“The test of a first-rate intelligence is the ability to hold two opposing ideas in mind at the same time and still retain the ability to function.”

– F. Scott Fitzgerald

We will get through this financial market weakness remembering that the last few years have been a positive environment for investors. But right now, it seems like all prices need to find a new level. While we anticipated that 2022 would be a year of financial market headwinds, investors are faced with almost too many problems all at the same time. There are now so many negative issues: financial, economic, environmental, and geopolitical that they seem too many to list. Hence one could say there are many spinning plates, and it is just a question of which plates fall first. But what we know about investing is that when everyone is universally negative, this pessimism may already be reflected in the prices of bonds and stocks. We must force ourselves to think positively and look for opportunity.

The Great Unwinding

Our current financial market weakness is first and foremost due to rising interest rates on the back of a resurgence in inflation. We have experienced a decade-long period where interest rates were kept artificially low for too long. Historically, in very simple terms, if the stock market goes down then the bond market usually goes up. This has been the underpinning of balanced portfolio construction for over 50 years. In our current situation, low interest rates resulted in elevated prices of both bonds and stocks. Now that interest rates are going up, bond prices and stocks prices are declining at the same time.

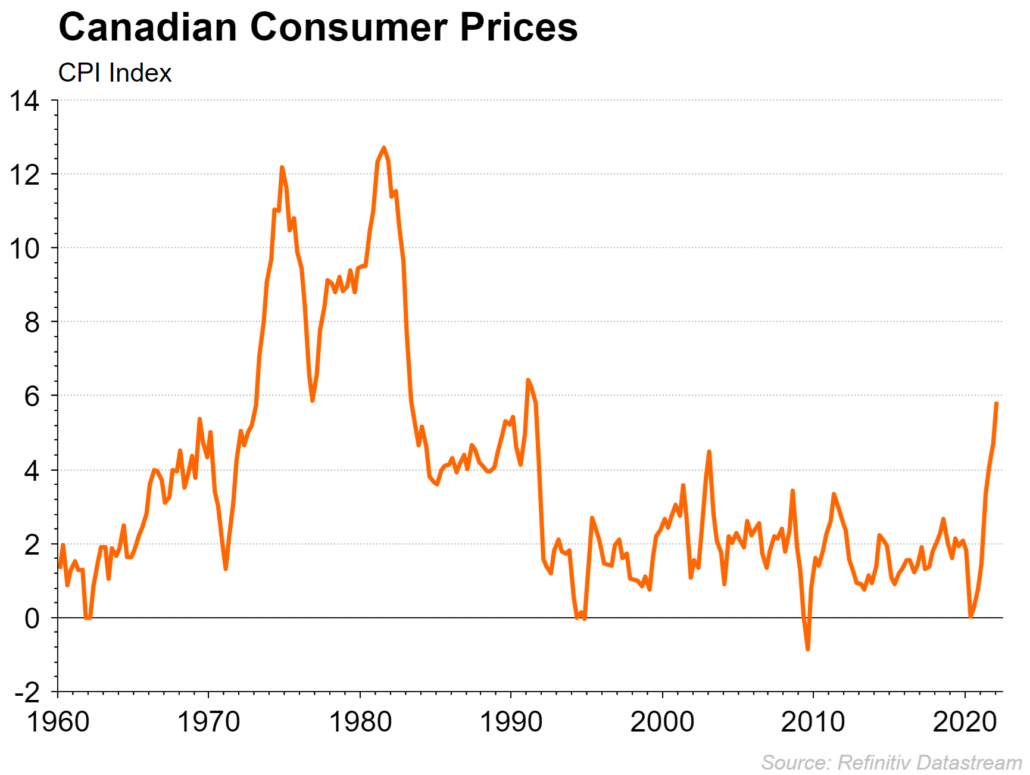

The Bank of Canada is raising short term rates to fight price inflation in an economy where unemployment is at a historic low. We would like to distinguish that there are two types of price inflations, which have distinct identifiers but confusedly are both called inflation.

One type of inflation happens when new money or credit is pumped into the financial system, as per our Government’s COVID response; asset prices go up as the money must go somewhere. This is commonly called monetary inflation. The sustainability of the monetary inflation can vary depending on how much money or credit has been created, and whether it is done by the government or by the commercial banking system.

