The saying, ‘stay the course’ has a long military history but it is Ronald Reagan who repurposed ‘stay the course’ as a catch phrase for resetting the economy post 1970s inflation. At Avenue, we have a strategy that incorporates bad markets as well as good and we plan to come through this current weak period stronger than when we started.

The message we would like to convey is a positive one. While 2022 has been hard for investors, we believe a significant amount of damage has already been done. Bond and stock prices are at a much better level for us to accomplish long term compounding. But we caution that the central banks have no quick fix so our expectations of recovery will be gradual and accompanied with larger short-term price swings.

As long-term investors, we know that while there are strong markets, there will also be weak markets. As we have written in our last three quarterly reports, 2021 was about excess financial stimulus and 2022 was the year stimulus was taken away. We have been positioned defensively in terms of what we own and how much cash we have raised for most of the year. Now interest rates are at a level where we can build a bond portfolio which gives us a decent return. As well, while we believe many stocks are still too expensive, Avenue’s portfolio of stocks are trading at a good level relative to the cash flow these businesses produce.

We are going to share with you a few charts which show how weak the bond and stock market has been this year. But what we take away from these statistics is that because prices have been bad, we should be closer to a bottom, and going forward the returns will be better. While our strategy has been defensive throughout 2022, we must start thinking offensively and look for high-quality businesses we can invest in.

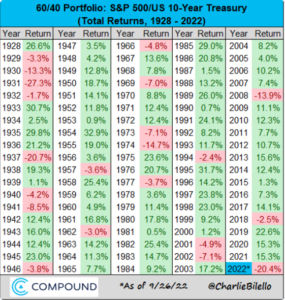

This year feels particularly bad due to the combined effect of weakness in both the bond and stock markets at the same time, while the cost of living is going up. For the last forty years, when stocks fell due to the financial crisis of the day, a central bank was able to lower interest rates and the bond market was seen as a safe haven for investors. So, if stocks went down, bonds went up. A balanced portfolio with a mix of bonds and stocks would counterbalance each other.

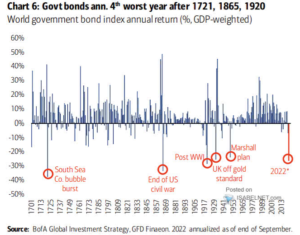

What we can see in this chart is how unusual an event it is that bonds and stocks went down in the same year together. Above all, this year has been about interest rates going up. With higher interest rates, stocks valuations came down. Again, as you can see from the chart, returns have been bad, and under these circumstances, history predicts that positive returns are more likely sooner rather than later.

Inflation is commonly expressed by the consumer price index (CPI). In our last letter we laid out how CPI is a complicated term often describing conflicting economic concepts. For simplicity’s sake, this quarter we would like to focus on the rise in prices for food, fuel and rent. To point out the obvious, the rise has been dramatic as this year’s CPI increase is coming off a low base. While the CPI headline number is jarring, central bank behavior and economic weakness tells us the CPI will be much lower this time next year.

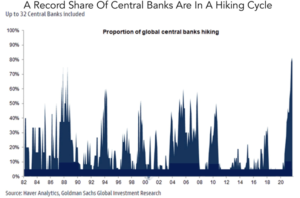

Our current economic circumstances are unique and so is the behaviour of the central banks. It is very unusual, if not unprecedented, to have 28 central banks all tightening interest rates at the same time. The result is that globally there is less money and liquidity in the financial system. From having too much liquidity a year ago, we now have very little. But we anticipate that the next swing will likely take us back in the other direction.

When global financial markets have stress, the safe haven remains the US dollar and short-term US treasury bills. The Canadian dollar relative to the US dollar has fared better than most major currencies, because Canada’s main exports are commodity related. While US dollar cash is not part of our strategy at this time, we do maintain US dollar exposure through our stock market investments which make money from their businesses in the US. Currently we measure that exposure as 45% of the cash flow of our equity portfolio. As well a Canadian business like Canadian Natural Resources produces oil with their costs in Canadian dollars and sells their product in US dollars. Currently the Canadian price per barrel of Edmonton Par is $118 Canadian. The last time we had high oil prices the Canadian dollar was valued at one to one with the US dollar. Our current period of high oil prices is accompanied with a Canadian to US exchange rate of $0.73, as of this writing.

