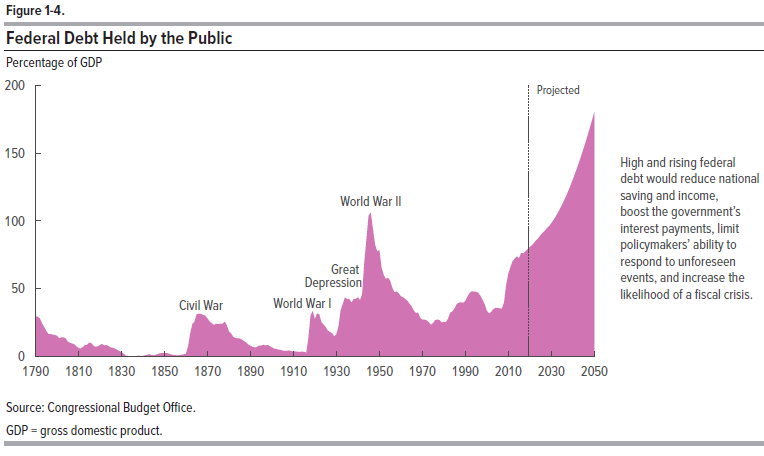

The level of US Government debt was an issue before this recent crisis. Now we believe excess debt will come to define financial markets in the coming years.

Our conclusion is that there is simply too much debt to be paid back in real terms. In the case of the US, being a reserve currency, they will not default on their spending obligations but rather devalue the purchasing power of the US dollar over time. Being invested in businesses and hard assets is the best way to protect our wealth in a world where cash and bonds lose their purchasing power over time.

When the central bank starts printing money to pay for government spending, crazy things can happen. Historical examples include Weimar Germany, Zimbabwe, Venezuela, and Argentina. We have a few charts which show the recent currency devaluation in Argentina to illustrate what this can look like in an extreme version.

The first is showing gold. The gold price in US dollars during this period was relatively stable. This is not a chart of gold going up, but rather the Argentinian peso going down. This requires real mental gymnastics because it is just not what we are used to seeing. Gold looks like it has gone up 500% in Argentina pesos since 2018, when actually the purchasing power of the Argentine peso has gone down.

While we want to have a certain amount invested in gold, there are still lots of things that can go wrong. A portfolio made up of a mixture of hard assets and income producing businesses is ideal. Real estate or a power plant retain their intrinsic value while the value of the currency declines.

However, as we see in the case of Argentine stocks, returns are not linear. A portfolio of stocks accomplished about half of the same protection as gold, but there are big 50% or more swings along the way that test the resolve of investors.

While it will be tempting to jump from stocks to cash and back, getting the timing right on this type of move will be impossible to do consistently. Our discipline is to stay invested. We will continue to be cautious when the market is up, and sentiment is positive. And by that same token, we will buy when the market is down, and sentiment is negative.