“John Bull can stand many things, but he cannot stand 2% interest”

– Walter Bagehot

Walter Bagehot was the famed English financial writer and editor of the Economist through the 1860s and 70s. In the quote above, Bagehot refers to John Bull as the British everyman who would never accept anything less than a 2% return on his savings. This attitude was the standard for well over 300 years. Ironically, today this aphorism is flipped on its head, where the average debtor, governments included, could not stand an interest rate greater than 2%. We are clearly in a new financial age.

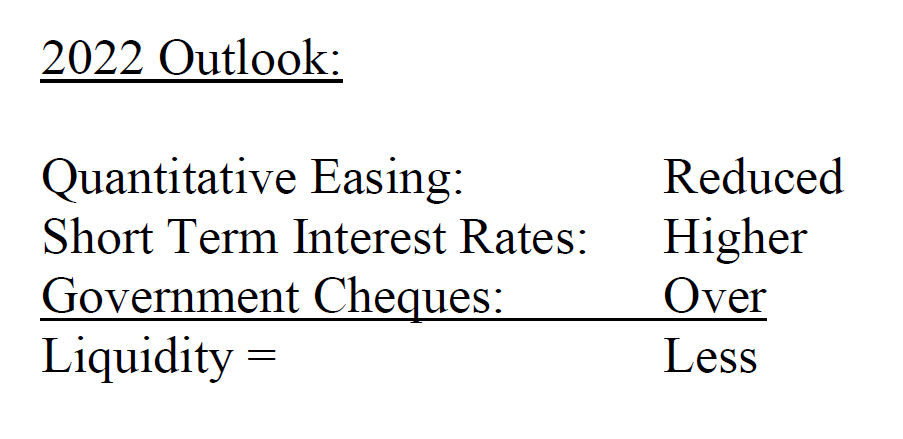

In our Q4 Letter, we will start by giving our view on how financial markets are interpreting the possibility that the Omicron variant will evolve to being endemic. This past year, 2021, was the second year where the virus drove central banks and governments to dramatically increase liquidity, resulting in consumer price inflation. We will discuss our view that regardless of inflation, longer term interest rates can only go up so much. The big theme for 2022 is the deceleration of liquidity as central banks tighten and governments no longer hand out cheques. Liquidity has been the main driver of the financial markets so pricing of all assets will be affected. This is why we have worked hard over the past quarter to build resiliency into Avenue’s equity portfolio.

A few days before Christmas, European and American newspapers simultaneously started to write about how South Africa was willing to approach the Omicron variant as endemic. Given the speed of transmission and how many infected people were asymptomatic, the South African government has concluded there is no way to control Omicron in an active economy. Yes, there seem to be ever evolving twists with this virus, but for this iteration, the stock market is looking through the current dramatic spike in infections and is predicting that the worst for the economy is over.