Avenue’s Bond Portfolio

Our conclusion from the chart below on the historical return of the global bond index is that this might be the worst annual return in our lifetime. We have described 2022 as the year where we have experienced the tearing off of the band aid of low interest rate policy. It is the speed measured in months and the magnitude measured in percentage terms that is so extreme. Over the decade of the 1970s, the last time interest rates went up dramatically, yields started at 4% which then doubled to 8% which then doubled to 16%. With today’s much higher level of debt and a more mature economy we have just experienced the same impact where 1% interest rates doubled to 2% which then doubled to 4%, but within the space of a several months.

The benefit of having bond prices fall this past year has been the resetting of bond yields to level where we can receive a more rational return. We expect inflation to come down from our current elevated levels but remain higher than the past few years where inflation sat at only 1.5%. If inflation was to average 3% for the next decade, Canadian government bonds should offer an added return of 1% for a total of 4%. Corporate bonds should offer an additional 1.5% for a combined yield of 5.5%. Historically, Avenue’s bond portfolio has had a majority weighting in corporate bonds. At this time, we are still being patient as the stress in the credit market might still affect credit spreads between corporate and government bonds. If credit spreads widen, we would like to take advantage of the opportunity to invest in higher yields. The main point we wish to make is that Avenue can build a bond portfolio that gives us a decent return, now that we have a break from the era of ultra-low interest rates.

Avenue’s Equity Portfolio

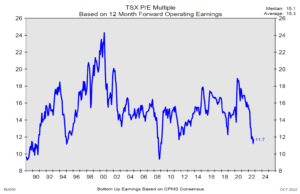

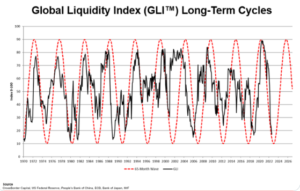

Stock market pricing is the result of two simple components: the amount of earnings and the multiple that investors will pay for those earnings. Let’s start with the stock market multiple which itself is a function of liquidity. Liquidity is the financial term for how much money is floating around in the system. As interest rates have risen this year, liquidity has dried up. As a simple example, investors are less likely to borrow money to buy stocks because the cost of borrowing has risen. Less liquidity, by definition, means that investors have less money to buy stocks with. The term used in the financial industry is ‘the market multiple will compress.’

The good news is that much of this compression has happened. While many stock valuations still can come down, we just need to focus on the ones we own. We have worked hard over the last year to make sure we don’t have any investments where the valuations are overly expensive. As well, we are keeping a cash position in case we get an opportunity of a further sell off. However, we need to be aware to the potential that much of this stock market weakness may have run its course. We showed the chart below of financial market liquidity in our Q1 letter in April, when global liquidity was at its peak and beginning to fall. This key indicator is now closer to the bottom. We don’t have a time frame for how long it may take to get to the bottom as it might take months or even a year. That doesn’t mean we run out and spend our cash, it just means we are now looking for opportunities as opposed to forcing ourselves to sit on our hands.

Stock market earnings, and thus profit margins, are very hard to generalize when inflation rises to this degree. The chart below shows how historically inexpensive the Canadian TSX index is based on analysts’ estimated earnings for 2023. To be clear, the price earnings multiple might increase from this level, not because stock prices go up but because profitability may start to fade in coming months. While this valuation gives us a general view on the overall Canadian stock market, it is much more important to focus on the earnings of each individual business. As we have stressed this year, we are focusing our investment strategy on simple and essential businesses that can maintain margins and do not need additional stock market financing. Whether the company we have invested in continues to pay a dividend or buys back stock, Avenue’s underlying portfolio will become more valuable as we go through what we believe will be an extended period of economic weakness.