To quote every young child on a long car trip, “are we there yet?” When we look at the valuation of many markets, it is much the same when we ask the question, are we in a financial bubble yet? The three biggest markets, where most wealth is stored, are residential real estate, bonds, and many parts of the stock market. All three markets have valuations that are stretched in comparison to previous historical levels. While these three market valuations are elevated, there are certain collectibles that fall into the category of extreme bubbles. We will stick our neck out and call this type of collectible a mania.

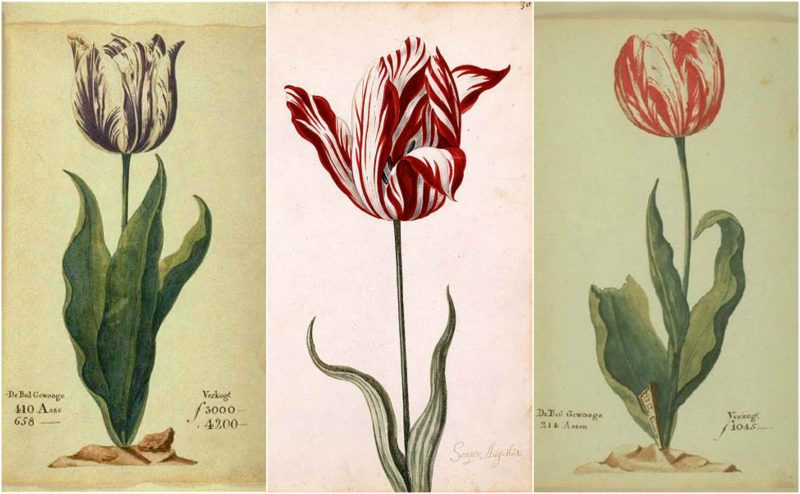

The historical example of a mania that is often sited is the Dutch tulip bulb frenzy of the 1630s. The tulip craze became popularized as a cautionary tale for investors in the 1841 book by Charles Mackay called Extraordinary Popular Delusions and the Madness of Crowds. Excessively easy monetary policy accompanied by a strong economy led to one of the oddest, speculative, price increases ever.

In the Netherlands, between 1634 and February of 1637, tulip bulbs became a sought-after collectable item and a way to display one’s wealth. Over the course of a few years, bulbs that sold for a few guilders rose in price to a high of 200 guilders. Rare bulbs, like The Viceroy tulip bulb pictured here, sold for over 3,000 guilders. This price was the equivalent of ten times the average person’s annual income.

The tulip craze was as much a cultural phenomenon as it was an easy money mania. Similar tulip bulbs can be reproduced so there was no real limit to the supply. As well, financial conditions can tighten. In the case of the tulip bulb mania, the record states that the prices hit a peak and simply declined abruptly as interest dropped. Only a few months after the market topped, the bulb prices fell to where they started. Once again, one could buy a beautiful, flowering garden plant for a few guilders.

With this story in mind, we present to you that 2021 saw the broad adoption of the Non-Fungible Token (NFT), a unique and non-transferable unit of data. NFTs look like they will transform the way we own assets, and they will complement the use of blockchain, a form of digital ledger. But there is a practical use and then there is mania. Below is an image of the NTF ‘man with a pipe’, not to be confused with Paul Cézanne‘s 1892 original. This digital art property named “Crypto Punk #7804” recently sold at auction for $7.56 million US dollars.

That’s correct. The ownership rights to this digital art above sold for $7.56 million US dollars in 2021.

The parallel to the tulip bulb mania that we would like to draw is that NFT digital art is as much a cultural phenomenon as it has to do with an easy money mania. Digital art can be reproduced so there is no real limit to the supply. As well, financial conditions can tighten.

At Avenue, we continue to argue that given the high level of debt and easy money conditions, we need to have our money invested in hard tangible assets and businesses that generate excess cash flow. As a way to store one’s assets and compound one’s wealth, we will take a pass on “Crypto Punk #7804” and be very wary of the excess money around us as we begin 2022.