that many of the businesses in our portfolio can raise prices and maintain profit margins even as their costs increase. This is a crucial concept to understand and is why we see many companies as still being able to thrive in the current environment. This will be a year to keenly watch profitability and how rising costs affect stock market earnings. The following chart is a reminder that we are starting from a historical high point for US profit margins, mostly driven by the influence in the index of big technology companies’ outsized profit margins.

Hording Gold

Previously in this letter we wrote that when we are accumulating income producing assets, we would like them to be cheaper for longer. However, in the case of being a gold investor, at some point we would like the price of gold to go up. The chart below shows what is essentially non-Western central banks buying physical gold and tightening the open market. While this buying is positive for the gold price, we don’t know why there has been a noticeable increase in buying. Often what is good for gold is not good for everything else, which is why we have it as a diversifier. In Avenue’s equity portfolio we have primarily invested in royalty companies because they are unaffected by the rising cost of mining.