“Successful investing is having everyone agree with you…… later”

– James Grant

We will start this quarter’s letter with our view on how the lingering pandemic is having a significant effect on the operations of all corporations. The economy and the stock market are changing at a fast pace, and we have seen our equity portfolio turnover increase this year. As well, we have made an incremental shift back to Canadian companies for the time being because we are finding better opportunities here. We will also discuss the bond portfolio and how we have protected it against the uptick in Consumer Price Inflation (CPI).

Every conversation between two people still seems to start with an update on how the pandemic is affecting them both and how they feel about the continued restricted living. While most people hope we will be back to some sort of normal in our everyday lives soon, Avenue believes there is no back to pre-pandemic normal for business or investing in the near future.

Supply disruption leads to demand destruction

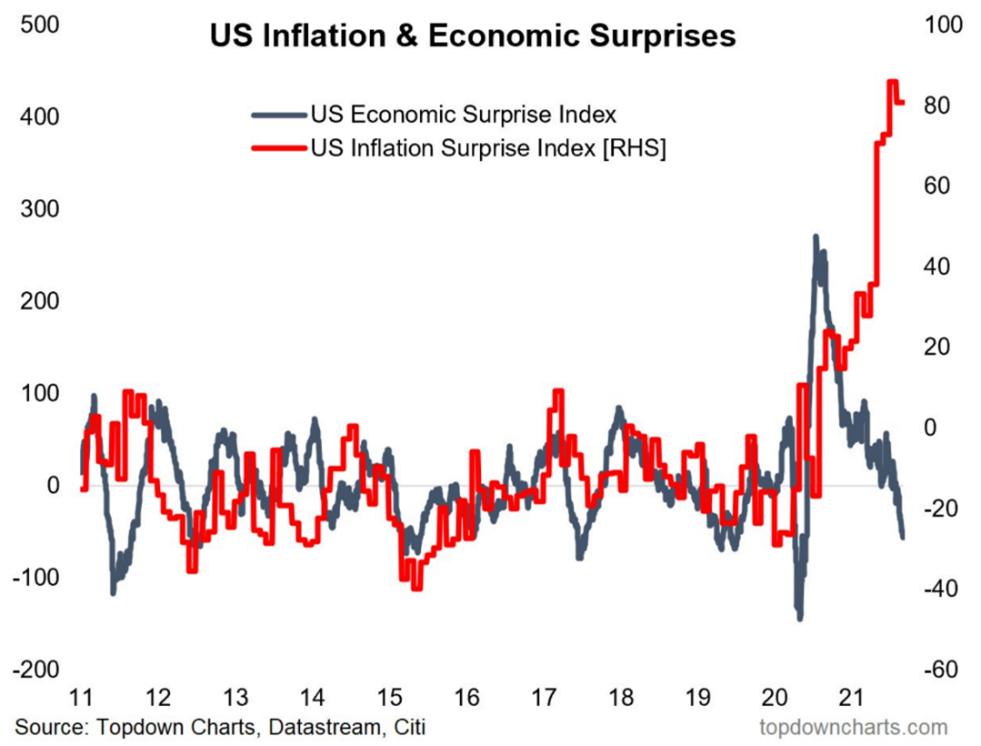

In our Q2 letter we described how the level of Consumer Price Inflation has jumped in the US and Canada. Initially, this is a natural result of year over year statistics where the summer shutdown of 2020 is compared to the summer recovery of 2021. However, we are now seeing real supply disruption everywhere with the global supply chain massively backed up. In 2019 there was global oversupply of almost all goods and the manufacturing capacity to make them. Fast forward to today and we find that raw materials can’t get to the manufacturer, finished goods can’t get to the wholesaler, and retailers can’t find enough people to work on their sales floors.

To use a simple example, if there is only one bicycle and two people want it, the price goes up until one person owns the bike and the other person decides they don’t want to spend that much money anyway. The prices of goods are increasing but because fewer goods are being sold, the economy is stalling. Supply disruptions have led to price increases of basic materials, finished goods, and labour costs, which in the absence of an overall boom in wealth, has resulted in demand destruction.

