“Inflation is always and everywhere a monetary phenomenon in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output.”

– Milton Friedman

In this quarterly letter we would first like to discuss Avenue’s view of inflation, which has quickly become the main topic for investors. Leading from our view on inflation is our broader thinking about how nothing is normal in our current financial world. But we believe we need to get used to it; we are living in a new normal. Our conclusion continues to be that we have to stay invested, but more than ever it matters what we own and it certainly will always matter how much we pay for our investments. Lastly, we would like to give an update on the Avenue Tail Hedge portfolio now that we have been incorporating this strategy for a full year.

Goods Inflation is Temporary

At Avenue we went into the year expecting inflation to increase as the economy recovers from the pandemic. We are halfway through the year 2021 and the headline consumer price index (CPI) measure of inflation is at 3.6% for Canada and 5% in the US. Now that inflation has arrived, there is an active debate about whether inflation is permanent, or will it at least continue at an elevated level from the less than 2% we experienced for the last decade. This is a central issue because the level of inflation sets the tone for the level of interest rates which in turn underpins the valuation of all financial assets.

It is our observation that most of the recent price increases are due to disruption in supply chains and shortages of labour caused by the pandemic. We are emerging from lockdown and most industries are up and running, but it will take at least another year to smooth out raw material production and distribution, transportation networks and global trade links. Here is where we make the argument that higher prices, caused by more demand than supply, are not inflationary as long as the pool of money is not increasing. If there really is no excess money in the economy then as goods become more expensive, consumers will be forced to cut back and consume less.

The next part of this argument is to address what is often described in the media as trillions of dollars of ‘money printing’ to help sustain the average person through the last year and a half. As we have outlined in previous letters, the reality is that the trillions of dollars of stimulus in Canada and the US have not been printed but borrowed. For the time being, this implies that this money will be paid back and yes, it is stimulative but not in a conventional way. This is where central bank policies like quantitative easing get complicated. Money is created but because of the mechanics of the banking system, this money is not loaned out to create the positive knock-on effects from productive capital investment. Or as we mentioned earlier, this money does not make it into the economy and does not get used to build businesses. The money effectively gets trapped in the financial system where it seeks out returns from financial assets.

There are two important results of this central bank policy of quantitative easing, where government bonds are issued but then bought right back again by the central bank. There is new money in the financial system that has to be invested somewhere but now there are fewer bonds available because of the central bank purchases. The interest rate levels are lower than they would have been otherwise. All investors, from individuals to pension plans and insurance companies, are seeking a decent return which government bonds no longer offer. The new money is compelled to find higher risk investments like mortgages, corporate bonds, and stocks.

Asset Inflation Will Continue

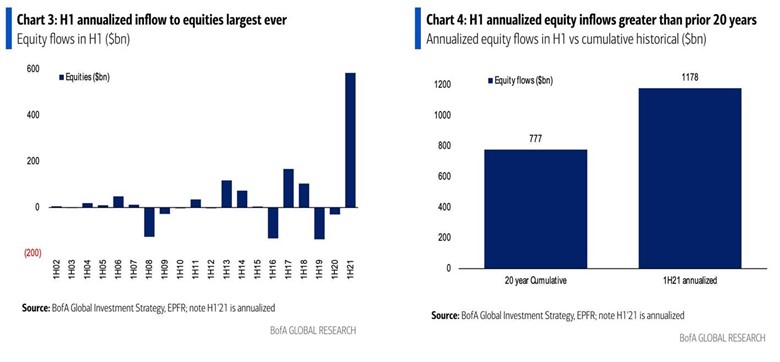

While we have anticipated that money should be flowing into financial markets, we are now witnessing unprecedented waves of money coming into the stock markets around the world, particularly in the US. Year to date inflows into global equities are on pace to surpass the last 20 years combined.

A large amount of the money that is chasing global stocks is going into US equities. As seen in the chart below, the foreign ownership of US stocks is now over $10 trillion dollars, a record amount. The newspaper headline on the right is from a copy of the Philadelphia Inquirer in 1929. A similar dynamic was occurring in the late 1920s when Wall Street was serving as a suction pump for capital from all over the world. At that time investors were speculating in stocks like General Motors, RCA, and Montgomery Ward. Today it is the FAANG stocks: Facebook, Apple, Amazon, Netflix and Google. Every generation of investors that comes along thinks they have found their version of the philosopher’s stone which will bless them with unlimited easy riches and prosperity. But in investing, like human nature, there is nothing new under the sun.

Source: St. Louis Federal Reserve, Philadelphia Inquirer

Warren Buffett has a famous saying to ‘be greedy when others are fearful and fearful when others are greedy’. Therefore, we were aggressive when the stock valuations were lower last summer, and now we are building more caution into our investment portfolio given the current, almost universal, positive sentiment. This means selling individual investments when they reach our return targets and recycling this capital back into other new businesses that provide more attractive risk/reward opportunities. Because of this strategy the first half of the year had more turnover in the portfolio than normal.