The other type of price inflation happens when there is an increase in the price of a specific commodity or a product. This increase can be caused because demand remains constant, but supply becomes constrained. Businesses are incentivized to respond to these higher prices by allocating resources so they can produce and sell more of that product and earn a profit. Competition for these profits then creates more supply from other businesses, which brings economic harmony and prices back into balance. If there is no supply response, then prices will rise until consumers reject the new prices and demand destruction occurs. Only new supply or demand destruction will bring down this type of price inflation.

The challenge in the current environment is that we have both monetary and supply/demand inflation at the same time. We are forced to take both types into consideration when we make rough approximations of what price levels will be in the future. We need to try and determine the direction of consumer price inflation (CPI) in a year from now. It is CPI that sets the tone for the level of interest rates. The level of CPI inflation also elicits a certain response function from Central Bank policy, which can impact investor sentiment and financial market liquidity. To reiterate our underlying theme, as interest rates rise from near zero, the price of almost everything must find a new level. Higher interest rates serve as a form of gravity on asset values.

An Orderly Decline, Not A Panic

One point we would like to highlight is that the bond and stock market weakness so far have not been accompanied by a rapid collapse in the major indexes consistent with a market panic. Individual securities have experienced large single day declines, but the overall weakness in the market is being popularly described as ‘an orderly decline’.

At Avenue, we wrote in our quarterly letters as early as last September that we were repositioning our bond and stock portfolios to be defensive. In our December letter we described how 2022 was going to be the year where ‘financial liquidity’ would be gradually drained from the system.

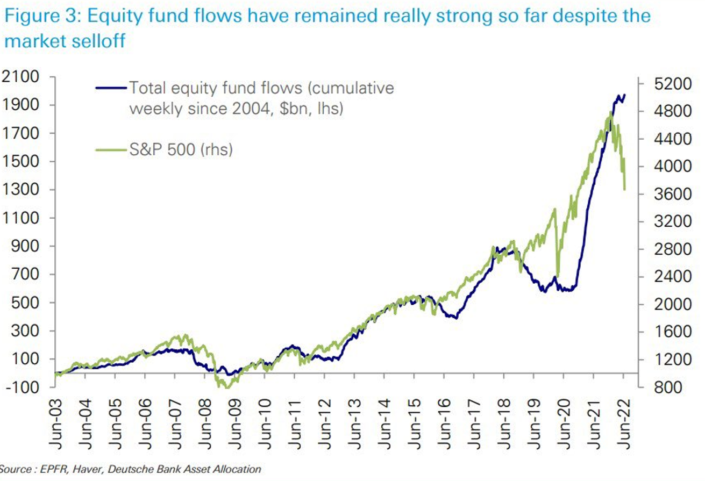

While we might have been early by a few months, this view is now more common among institutional investors. For example, stock market sentiment is close to an all-time low with professional investors because they have already adjusted their portfolios. Strangely enough there has been no stock market panic because private investors are still net buyers of securities.

This private investor behavior may still be interpreted as a short-term negative. As a rule of thumb, private investors are usually bullish at the top of the market and bearish when stocks are at the bottom. For these reasons we are still taking a cautious outlook.

KISS – Keep It Simple, Stupid

KISS is a well-known marketing acronym which helps guide marketing campaigns to not overcomplicate their message. We believe KISS can also be a guiding principle for constructing a portfolio to see us through what we have anticipated to be a challenging year.

The simple answer will likely be the right answer.

During the quarter we increased cash levels in all the portfolios. The most obvious decision is to avoid stocks where the valuation is excessive. Most of the stock market decline so far has been due to overpriced stocks falling to more reasonable values. As well, we have avoided or sold all corporate bonds and stocks where the business model is complicated or requires liquidity from the financial market. The best examples of this would be selling our position in Brookfield Asset Management and Onex, which are both global asset management companies with lots of exposure to leveraged real estate and private credit.

Avenue’s portfolio strategy at this time is to invest in simple and essential businesses. As always, these businesses need to be consistently profitable and the valuations we pay have to be reasonable. While this strategy does have an element of an analyst’s opinion, if broadly applied, we should be able to reduce our risk and have capacity to take advantage of opportunities to invest at good valuations as we go forward.

Avenue’s Bond Portfolio

Avenue’s bond portfolio has been positioned defensively for several years anticipating a return to higher interest rates. It seems too obvious to state but in a bond portfolio we still have to own bonds. To be defensive, we have held higher cash levels, kept the maturities shorter and avoided more speculative corporate bonds.

We also manage the bond portfolio with a view to compound returns over the longer term. In what has been an extremely low interest rate environment over the previous three years, Avenue’s bond portfolio was up +14.5% from 2019 to 2021.

