We are experiencing a continuous stream of crises, with the latest being Brexit. The results from all these events (the Greek debt, the slowing Chinese economy and Brazilian corruption) are causing ongoing pressures to lower inflation and subdue growth, which hold down interest rates to very low yields. The world is awash in surplus money that needs to go somewhere and any income generating business, asset or higher yielding bond should become increasingly valuable. However, as investors we will always have to live with short term volatility.

As we write this letter, Brexit is still being digested by the market. Brexit is the term given to the United Kingdom’s majority vote on June 23rd to leave the European Union. Whatever the long term consequences for the economies of England and Europe, the near term result will be to further depress inflation and constrain growth with the result that interest rates will remain low.

Constrained global growth and an excess of saving is affecting all major financial markets. In light of Brexit, it is not likely that the US Federal Reserve will raise interest rates this year. The US 10-year Government bond is now yielding 1.45% having dropped 0.4% in the last month. Between Japan and Europe there are now estimated to be $10 trillion of government securities trading with a yield of less than zero.

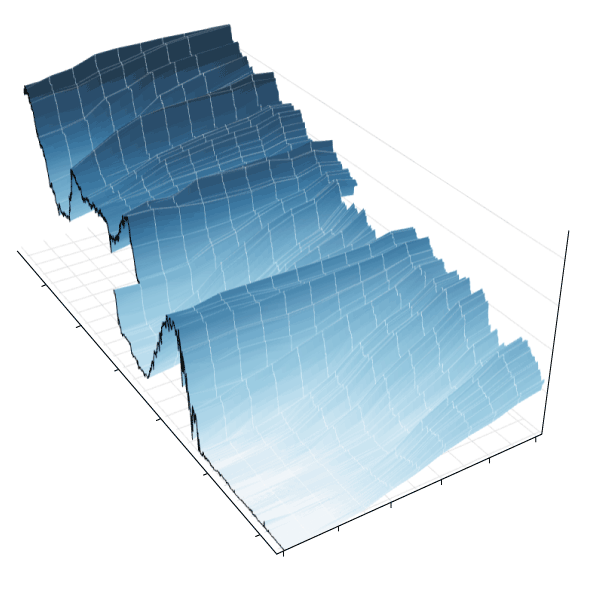

The link below will forward you to a unique 3-D image of the major world interest rate curves over the last 20 years. These images are not necessarily predictive but they do illustrate the magnitude of the shift to lower interest rates around the world.

All savings or investment dollars are looking for the best return with the least amount of risk. So the truly confounding fact of our times is that $10 trillion worth of investors happen to believe a negative return is the best risk adjusted return they can get. The reality is that there is a global excess of saving with few places to save and invest it. A safe legal jurisdiction with a reliable currency obviously is the desired investment and a negative interest rate has become the cost of parking money in a deemed safe destination.

We argue that regardless of the US and European Union central banks dropping short term interest rates to zero post the 2008 financial crisis and then instigating quantitative easing, yields were going to drop dramatically regardless. There is too much consumer and government debt for low interest rates to stimulate more borrowing to drive growth. On top of this, ironically there is also a surplus of savings versus income generating investment opportunities.

With this as our background, investing in bonds has become much more complicated. We often get asked the fundamental question, “why invest in bonds at all”? A high interest savings account at a bank like Tangerine yields 0.8%. We have put together a slide of Avenue’s bond portfolio to show that investing money in a portfolio where a majority of the investments are Canadian corporate bonds will still give us an annual return of 3-4%.

In the chart above you can see Avenue’s individual bond investments and their maturities. (Maturity means the number of years we have lent money to a company). Investing in bonds with shorter to medium term maturities reduces risk and volatility compared to ‘stretching for yield’ by owning a portfolio of longer term bonds. There are a few investments in Government bonds but the majority of the investments are Canadian corporate bonds which gives us our higher rate of return. We feel a 3-4% annual return is realistic and accomplishes the goal of income with security.

Investors’ search for income also translates directly to stock market equity investments. If a company can demonstrate the ability to generate a consistent income stream, then this is very valuable. With stock market jitters, from events like Brexit, certainly most stocks will sell off, but we observe that stable income producers and dividend paying securities bounce right back. Our job at Avenue is to find good consistent businesses that make money. We added TransCanada this quarter and took advantage of the Brexit decline to add to our investments in TD and Royal Bank.

Oil is still very much a factor in the Canadian stock market and exercises a major influence over the value of the Canadian dollar. So far this year we have had a strong rally in the price of oil and the Canadian dollar. In the short term the oil price and the Canadian dollar might have recovered too quickly. However, over the next year global supply and demand will come back into balance and we believe a long term oil price of $60 – $70 Canadian per barrel is possible. This is a good price for our energy investments and should underpin further strengthening of the Canadian dollar.

On a final note, we have written that liquidity has become a real problem with companies that have a market capitalization below $1 billion. In the 2015 Q4 letter we wrote that we had three investments in our portfolio with yields, at that time, of over 10%. However, in the stock market, value has a way of fixing itself. Sirius Satellite Radio is now engaged in a parent buy out, BTB REIT rallied nicely and the two TimberCreek listed pools are now merging to form a more market friendly $700 million market capitalization entity.