We have lived through an extraordinary few weeks. Across the country Canadians are now bracing for the full impact of the virus. Hopefully all our collective efforts at social distancing will pay off. Currently, we don’t know of anyone within our Avenue network who is ill with the virus, and we truly hope it stays that way. We give our thanks to all of you who are on the frontlines in the medical and support professions as you work tirelessly to keep Canadians safe.

With the wonders of modern technology, the full Avenue team continues to operate smoothly and without interruption. Periods of time like this are why we test our offsite systems and technology annually to ensure for smooth operations during potential events like we are currently experiencing.

With regards to the state of the economy, the best analogy we have heard compares our current state of quarantine to the economic world being stuck in a plane on a runway with the message that there is a ‘flight delay’. It is an incredibly frustrating and helpless feeling for anyone who has been in this situation. In the interim, you are not allowed to leave your seat and there is unclear information as to how long this situation will last.

This is where we find ourselves today. We know there will be a time in the future when our outside lives will get back to normal. However, we now know the economy will be shut down for longer than a month, but we don’t know how long it needs to remain closed to contain the virus.

When we look at our portfolio investments, we need to weigh many rapidly changing factors. We understand the most immediate issue is the uncertainty around how long the economic paralysis lasts. As time passes there will be more damage done to the consumer and services industry which are the largest parts of the economy.

On the other hand, we must weigh this short-term economic shutdown against the unprecedented amount of government and central bank stimulus that is being injected into financial markets and the economy. We have already seen the results in the strong rebound in the stock market after the panic low on March 23rd. As we wrote in our last mid-month update, the stock market has a way of looking through the global economic shut down and will attempt to measure what the economy will look like at the end of the year and beyond.

While we have witnessed a breathtaking market decline in both speed and severity, we have done our best to transition the portfolio to have a much larger weight in what we describe as essential businesses. These are the types of businesses that will remain strong through this economic downturn.

Businesses like BCE are well positioned as people continue to keep paying their phone and internet bills.

Canadian Pacific Rail and Superior Plus (propane distribution) both have an element of essential service and a soft monopoly on their respective markets.

If you have purchased any items through online shopping over the past month it was most likely delivered overnight on a Cargojet plane. They have a virtual monopoly on overnight air cargo delivery throughout Canada and have a unique partnership with Amazon.

Enghouse Systems and Constellation Software are new positions we added and are both Canadian technology success stories. They provide critical technology services to businesses all around the world.

Other businesses like Emera (regulated utility) and Brookfield Infrastructure will also remain as essential businesses during this period. Many of the companies discussed above have already seen sizable increases in their stock prices over the past two weeks.

During volatile periods in the stock market, such as the one we currently find ourselves in, we often think of our favourite quote from famed investor Warren Buffett:

“Every decade or so, dark clouds will fill the economic skies, and they will briefly rain gold. When downpours of that sort occur, it’s imperative that we rush outdoors carrying washtubs, not teaspoons. And that we will do.”

Your Avenue team channeled this investing mindset through the month of March as we actively purchased shares in great businesses that we believed were being unfairly punished. We have always explained Avenue’s strategy as investing in consistently profitable businesses that generate stable income streams. And then we make sure not to pay too much for them.

Over time, these types of businesses are less volatile than other less profitable parts of the stock market that trade off “themes” and not the underlying profitability or cash flow. We have never experienced a period in the market, in this case a global pandemic and economic shutdown, that has sharpened our perspective so fast on what qualifies for this characterization.

We also emphasize the diversification of Avenue’s portfolio when compared to how concentrated the stock market indexes have become. In this stock market sell-off all sectors were punished. In the liquidity vacuum that the markets experienced in March, investors stopped viewing stocks as small pieces of great businesses. Rather everything became just another stock on a stock exchange and got sold to raise cash. This occurred in all asset classes. We now are seeing that over the past two weeks the market is beginning to sort out which companies offer long term value and which businesses are going to remain distressed.

The other phenomenon that exacerbated the volatility throughout March was the rise and ubiquity of the Exchange Traded Fund (ETF) as an investment vehicle for many investors over the past decade. We have long been discussing the impact that ETFs were having on the market structure, and that the impact they would have on markets during periods of extreme stress were still unproven. Well, now we know.

There were several earthquakes that went off in the bond ETF market during the month of March. We thought it would be insightful to highlight a few of them.