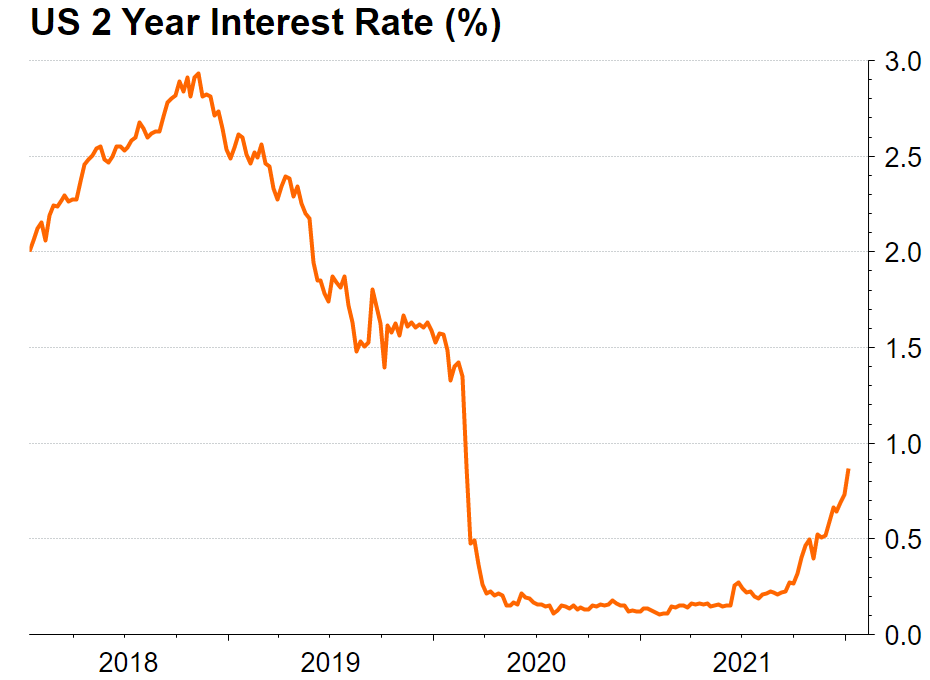

While we would all like to breathe a sigh of relief that our restricted living might be coming to an end, this opening up will have a dramatic and complex impact on financial markets. If Covid becomes endemic, like the flu virus, there is no need for further stimulus. Quantitative easing can be withdrawn, and interest rates can go up to cool consumer price inflation. We have already had a big move in 2-year interest rates from the levels seen early last year.

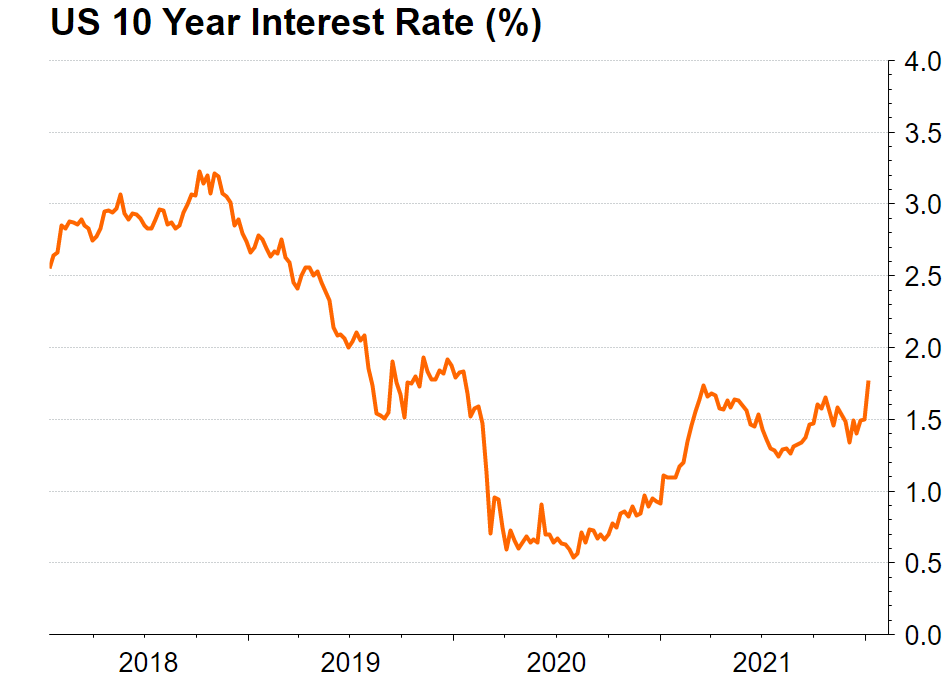

The first big contradiction is that because of the absolute size of our collective debt levels, interest rates can only go up so much before they trigger an economic slowdown. We may end up going into a potential economic recession before we even emerge from our Covid induced economic slowdown. We are not seeing longer term interest rates going up very much. As we have highlighted in past letters, businesses, and therefore the economy, care the most about the US 10year government bond yield. To refer to our Walter Bagehot quote, we believe as interest rates rise closer to 2% this will have a massive cooling effect on asset prices and even slow the pace of private money creation by the banks.

Avenue’s bond portfolio had an exceptional relative return in 2021. We were, and continue to be, defensively positioned given a rising interest rate environment. We also believe we are in a position to take advantage of any corporate bond weakness if prices deteriorate.