Avenue’s Equity turnover and Canadian exposure

As usual we ask the question, what are the consistently high profit margin businesses trading at reasonable prices? But now the answer is changing slightly. We want to make sure we have investments in raw materials where the prices are rising. We can maintain our investments in hard asset businesses like real estate and infrastructure where the asset is already built. Software and many services operate seamlessly across borders in the digital age. What we want to avoid in the current market are businesses which rely on many inputs and have a long sales cycle. To adjust to this changing business dynamic, our portfolio has been more active than what we normally plan for.

Historically, Avenue’s equity portfolio has on average a five-year hold period per investment, which means the portfolio has a turnover rate of 20% per year. So far this year Avenue has a turnover rate of 40%. Some of the turnover was a welcome surprise in that WPT Industrial REIT and Roxgold were effectively acquired. But most of the turnover has occurred because stock prices have moved up and business outlooks have changed rapidly in the industrial and healthcare sectors of the portfolio. We are hoping that the high turnover rates, this year and last year, were an anomaly and what we currently own can be held for the foreseeable future, with the exception of a few cyclical commodity investments.

The other incremental shift in the portfolio has been an increase in Canadian business exposure, driven by value opportunities. Historically, Avenue’s equity portfolio has had direct foreign investments ranging between 25% to 30% of the portfolio. We have always argued that if we can find a great business in Canada, we don’t need to take on the extra currency risk of investing outside the country. However, there have not been many good choices, given Avenue’s criteria, in the Canadian stock market in terms of technology and healthcare businesses. Thus, if we could not find Canadian stocks, we went outside the country to find high quality investments.

What we have found over the course of 2021 is that US healthcare and technology stocks are becoming increasingly expensive or are facing uncertain business risks. At the same time, several Canadian businesses have emerged that fit our criteria of a good business at a fair price. For example, in healthcare we have made an investment in DentalCorp and in technology we made an investment in Topicus. Avenue’s equity portfolio is currently invested 17% in direct foreign listings because we have found that comparatively more opportunities are here in Canada where fewer people are paying attention.

We still have foreign cash flow exposure. However, the exposure is through Canadian companies where the valuation is lower and we can pay less for an equal amount of cash flow. For example, Lundin Mining is a copper mining company with over half its production in Chile. We have ownership in a Canadian mining company that sells copper at the global US dollar price, but the profit margin is determined by the local production costs in Chile.

Another example is Topicus. The company is Canadian listed but with a European management team that buys and operates technology businesses in Europe. When we add up where the cash is made by the underlying businesses in the portfolio, fully 47% of the cash flows come from outside Canada. We want to have foreign asset exposure in Avenue’s equity portfolio but currently the most cost-efficient way to get it is through Canadian listed companies, which make money from their foreign subsidiaries.

Not all stocks are expensive

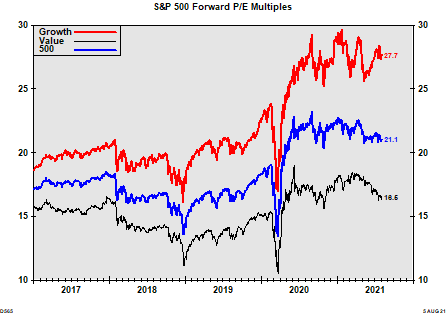

‘Stocks are really expensive’ is the oft-repeated phrase lately. We just said the same thing in the previous section, when referring to the valuation of healthcare and technology stocks in the US. We would like to make our case that this catch-all phase requires a bit of nuance. At Avenue we argue that it is US technology and index leading mega-capitalization stocks that are expensive. In our Q2 letter we presented a chart showing the incredible inflow of money into the US equity market in the first half of this year.

Running with the crowd has historically not been the best place to be when investing in the stock market. In the following chart, the SP500 US Index price/earnings ratios are broken into growth companies and value companies. While the growth companies are expensive by historical comparison, the value companies, with a price earnings ratio of 16, are trading at about their historical average.