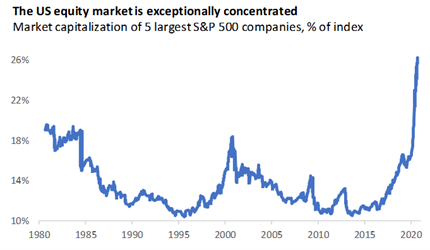

A lot of money is being invested quickly and much of this money is being invested in passive index funds, which distorts individual stock prices. To understand the lure of index funds the argument goes like this. If you buy an individual stock and something goes wrong with the underlying business, then the stock will fall. However, if you buy the broad market index, if the index falls then the central bank will come in and support the overall market. There is a win-win mentality that has seeped into index investing that is getting close to a tipping point of altering how the stock market functions. For instance, stocks like Apple are trading as if they are safe and defensive places for investors to hide, even when the stock is trading at 40 to 60 times their true accounting profits.

Source: Russell Investments

There is a great article written by Bloomberg on July 2nd that covers all the main problems with index investing on this scale. Instead of reproducing what is already a thorough article, we have added it as this quarter’s case study for anyone who would like a deeper read.

When large amounts of money flow into index investing, sectors of the stock market become dominant precisely when they are at their most expensive valuation. For any long-term investor this creates a perilous future investment return.

Index funds are threatening the core purpose of the stock market which is to allocate savings efficiently. As long as the money keeps coming in, stocks will keep going up with the biggest stocks going up the most. The problem we have as investors is that we know this is not sustainable, but we also do not know how long this excess financial stimulus will last. It might continue for a week or years. As we have discussed in previous letters, waiting on the sidelines for excesses to pass is risky as well. To sit in cash on the sideline is fine for a month or two but there is little interest income from short term bonds. Long term, the currency may devalue or the risk of an overheated market may be too great. We know we cannot compound our investments if we are not invested.

For most professional investors this is a period in time when “career-risk” becomes a driving force for making investment decisions. If you are managing a large mutual fund or institutional portfolio, you feel pressure to chase the market and really go for it. If you do not do this, you worry that your clients or fund company is going to fire you because you did not win big enough in a rising market. This is why alignment of interests between investment manager and client is so crucial for long term successful investing.

Fortunately, at Avenue we do not feel this pressure in the same way and that is a core reason why we are independent. Our equity portfolio has had a strong start to the year however our portfolio does not look like the index. We believe we are finding opportunity in investments that other people have missed. At Avenue, we do not speculate or chase expensive stocks. Our client’s place their utmost trust in us, otherwise they would not be invested alongside us.

The New Normal

We now find ourselves in a financial climate that is not normal or stable. Avenue is willing to project that this environment will continue for a while. In which case we need to get used to it and treat it as the new normal. How do we still accomplish our return goals and stay invested in what is becoming an uncomfortable and fragile market?

In summary, Avenue believes that government debt levels are far too high for the size of the economy. Hence, the productive economy will grow at a lower rate, somewhere closer to 1%. Interest rates on government bonds will remain low. Asset prices for things like stocks and real estate will remain high.

What do we do to structure a long-term portfolio given this environment? We know we have to have our money invested. Either in tangible things or high cash flowing businesses to protect us against the increasing cost of living, asset inflation and potential economic stagnation.

But given the excesses of the stock market, it now very much matters what we own. At Avenue we focus on consistent and essential businesses. And more important than ever, it very much matters what we pay for our investment. Reasonable valuations are an essential buffer for protecting the downside of our investments.

It matters what we own.

It matters how much we pay.

There Are Still Opportunities

The Canadian dollar has strengthened significantly over the last year to a point where our bias from a year ago towards investing in Canada has been reduced. However, it is important to highlight that with a Canadian dollar now in the mid to low $0.80 range we are somewhat indifferent to where investment opportunities are located. If the Canadian dollar moved closer to $0.95, we would definitely look at investing our appreciated Canadian dollars outside of Canada.

At this level of the Canadian/US exchange rate we are country neutral, and we let the return opportunities dictate where our incremental investments are made. For example, our healthcare investments have primarily focused on the US because of the size and depth of their sector. However, this quarter we made an initial investment in DentalCorp, which is a Canadian business that owns over 400 dental practices across the country. We really like the consistency of the underlying cash flow. The valuation was compelling which is the basis for achieving our rate of return objective.

Avenue Tail Hedge Strategy

The biggest change at Avenue over the last year was the introduction of our tail hedge strategy. Roughly 2% of the equity portfolio each year is used to buy hedges on the overall stock market index. These investments act as protection and have a positive return if the stock market falls significantly. We feel even stronger about the importance of this strategy as the market continues to climb.

Having the hedge has a strong psychological effect of keeping us more fully invested. We are not always looking over our shoulders worrying about every little daily bump in prices. We can focus on the longer term and make rational decisions about the valuation of economic sectors and individual stocks.

What we know about financial markets is that major market falls happen without any advanced notice. Major declines happen when most people are positive about the future, because to get a big stock market drop most people have to be already all in.

We now have a way to patiently own our high-quality core investments but profit from our hedge given a sharp market decline. If the stock market decline is significant enough, we will cash in our hedges and with the returns, reinvest in our favourite stocks at good prices.