A deceleration of liquidity is the head wind facing financial markets this year. We try not to use financial industry jargon in our quarterly letters. However, there really isn’t a substitute for the term liquidity so let’s try a simple definition. Liquidity is the term used to define the speed with which an asset can be turned into cash. If we want to sell an asset, receive cash, then buy another asset and it all takes 30 seconds, that is a liquid market. If that same transaction takes days, then that market is less liquid.

Financial liquidity increased significantly over the course of the pandemic in three ways. Central banks accelerated already established quantitative easing, where the government issues bonds to financial institutions then buys the same bonds back, leaving newly created money in the financial system. Central banks lowered interest rates to basically zero. And the federal governments in Canada and the US wrote cheques to people and companies to tide them over while getting through the pandemic.

Ever larger amounts of money, even if borrowed, drive financial markets in the short term. Money will continue to increase in 2022, but the rate of change is slowing. First, the US central bank is committed to slowing their purchases of bonds. Next, it is anticipated that the US central bank will increase short term interest rates. Even if the absolute level of interest rates remains below the rate of consumer price inflation, liquidity will be tighter than what it has been. As well, government direct income supports will not continue. In 2022 there will be less liquidity and speculative financial markets will have less fuel.

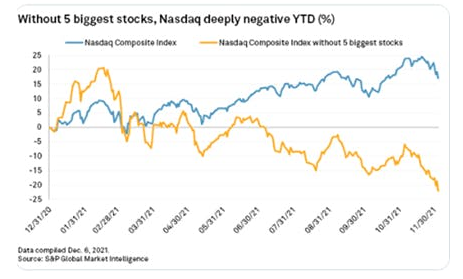

Anticipating this loss of liquidity, we have actively repositioned the Avenue equity portfolio. We have made more trades than usual, but we feel this was important to get us in a more defensive position and build more resiliency into the portfolio. The coming year might offer buying opportunities and we need to be ready in advance. Many parts of the stock market that benefited from this excess liquidity in 2021 are already beginning their unwind, but we believe high quality businesses will continue to be the best source of long-term returns.

Chart Section

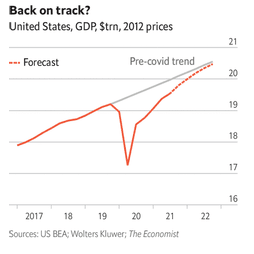

For a slightly different format, we would like to share with you some charts that best tell the story of what Avenue finds interesting about the economy and financial markets at the outset of 2022. The US economy has recovered and surpassed its pre Covid level and is expected to grow again this year.

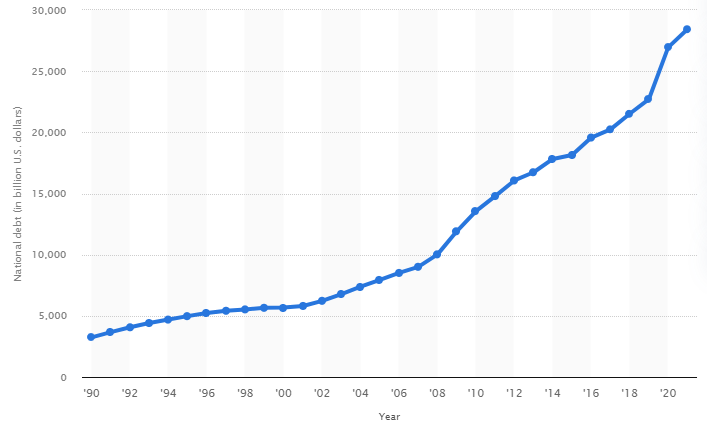

Financial markets have been buoyant because governments have taken on a massive amount of debt to fill the gap caused by the pandemic shutdowns. In 2019, the US had roughly the same amount of government debt compared to the value of its economy (GDP). In 2022, the US economy is a little bigger than it was at the beginning of 2020, but the government debt is approaching $30 trillion which is now 127% of GDP.

Looking at the US debt clock can be mesmerizing and unsettling at the same time. If you click the link below, in the top right corner there is a time machine button which projects US debt levels out five years to 2026.