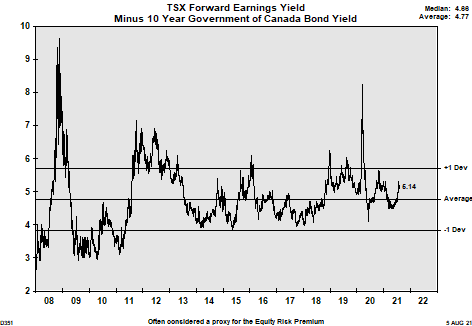

Again, in Canada we find that valuations are generally not high. This next chart is a bit more esoteric, but it makes the point that Canadian stock valuations are a bit above their historical average relative to interest rates, but not by much. We find that there are many opportunities to find good businesses and the valuations are not excessive.

Remember the Tail Hedge

We have made the case that we are able to build an equity portfolio of high-quality businesses at a reasonable price. However, the risk remains that there are excesses in the broad stock market indexes like the US S&P500 Index. Money flows are at all-time highs, margin debt is at all-time highs, initial public offerings are soaring, and retail trader participation is described as a mania. Our strategy is to acknowledge this systemic risk and hedge our portfolio of high-quality companies against any potential stock market shock using Avenue’s Tail Hedge strategy.

Avenue’s Bond Portfolio remains defensive

Avenue’s bond portfolio performance in 2021 continues to demonstrate the difference between Avenue’s strategy and the overall Canadian bond index. Avenue’s bond portfolio is up 2.2% year-to-date versus the Canadian bond index return of -3.9%. Avenue’s portfolio out-performed the Canadian bond index by 6.1% and more importantly had a positive performance in what has been a bad year for bonds.

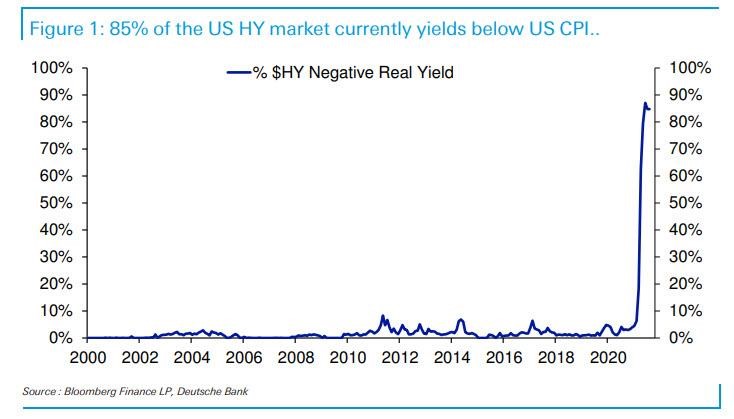

We have written previously about the effect on reducing interest rates by central bank activity called quantitative easing. A few papers recently have tried to quantify the impact of this act of yield suppression on the level of interest rates. The consensus is that interest rates have been artificially reduced by central banks by about 2%. So, if we back calculate this with our current yield, this implies that the US 10-year yield of 1.5% should in fact be 3.5%. If we add a historically normal corporate bond spread of 1.5%, this would imply a corporate bond yield of 5%. Avenue would be very happy to build a corporate bond portfolio which has a 5% yield in a 2-3% inflationary world. This gives us a sense of the scale for how far we are away from a properly functioning interest rate market.

We can now see the consequences of interest rates being this low. There are very few if any corporate defaults because borrowing is so cheap. This is bad news for keeping the economy fresh because defaults and bankruptcies remove inefficient businesses from the market. The following chart is not supposed to happen and demonstrates how yields have dropped to an extremely low level. About 85% of high yield bonds or what are called ‘junk bonds’ in the US are trading below the rate of inflation.

Given the extremely low corporate bond yields, Avenue’s bond portfolio remains defensively positioned. As well, 15% of the bond portfolio is invested in TIPS or Government Inflation Protected Securities. In our next quarterly letter, we will take some time to dig into this topic in more detail.