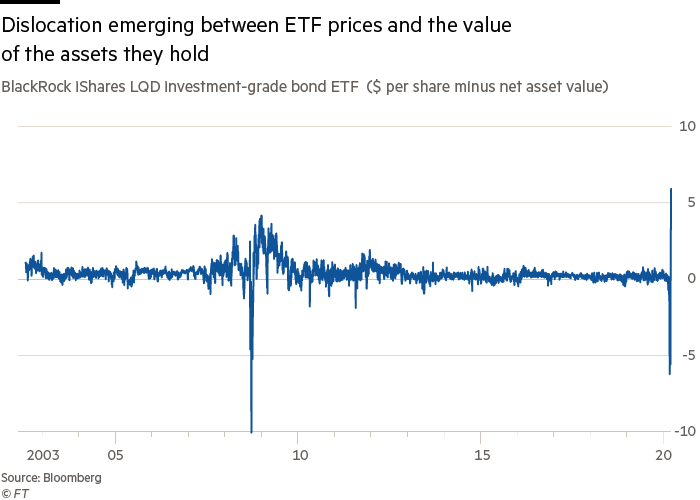

Below is a chart from the Financial Times highlighting the disparity between the net asset value (NAV) of the iShares corporate bond ETF product, and the price that the ETF was trading at during the period of extreme market stress in March.

This bond ETF is supposed to trade at the net asset value of the underlying bonds. The far-right side of the picture is not supposed to look like that.