US National Debt is approaching $30 trillion. Click the link:

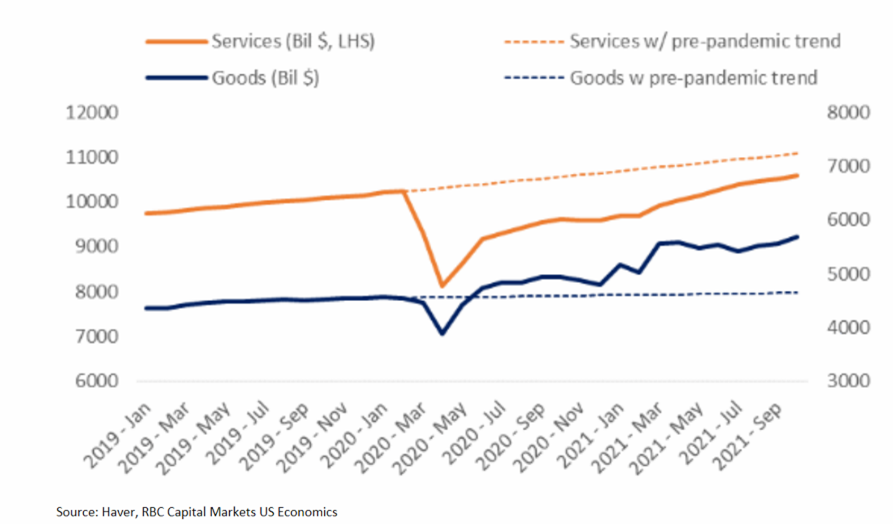

Borrowing this amount of money to bridge the economic gap does not tell the whole story. The pandemic created a situation where money that has been borrowed is spent more on goods and less on services. When people want to buy goods, supply disruptions due to Covid make goods less available, resulting in consumer price inflation. The goods economy continues to run far ahead of its pre-pandemic growth trend.

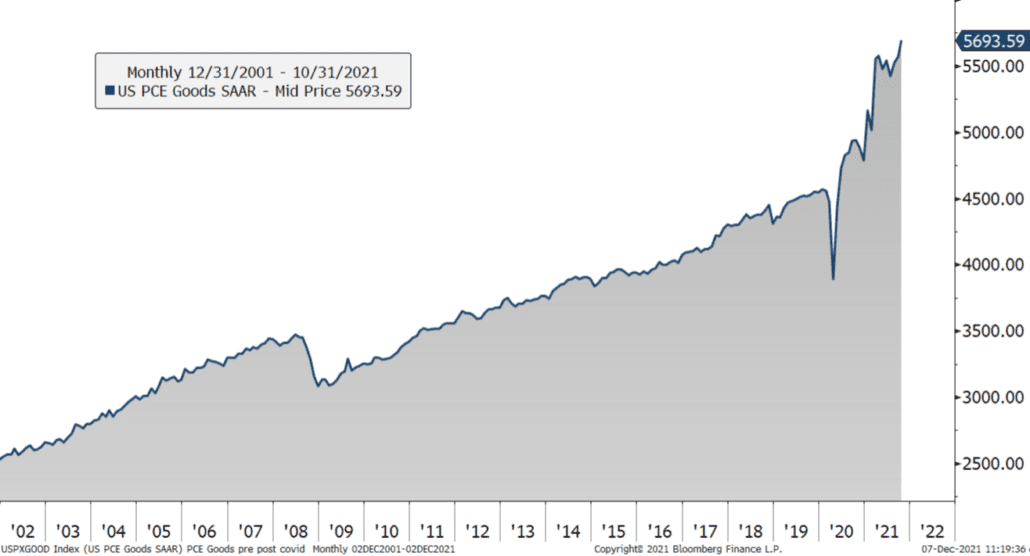

We added this chart because it really illustrates the incredible surge in consumer demand. The U.S. consumer purchased as many goods in the last 18 months as it had in the previous 10 years.

You can also extrapolate what it will look like 12 months from now if spending returns to its long-term trend.

US CONSUMER GOODS SPENDING

Finally, we would like to highlight that many speculative stocks are already off from their highs. It is just the dominant technology names that are holding up the index. A lot of the liquidity excesses are already being unwound and liquidated throughout the stock market.