This last six-month period is akin to ‘tearing the band-aid’ off the world of interest rate suppression. Going forward we will continue to collect our interest income. Most importantly we can invest our cash and re-invest our maturing bonds at higher interest rates. We absolutely need these higher interest rates so that we can compound at a decent rate of return in the years to come. The rise in interest rates, although painful in the short term, creates a better environment over the long term for bond investors.

Now that 10 year government bonds are yielding just over 3%, Avenue’s bond portfolio is neutral in its positioning relative to the bond index. This is simply a way to relate our thinking in relationship to an industry benchmark. At some point in the next few months or maybe as long as a year, there may be an opportunity to be more aggressive. For now, our stance remains cautiously neutral.

Avenue’s Stock Portfolio

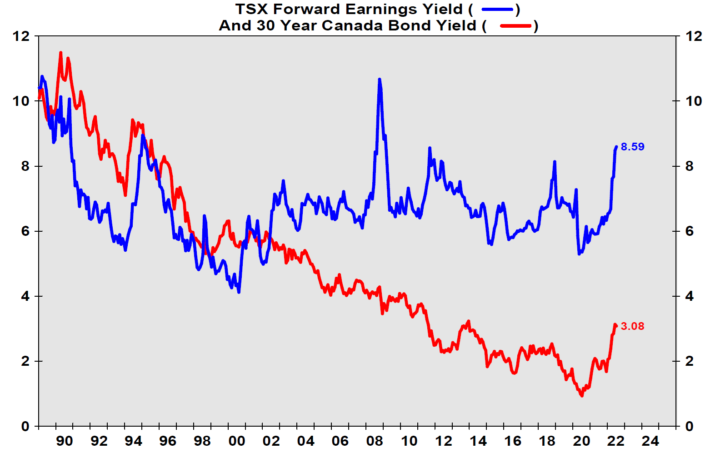

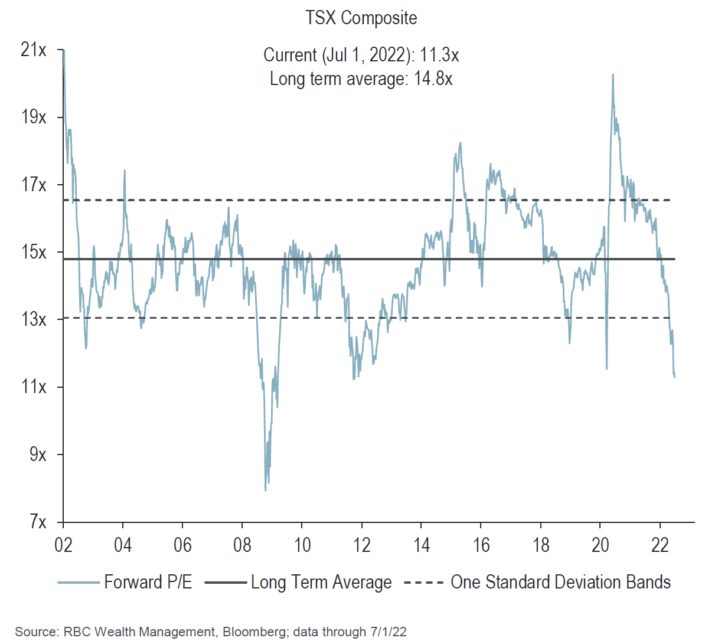

Avenue’s stock portfolio has been positioned defensively since last fall, anticipating the impact from a withdrawal of financial liquidity and a gummed up global supply chain. To be defensive, we have held higher cash levels. While we try to avoid overtrading, we have sold any stock that relied on financial markets for support. Maybe it is easier to think of the opposite type of business which is one that is an essential part of the economy that continues to make money through bad times. In Canada the valuations remain very fair.

We can be defensive, but we still own stocks in the stock market. We also manage the stock portfolio with a view to compound returns over the longer term. In this period of low interest rates, we have had good financial returns.

One might argue that given the extreme pessimism in the market, a good part of the decline may have already happened. If there is another shoe to drop, it will likely come from a decline in earnings in various sectors of the economy. Although it may prove painful in the short run, we think this scenario would see many great investment opportunities emerge.

Again, we describe our current position as cautiously neutral. We will still avoid businesses that are termed ‘financialized’ and focus on simple essential businesses in the economy. Any further weakness may be an opportunity to get more aggressive but for the time being, we will watch and wait.