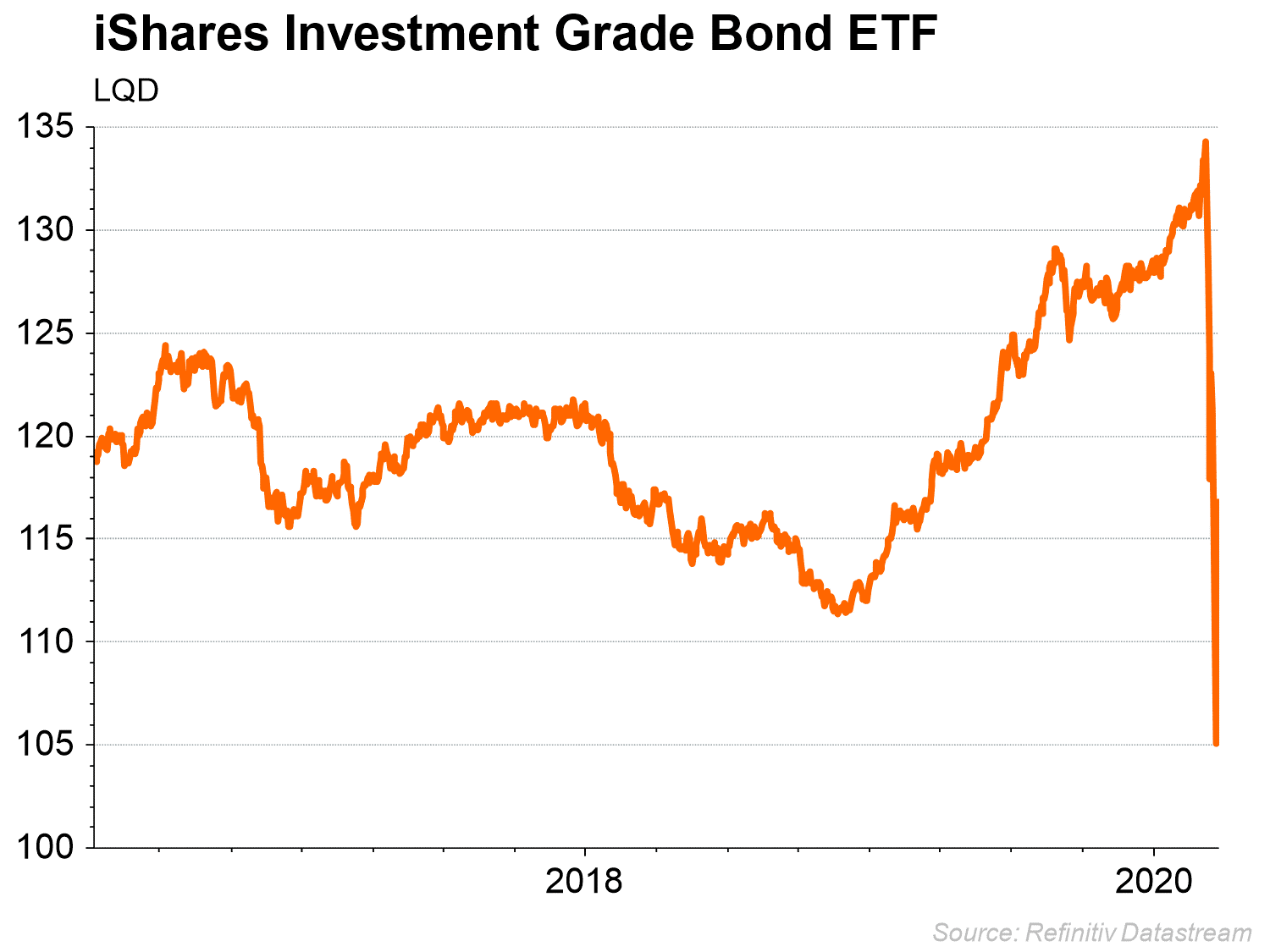

When looking at the price of this underlying corporate bond ETF (ticker: LQD), shown below, it is clear by looking at the price action in March that investors in this product all ran for the exits at the same time.

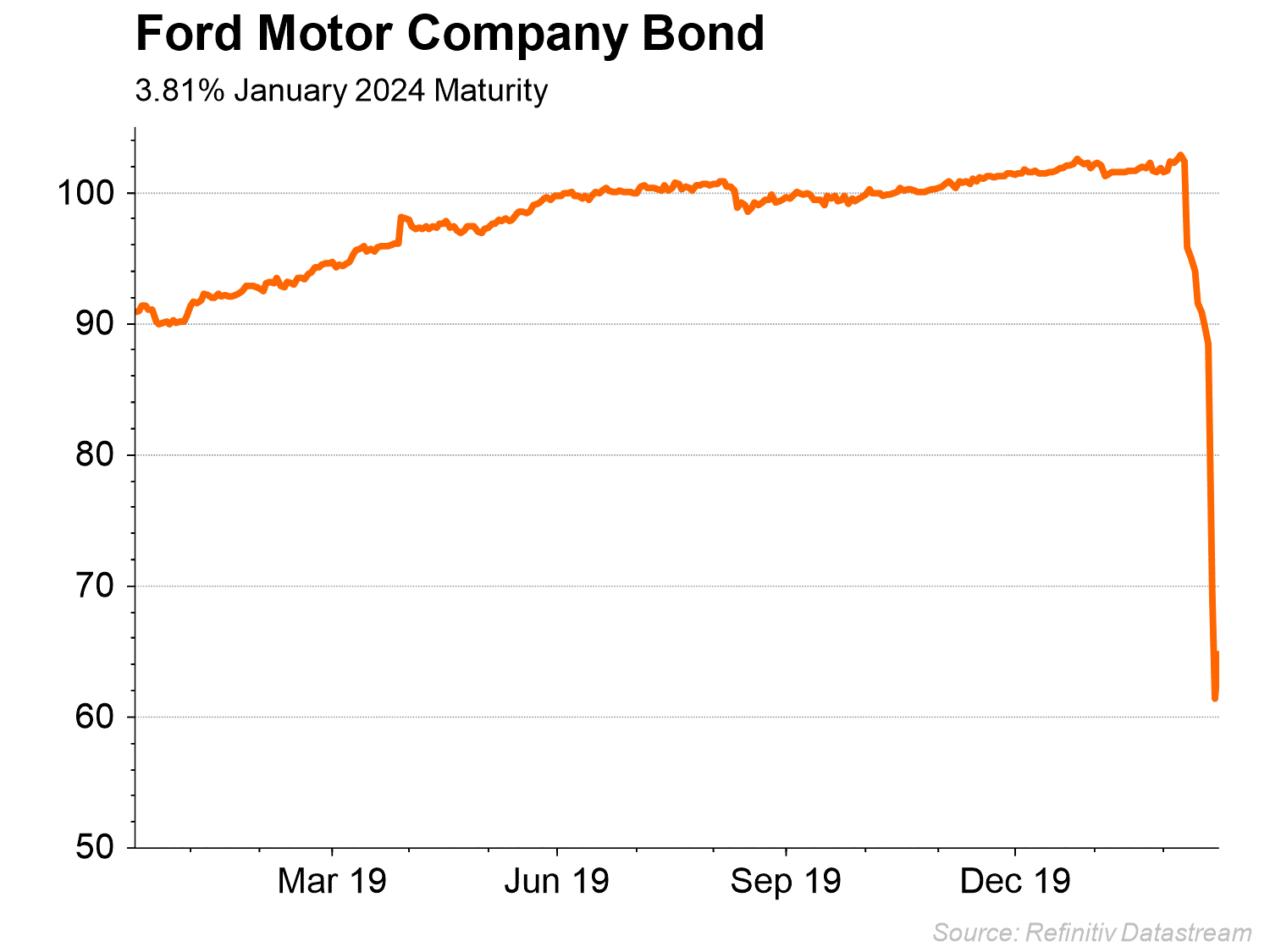

Think of corporate bonds as individual loans to different businesses. One great example is of a company that we should all be familiar with, Ford Motor Company (The Avenue bond portfolio DOES NOT own these bonds). Ford bonds paying 3.81% annual interest and maturing in 2024 were trading at a price of $102.30 to par on March 9th. If you purchased these bonds at this price you would receive an interest rate of approximately 2.8% for 4 years.

These Ford bonds became distressed during the month of March and closed at a price of $61.40 on March 20th, or down about 40% in 10 days.

Within bond ETF products like the iShares Investment Grade ETF (LQD) there are hundreds of individual corporate bonds, like these Ford 3.81% 2024 bonds, that get packaged together and are traded by investors on the stock exchange.

The corporate bond market was not meant to function like this.

The U.S. is now sitting with a record $13 trillion of corporate debt, much of which was issued over the past decade and used to buy back shares to boost stock prices. As a result of the significant dislocations in the bond market in March, the U.S. Federal Reserve announced that they would be stepping in to start purchasing corporate, municipal, and high yield bond ETFs to help alleviate the stress in these markets.

There are now market participants who try to ‘guess’ which assets the central bank will buy next – and then ‘front-run’ those central bank purchases to earn a profit. If you had correctly guessed that the US Federal Reserve would start purchasing junk bonds, you could have made a handsome profit on the 2024 Ford bonds which are now trading back at $94.65.

The Avenue team cannot in good conscience make investment decisions like the one mentioned above. This is not investing. We live in unprecedented times.

Another similar dynamic occurred in Canada during the month of March with a series of investment products from one of the Big Six Banks. We know from our conversations with our contacts in the financial sector that one bank trading desk was forced to sell $8 billion worth of pipeline, real-estate, and bank stocks over the course of two days in March because the leverage and options positioning in some of their structured investment products blew up. This forced selling action then caused significant losses for any investors who bought those same shares on margin, which led to more forced selling. Skittish investors then panic and sell their shares because they simply don’t know what’s going on. Rinse, wash, repeat. The unwind of leveraged positions can be very messy as we witnessed throughout the month of March.

The market structure has been significantly altered over the past several years as we continue to move through this period of effectively 0% interest rates along with the growth of new financial products. These dynamics have created associated risks, but also opportunities.

One of the great opportunities we saw in March was in real estate stocks. We believe the real estate sector was unfairly punished during the quarter, so we have added to our holdings. Although rents may decline over the short term as tenants wait to go back to work, we believe apartment focused Real Estate Investment Trusts (REITs) have sold off disproportionately to their long-term value. These buildings aren’t going anywhere.

The value of an apartment REIT should be based on accumulating rents over the next ten to twenty years. Apartment REITs have access to Canadian Mortgage Housing Corp backed financing at very low rates. The government’s income support measures have been designed to get money directly to helping renters. We added to our holding of Boardwalk REIT which focuses on Western Canada and added a new position in InterRent REIT which owns apartments in Ontario and Quebec. This is a good example of how we can look through this crisis and take advantage of long-term assets trading at a good value.

During this period, we have made more trades than usual, and this is in the effort to transition the portfolio to weather this storm and to emerge stronger than ever. There is always the possibility the stock market might do a ‘re-test’ of the March 23rd low before this is over, sometime later in the spring or summer. However, nothing is certain or absolute. For this reason, we are holding a slightly higher cash position and as dividends come in, we will continue to patiently pick away at new investments as opportunities are presented.

With many people and businesses having no income currently, we understand the need by many market participants to sell securities to raise cash. That this move to cash is happening on a global basis explains the continued strength in the US dollar. This has been dramatically impacted by the many trillions of dollars in global debts which are denominated in US dollars. Many global companies may have zero revenue for the time being because of the shutdown, but they still must make their interest payments on their U.S. dollar debt. We discussed this phenomenon in a recent podcast which is also now up on the Avenue website.

Herein lies the biggest investment dilemma going forward. The United States is on pace to run a deficit of $3.5 to $4 trillion for the current year, or up to 20% of GDP. Most of this new debt will be purchased by the central bank. A period of outright debt monetization, where the central bank prints money to pay for government expenditures, has now arrived.

We believe that the incredible amount of stimulus and money printing will eventually weaken the US dollar, potentially quite significantly. To protect ourselves from future inflation our best answer is, more than ever, that we need to maintain investments in good businesses that can navigate the changing world, along with owning investments in hard assets like real estate, gold, and utilities. We will talk a lot more about this strategy in the coming quarters.

The Avenue team wishes everyone a safe and healthy next few months.